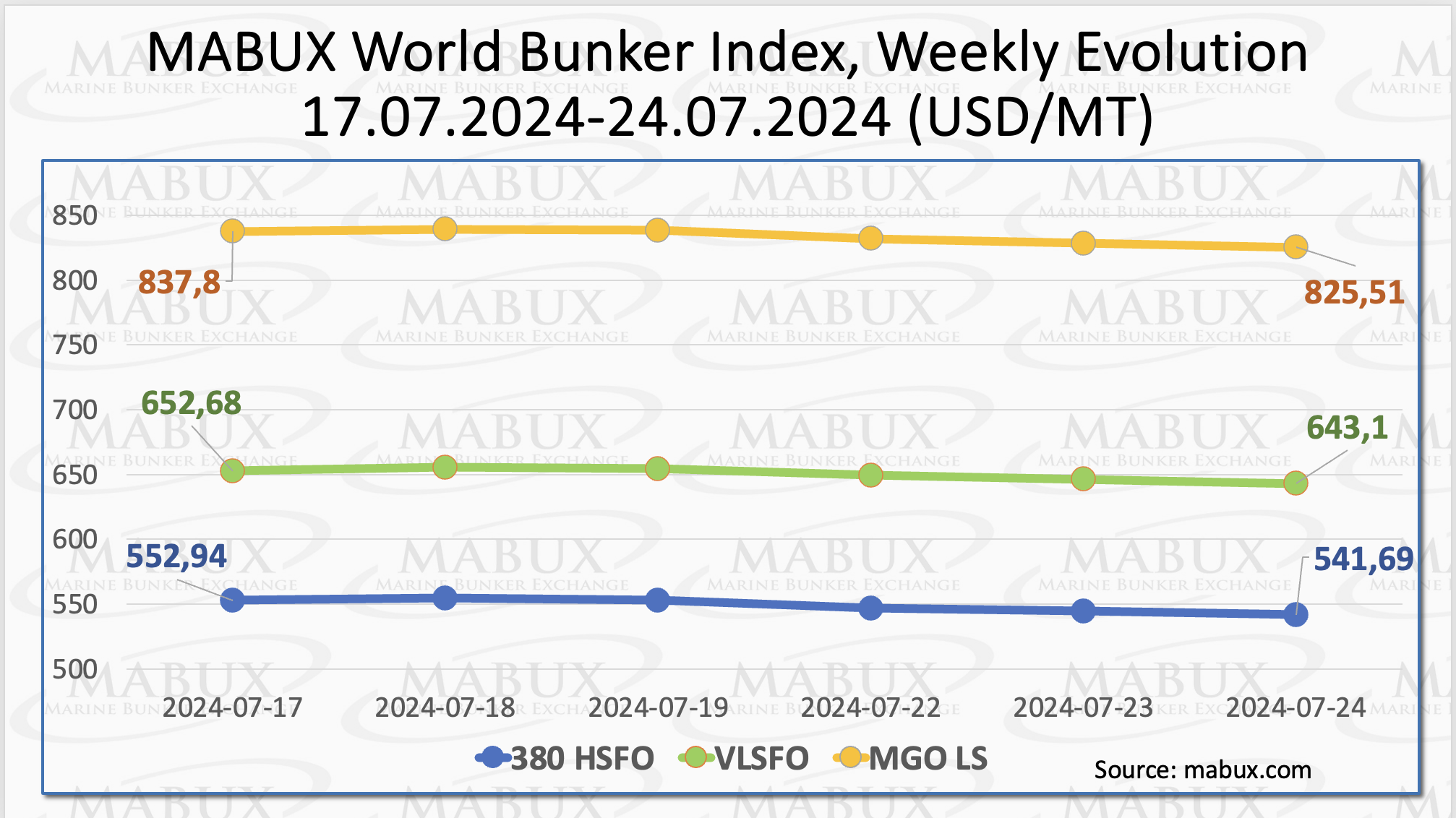

In the 30th week of the year, the Marine Bunker Exchange (MABUX) global indices maintained their moderate downward trend.

