Oil has been trading in a narrow range in the low US$40 more or less since July after the market began to worry that even with large supply cuts from OPEC+ and curtailments in the US, demand will not recover fast enough to draw down the record-high inventories that had built in the second quarter.

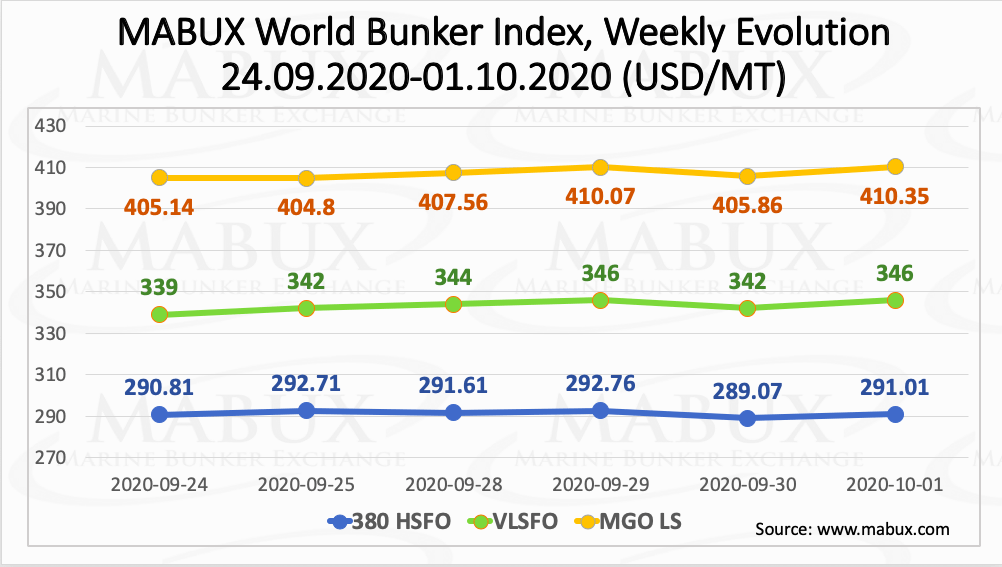

The global bunker market in turn has mirrored general trends of crude indexes, according to MABUX, whose World Bunker Index has risen slightly for a week.

