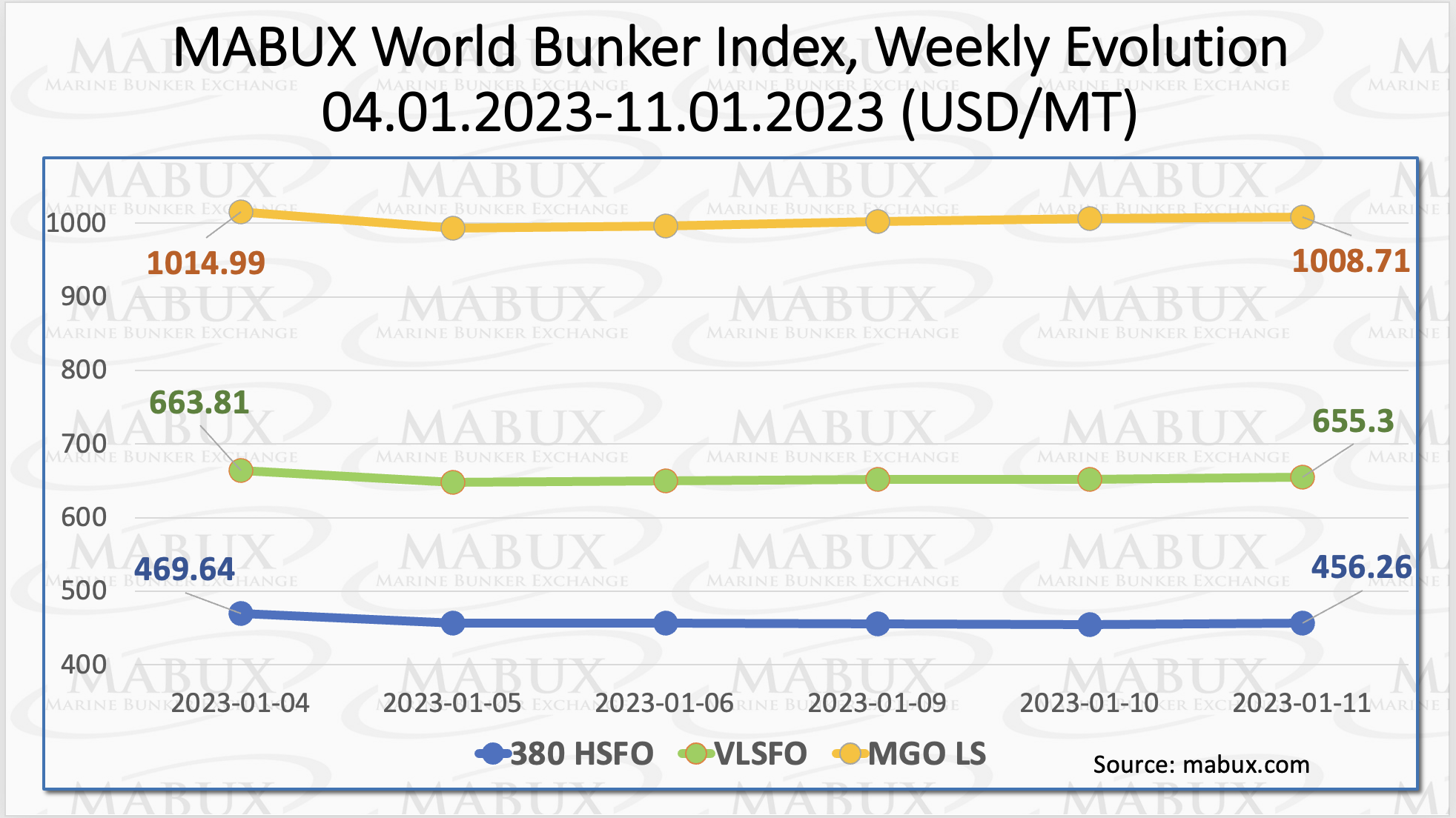

According to the weekly outlook of Marine Bunker Exchange (MABUX) for fuel prices, global bunker indices continued moderate decline. The 380 HSFO index fell by US$13.38 to US$456.26/MT, the VLSFO index lost US$8.51 to US$655.30/MT and the MGO index decreased by US$6.28, to US$1,008.71/MT.