The 380 HSFO index dropped by US$11.25 to US$541.69/MT, thus breaking below the US$550 mark. The VLSFO index decreased by US$9.58 to US$643.10/MT, falling below US$650. The MGO index declined by US$12.29 to US$825.51/MT.

“At the time of writing, the world bunker indices demonstrated a slight upward correction,” mentioned a MABUX spokesperson.

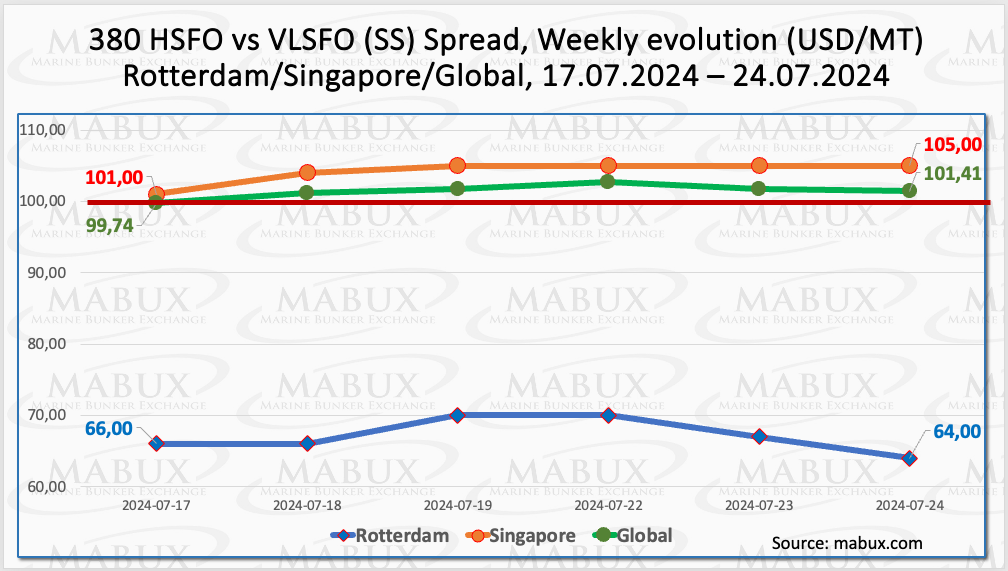

The MABUX Global Scrubber Spread (SS), which measures the price difference between 380 HSFO and VLSFO, returned to moderate growth, increasing by US$1.67 to US$101.41, thus surpassing the US$100 mark again (SS Breakeven). The weekly average also saw an increase of US$1.75.

In Rotterdam, the SS Spread narrowed by US$2 to US$64, while the weekly average widened by US$3.84. In Singapore, the 380 HSFO/VLSFO price differential rose by US$4 to US$105, remaining above the US$100 mark.

The port’s weekly average increased by US$5.84. Currently, there is no clear trend in the dynamics of the Global SS Spread and SS indices across ports, as the indicators are moving in different directions.

“We expect that a similar situation with SS Spread will continue next week,” stated a MABUX spokesperson.

