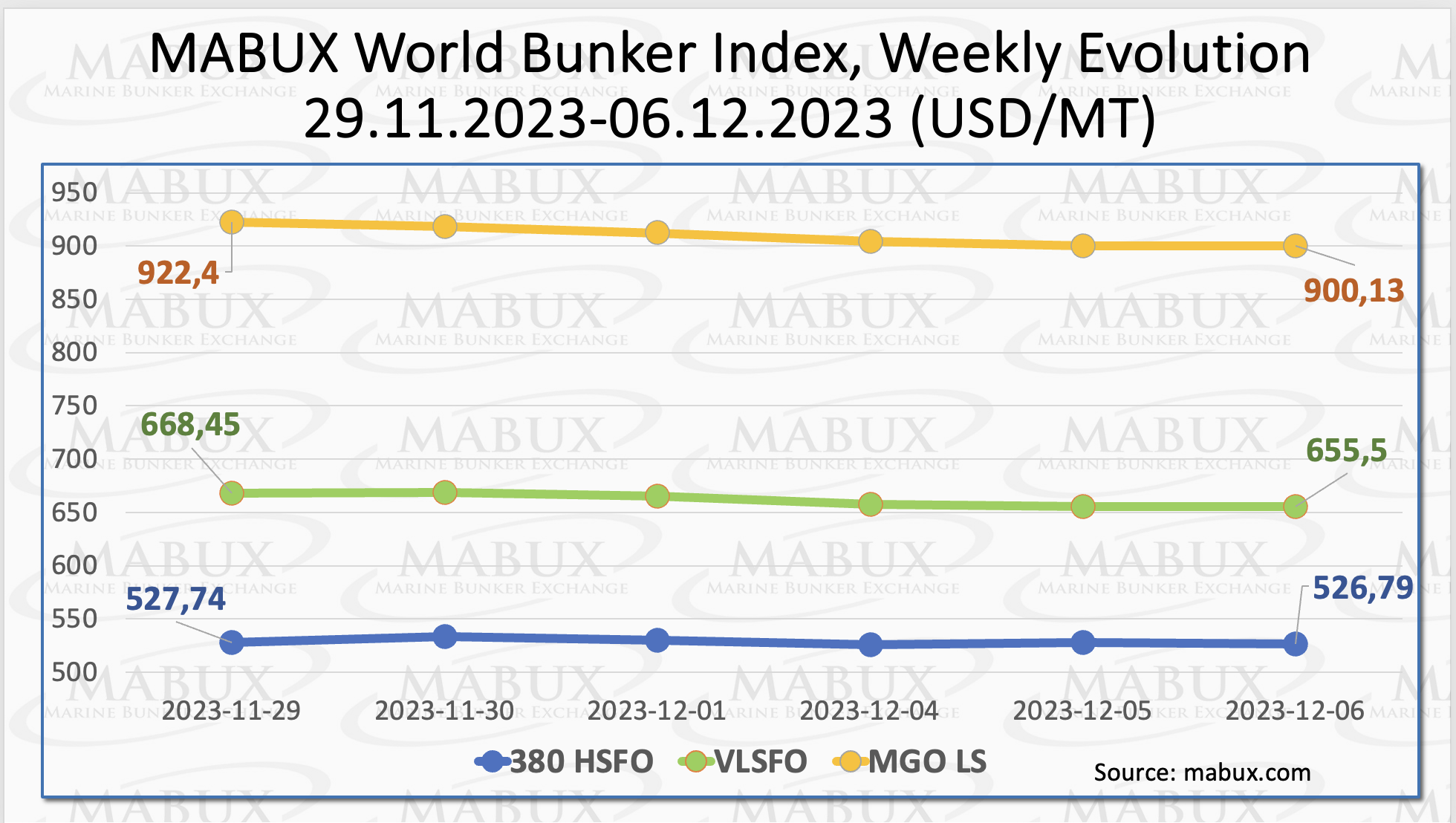

Marine Bunker Exchange (MABUX) reported that the 380 HSFO index fell to US$526.79/MT, the VLSFO index declined to US$655.50/MT and the MGO index dropped to US$900.13/MT.