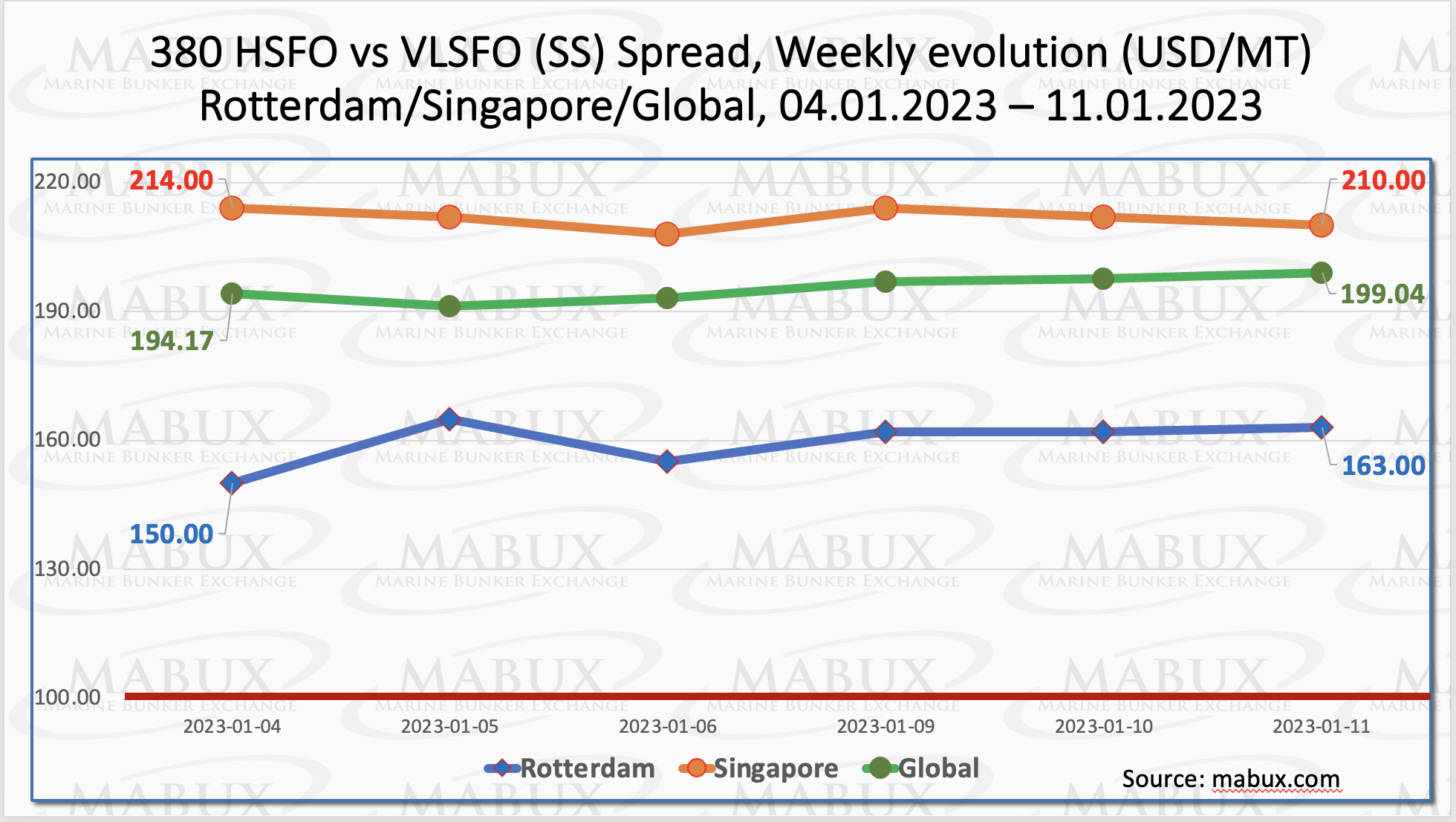

Additionally, Global Scrubber Spread (SS) – the price differential between 380 HSFO and VLSFO – showed a slight increase over the second week of the year – plus US$4.87 – reaching US$199.04.

