In a week when the MSC Ariane suffered an engine failure following what the owner described as “poor quality fuel”, the bunker index firm Marine Bunker Exchange (MABUX) has said that fuel quality issues have more than doubled this year.

The percentage of VLSFO samples found to be non-compliant because of their sulphur content has more than doubled in 2021, according to testing company VPS. About 3% of the samples VPS received last year were found to be non-compliant on sulphur levels, and this rate has risen to about 7% so far in 2021. The majority of the non-compliance is coming from samples from Europe and the Americas.

[s2If is_user_logged_in()]There has been no analysis, at this stage, that looks at the reasons behind the uptick in fuel quality issues.

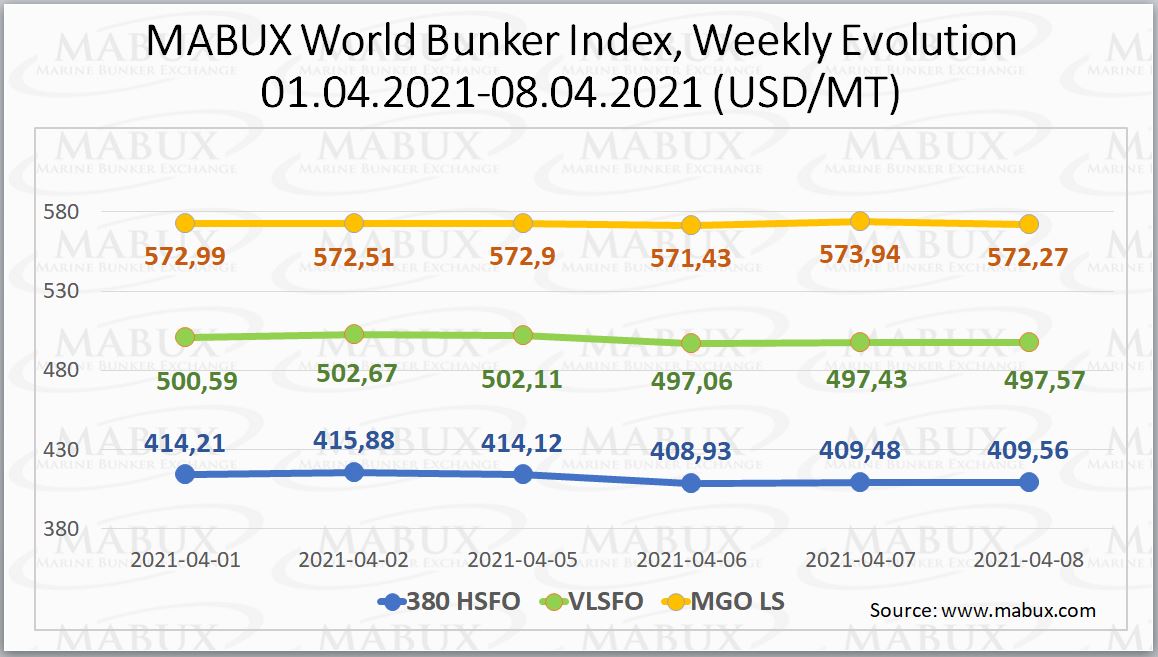

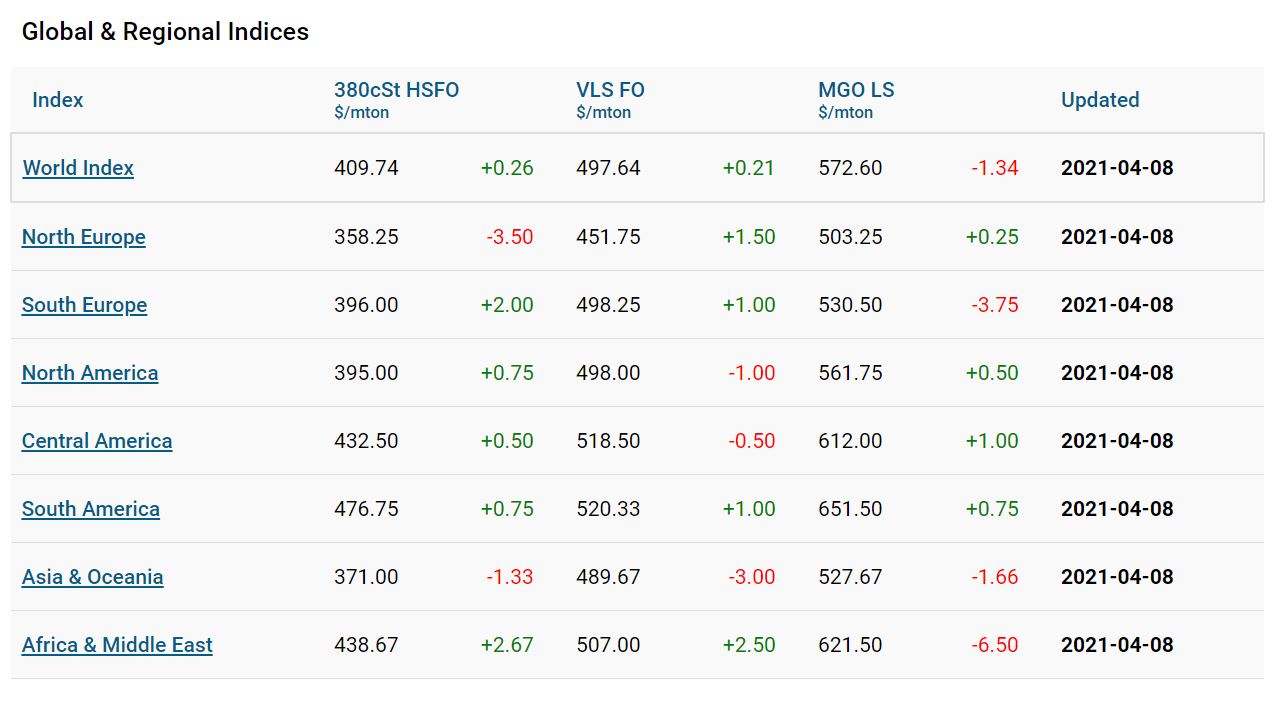

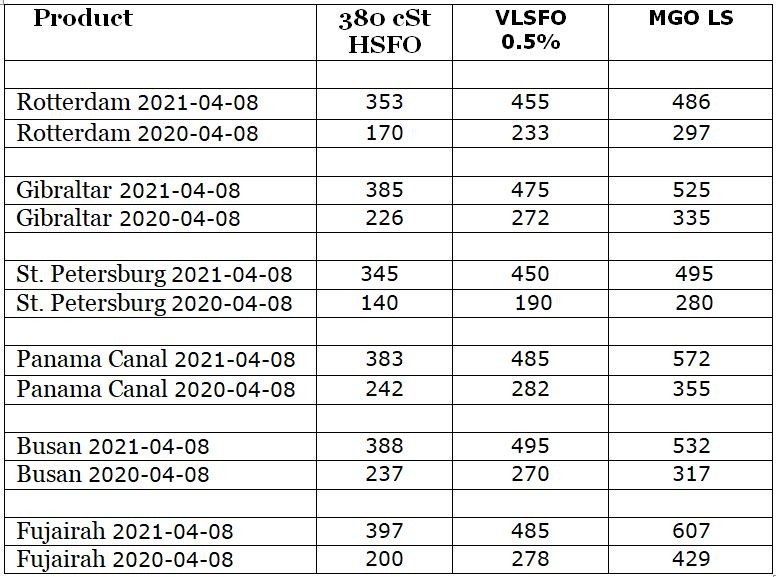

Nevertheless, The MABUX World Bunker Index has shown downward changes during the week. The 380 HSFO index has decreased from US$414.2 MT to US$409.56/MT (-US$4.65), VLSFO has lost US$3.02: from US$500.59/MT down to US$497.57/MT. MGO LS decreased by US$0.72 from US$572.99/MT to US$572.27/MT.

The Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – continued to decline during the week and averaged US$87.54 (US$89.41 last week).

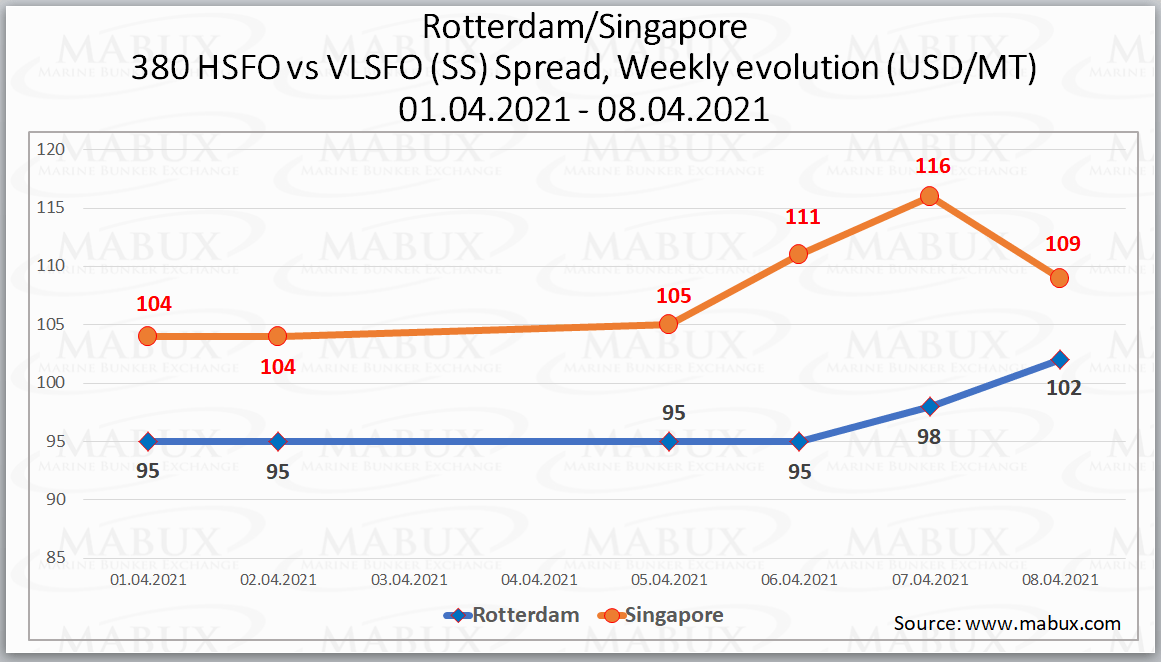

In Rotterdam the SS increased during the week from US$95.00 up to US$102.00 (+US$7.00), the average SS for the week also increased by US$3.00 from US$93.67 last week to US$96.67. In Singapore, SS has also slightly increased during the week – by US$5.00: from US$104.00 to US$109.00, while the average weekly SS index rose by US$4.00: from US$104.17 last week to US$108.17.