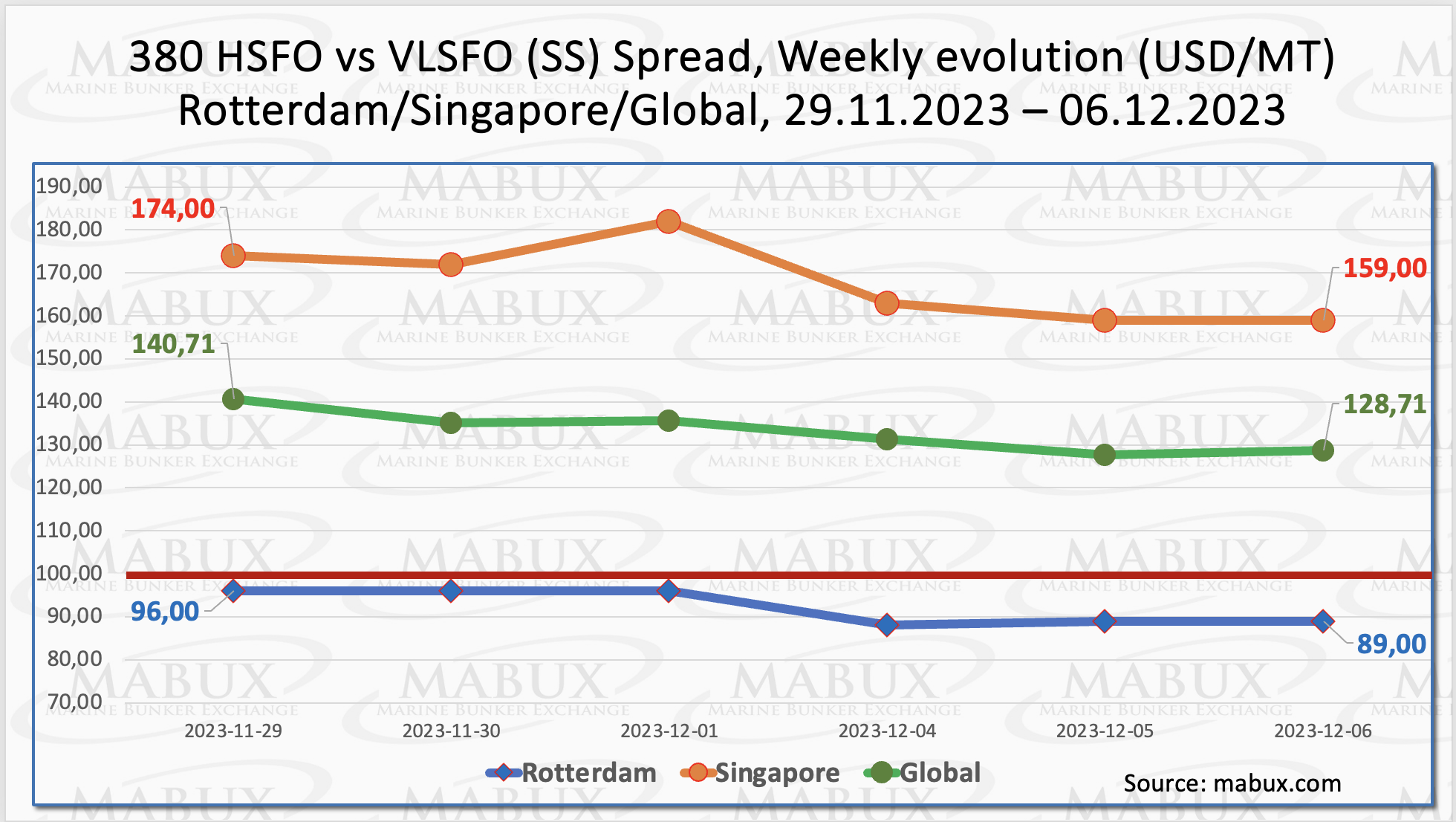

Global Scrubber Spread (SS), the price difference between 380 HSFO and VLSFO, fell another US$12 but remained over the key US$100 mark. The weekly average fell by US$8.23 as well.