In Rotterdam, SS Spread rose by US$13 to US$163. In Singapore, the price difference of 380 HSFO/VLSFO decreased by US$4 to US$210. At the same time, the SS Spread averages in Rotterdam and Singapore remained virtually unchanged, showing an increase of US$0.67 and US$0.84 respectively.

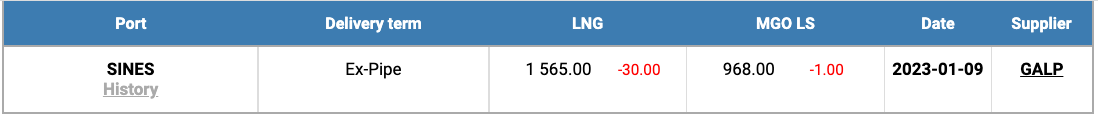

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to decline modestly and reached US$1,565/MT as of 9 January. The price difference between LNG and conventional fuel on 9 January was US$597 and MGO LS at the port of Sines was quoted at US$968/MT that day.

“The downward trend in the gas market is due to unseasonably warm winter temperatures since last month that left both the European and US heating markets sufficiently supplied,” commented a MABUX official.

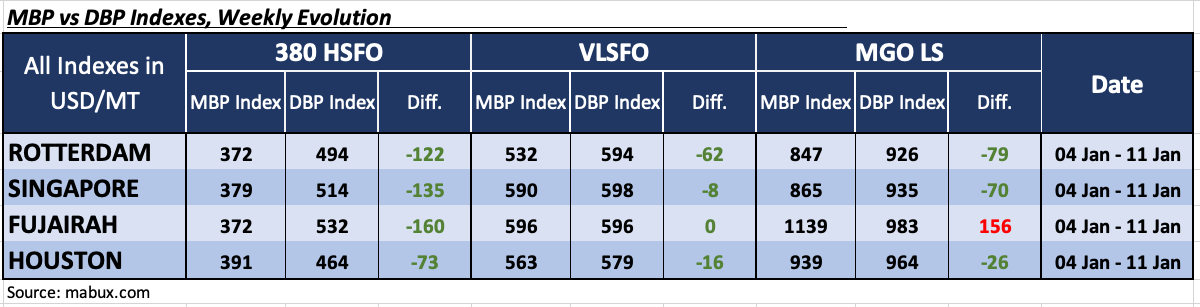

During the previous week, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) remained underestimated for 380 HSFO in all four selected ports, while the changes were minimal. Undercharge margins were registered as follows: Rotterdam – minus US$122, Singapore minus US$135, Fujairah minus US$160, and Houston minus US$73.

In the VLSFO segment, according to MDI, the port of Fujairah recorded a 100% correlation between the market price and the digital benchmark. In other ports, MDI showed some narrowing of underprice premium, Rotterdam – minus US$62, Singapore – minus US$8, and Houston – minus US$16.

In the MGO LS segment, Fujairah remains the only overvalued port, plus US$156. In all other ports, the MDI index registered an undervaluation of MGO LS, Rotterdam – minus US$79, Singapore – minus US$70, and Houston – minus US$26. Undercharge premium narrowed, while overcharge one widened.

“The European Union’s ban on Russian oil products set to come into force on 5 February could send bunker indices up. We expect slight upward evolution to prevail in the global bunker market next week,” pointed out Sergey Ivanov, director of MABUX.