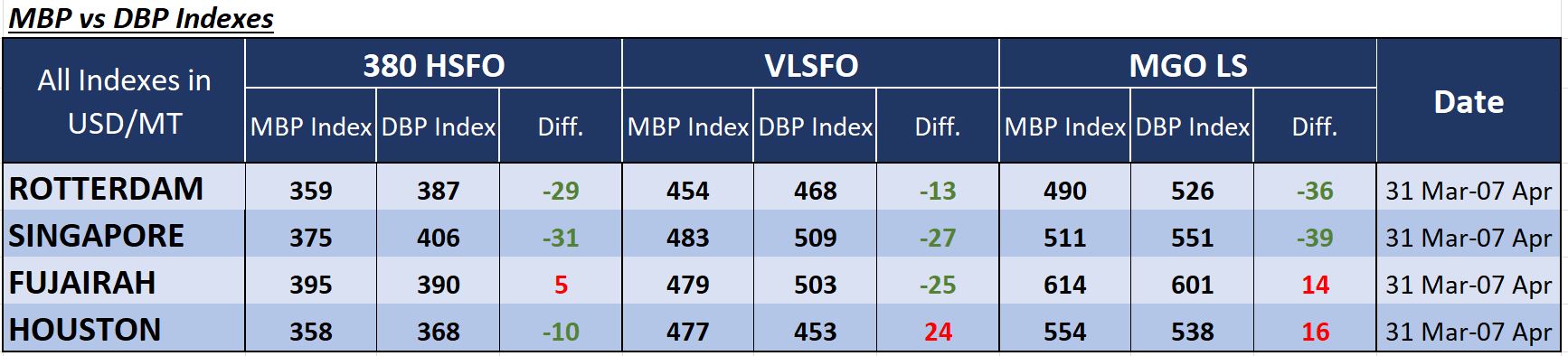

The correlation of the MBP Index (Market Bunker Prices) vs the DBP Index (MABUX Digital Benchmark) in the four global largest hubs during the past week showed that 380 HSFO remained undervalued in three selected ports in a range from minus US$10 (Houston) to minus US$31 (Singapore). This kind of fuel is overcharged in Fujairah by US$5. VLSFO according to DBP Index, is undervalued in a range from minus US$13 (Rotterdam) to minus US$27 (Singapore) in all selected ports except of Houston, where it is overpriced by +US$24. MGO LS was also overvalued in Fujairah (+US$14) and Houston (+US$16). In Rotterdam and Singapore this type of fuel remained underpriced by minus US$36 and minus US$39 respectively.

The supply of bunker fuels remains tight across most East of Suez ports, with lead times for VLSFO stems in Singapore stretching up to 11 days this week. Despite the weekly stock build, lead times for bunker fuels remain long in Singapore. The bunker hub’s demand seems to have picked up at the beginning of this week, adding further pressure on lead times. Fujairah’s low sulphur bunker availability is similar as last week. Lead times for VLSFO and LSMGO stems are unchanged on the week at six days in Fujairah, while lead times for HSFO380 has dropped from 12 days to eight days now.

Bunker fuels can be procured at a shorter notice in Zhoushan and Shanghai, which currently have the shortest lead times across East of Suez ports. Lead times for VLSFO and LSMGO stems now stand at three days in the two Chinese ports, up from two days last week. VLSFO and LSMGO stems remain tight in South Korea’s southern ports for another week. Lead times are steady on the week in Busan, stretching up to nine days. Japanese HSFO inventories fell to six-week lows last week, as rising exports has drawn stocks.

Bunker fuels can be procured at a shorter notice in Zhoushan and Shanghai, which currently have the shortest lead times across East of Suez ports. Lead times for VLSFO and LSMGO stems now stand at three days in the two Chinese ports, up from two days last week. VLSFO and LSMGO stems remain tight in South Korea’s southern ports for another week. Lead times are steady on the week in Busan, stretching up to nine days. Japanese HSFO inventories fell to six-week lows last week, as rising exports has drawn stocks.

Low sulphur fuels continue to be readily available in major bunker locations across Europe and Africa, while HSFO380 availability has tightened further in the Canary Islands this week. VLSFO and LSMGO stems can be procured at short notice in ARA and other Northern European ports like Skaw and Hamburg. Prompt VLSFO and LSMGO deliveries are also in good availability in the Gibraltar Strait ports, in ports further east in the Mediterranean (Piraeus, Istanbul and Malta), and in the Russian Black Sea port of Novorossiysk. HSFO380 availability has tightened further in the Canary Islands.

South African ports continue to have limited HSFO180 volumes to supply, while VLSFO and LSMGO can be sourced with shorter lead times.

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]