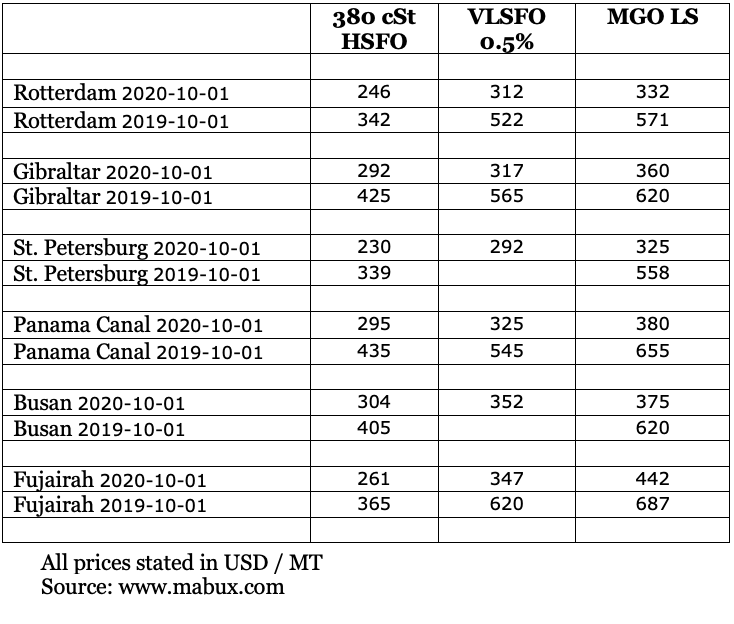

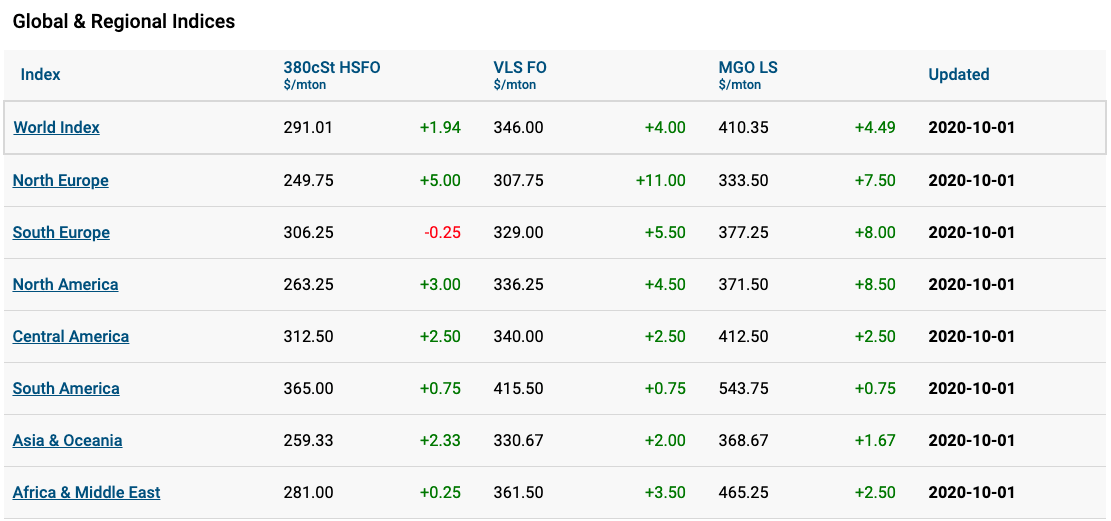

In particular, the 380 HSFO index bearly rose to US$291.01/mt, VLSFO added US$7 reaching at US$346/mt, while MGO index increased to US$410.35/mt.

At the same time, Global Scrubber Spread (SS) (price difference between 380 HSFOs and VLSFOs) has widened by US$4.56 and averaged US$51.84.

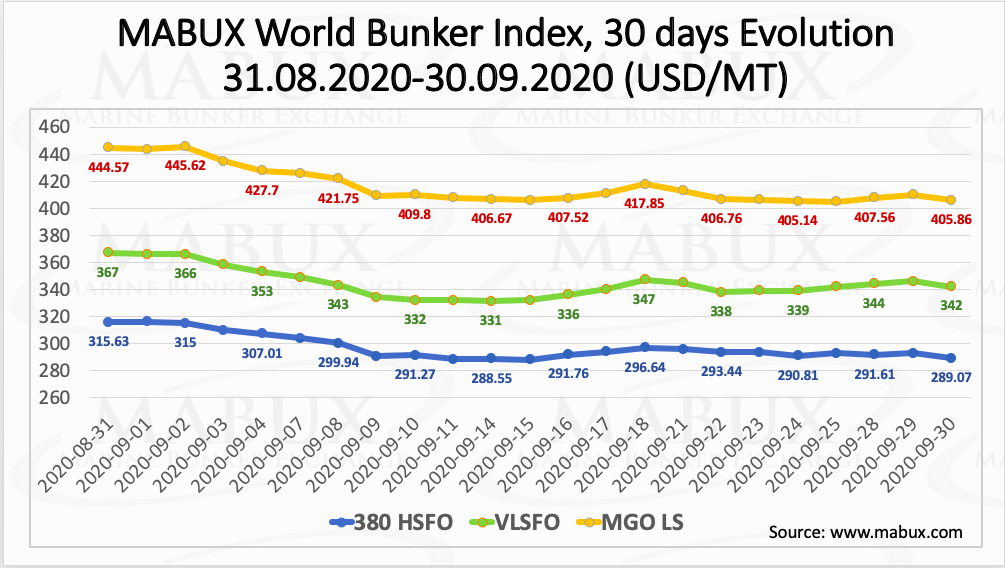

Since the beginning of September, the World Bunker Index has shown a firm downward trend (380 HSFO from US$315 to US$288, VLSFO from US$365 to US$331, MGO from US$445 to US$406), which stopped in the middle of the month, when the Index for all types of bunker fuel entered into a phase of moderate irregular fluctuations.

This trend continued until the end of the month. Globally the scrubber spread decreased slightly from US$54.78 in August to US$47.21 in September. It is worth noticing that the spread remains too narrow to become a driver to stimulate scrubber installations.

Meanwhile, the UK P&l Club, a shipowners and charterers insurance company, said that the usage of jet and automotive fuels as blend stocks for bunkers may lead to flash point problems.

In VLSFO, the possible result of this new practice is a general reduction in viscosity and density. Recently a significant uptick in fuels found to be off-specification because of a flash point lower than the minimum in Singapore and the Middle East.

Refineries on the US Gulf Coast and in Europe do not use jet fuel as a blend stock for marine fuels. Additionally, the smaller scale of the US Gulf market compared with Singapore makes the practice less viable in the specific region.

A circular issued by the Saudi Ports Authority on 19 August calls for the prevention of the discharge of washwater from ships with open loop types of exhaust gas clearing systems (EGCS) until an environmental standard is issued. Restrictions or bans on using open loop scrubbers have been reported in certain ports or territorial waters worldwide now.

Earlier this year, there was a call during an IMO (International Maritime Organization) meeting for the development of a centralised database detailing local/regional restrictions/conditions on the discharge water from EGCS.

Such a database could be managed by the IMO, and would require all member states to report on specific restrictions in ports and/or clearly designated waters under their jurisdiction.