In Rotterdam, the SS Spread declined by US$7 to US$89, remaining constantly below the US$100 mark, while the weekly average fell by US$8.23. Additionally, Singapore saw the greatest loss in the 380 HSFO/VLSFO price difference, recording a minus US$15, with the weekly average falling by US$47.50.

“We expect the sustainable narrowing trend in SS Spread will persist into the following week,” stated a MABUX official.

Natural gas prices in Europe have fallen below US$43 per megawatt-hour, the lowest level in the last two months. This decrease can be attributed to continually low consumption, which has allowed the region to control its gas supplies.

Despite a recent cold spell, storage withdrawals have been limited in comparison to past years. European Union gas storage sits at 94.4% as of 2 December, slightly lower than the 97.7% reported a week earlier. Germany’s reserves have fallen to 95.2%, France to 94.6%, and Italy to 93.5%.

“In addition to these factors, temperatures are anticipated to rise by the end of the week, leading to a reduction in heating demand. Furthermore, a challenging economic outlook suggests limited potential for a significant increase in industrial consumption of natural gas in the near future,” noted a MABUX spokesperson.

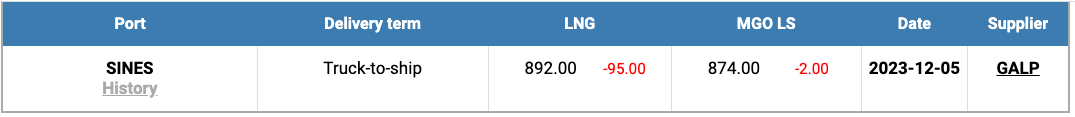

The price of LNG as bunker fuel in the port of Sines in Portugal fell significantly, falling by US$95 to US$892/MT on 5 December. The price differential between LNG and regular gasoline has also decreased to US$18 in favour of MGO, down from US$93 a week ago.

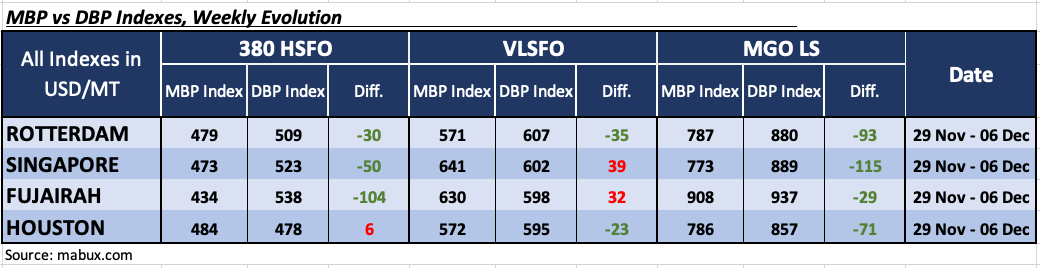

The MDI index (the ratio of market bunker pricing (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) increased in the 49th week. The following tendencies were observed in four different ports: Rotterdam, Singapore, Fujairah, and Houston are among the destinations.

Houston went into the overcharge zone in the 380 HSFO category, with the overprice weekly average increasing by 18 points. The other three ports continued to be undervalued. In Rotterdam, the undervalued weekly average declined by 2 points, whereas in Singapore, it plummeted by 11 points. The Fujairah’s MDI index remained constant after the week, remaining above US$100.

According to the MDI, Singapore and Fujairah were in the overcharge zone in the VLSFO category, with the average weekly premium dropping by 34 points in Singapore and 14 points in Fujairah. VLSFO remained undervalued in Rotterdam and Houston. Undercharging dropped by 1 point in Rotterdam and 22 points in Houston on weekly average levels.

All ports in the MGO LS section remained undervalued. The weekly average in Rotterdam fell by 2 points, Fujairah fell by 9 points, and Houston dropped by 22 points. In Singapore, the weekly average has constantly remained above US$100. The underprice premium, on the other hand, has increased by 5 points.

Overall, fluctuations in the MDI index in the world’s major hubs throughout the week did not imply the emergence of a long-term dynamic in the correlation between market prices and the digital benchmark.

“We expect the Global bunker indices may continue trending downwards in the upcoming

week,” highlighted Sergey Ivanov, director of MABUX.