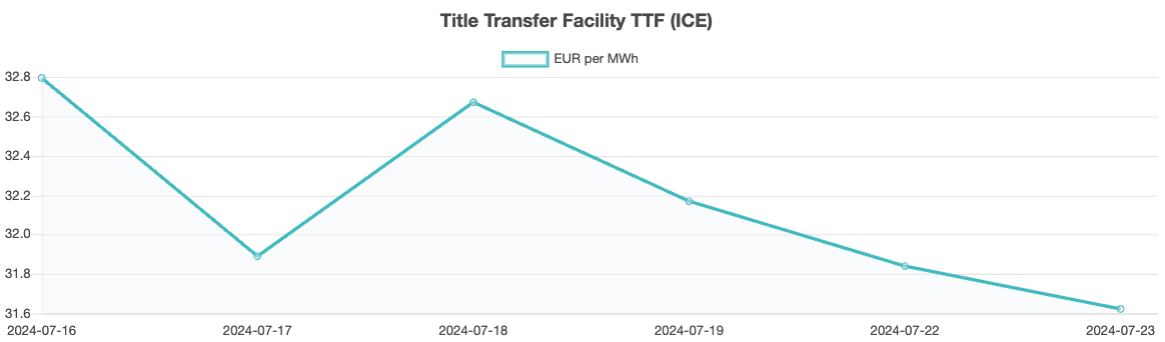

Global liquefied natural gas (LNG) markets are experiencing persistent volatility due to ongoing geopolitical tensions and conflicts, resulting in significant price fluctuations across the energy sector. Despite recent decreases in LNG prices, they remain exceptionally high—twice the average price over the past five years—placing considerable strain on net importers of this fossil fuel. In week 30, the European gas benchmark TTF experienced a moderate drop of €1.175/MWh, falling from €32.797/MWh the previous week to €31.622/MWh.

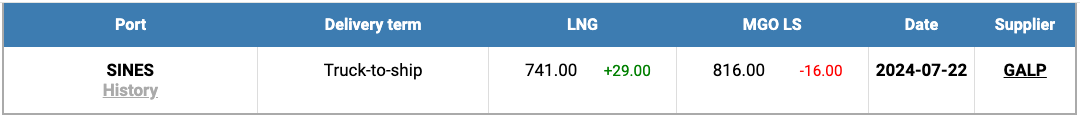

For the first time in a period of four weeks, the price of LNG as bunker fuel at the port of Sines (Portugal) rose to US$741/MT on 22 July, marking an increase of US$29 from the previous week.

At the same time, the price gap between LNG and conventional fuel narrowed to US$75 in favour of LNG, down from US$120 the week before. On 22 July, the price of MGO LS at the port of Sines was US$816/MT.

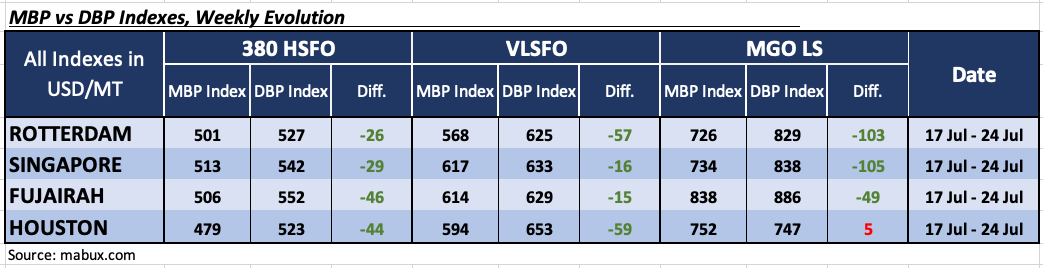

In Week 30, the MDI index, which measures the correlation between market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index), revealed the following trends in the world’s four major ports: Rotterdam, Singapore, Fujairah, and Houston:

For the 380 HSFO segment, all four ports were undervalued. Weekly averages increased by 1 point in Rotterdam, 3 points in Singapore, and 4 points in Houston, while Fujairah saw a 1-point decrease.

In the VLSFO segment, all four ports were in the undercharge zone. Average weekly levels dropped by 5 points in Rotterdam, 4 points in Singapore, and 4 points in Houston. The MDI index in Fujairah remained stable.

In the MGO LS segment, Houston was the only port showing overvaluation, with the weekly average decreasing by 15 points, approaching the 100% correlation mark with the MABUX digital benchmark. The other three ports remained undercharged, with weekly averages narrowing by 5 points in Rotterdam, 5 points in Singapore, and 16 points in Fujairah. The MDI indices in Rotterdam and Singapore were near the $100 mark.

“We expect the world bunker indices to continue their moderate downward movement

next week in the absence of potential growth movers in the market,” said Sergey Ivanov, director at MABUX.