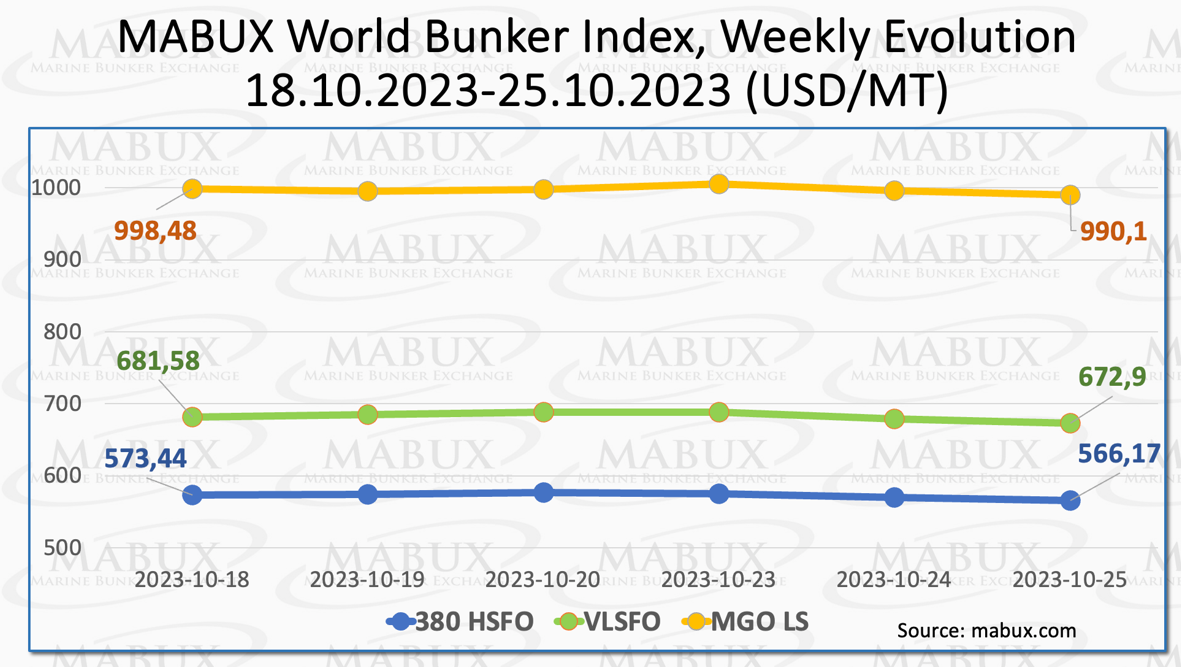

Marine Bunker Exchange (MABUX) global prices resumed again a moderate downward trend. The 380 HSFO index fell by US$7.27, the VLSFO index lost US$8.68 and the MGO index declined by US$8.38.

“At the time of writing, the market continued to move moderately downward,” pointed out a MABUX official.

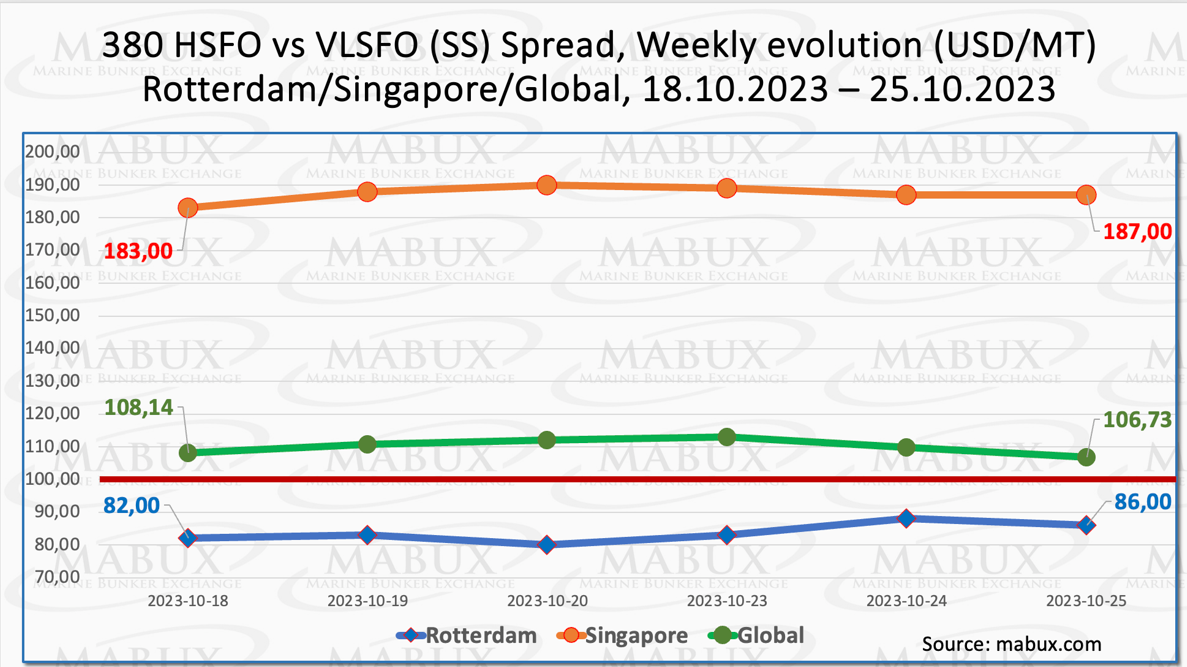

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – saw a slight reduction, now standing at minus US$1.41. Conversely, the weekly average increased by US$1.38.

In Rotterdam, SS Spread was up US$4 and the average rose by US$2.34. In Singapore, the difference in the price of 380 HSFO/VLSFO widened by US$4, with the weekly average increasing by US$2.83.

“We expect that the SS Spread will maintain moderate growth potential next week,” noted a MABUX official.

The European Union (EU) currently boasts gas storage levels exceeding 97%, while gas consumption remains lower than the levels observed in 2022. Additionally, there is the potential for increased gas exports from the United States.

The ongoing conflict in the Middle East is expected to exert a limited upward influence on near-term gas prices, as it reflects a geopolitical risk premium that is already evident in oil prices. Nevertheless, there is a lingering risk of the conflict escalating into a more extensive confrontation, which could temporarily drive up energy prices.

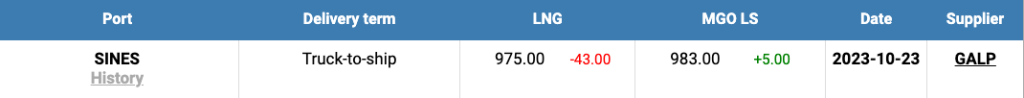

The price of LNG as bunker fuel in the port of Sines has once again decreased, reaching US$975/MT on 23 October. This marks a drop of US$43 compared to the previous week.

The difference in price between LNG and conventional fuel on 23 October has swung back in favor of LNG, with a US$8 advantage, as opposed to the US$41 advantage in favor of MGO just a week earlier.

On that day, MGO LS was quoted at US$983/MT in the port of Sines.

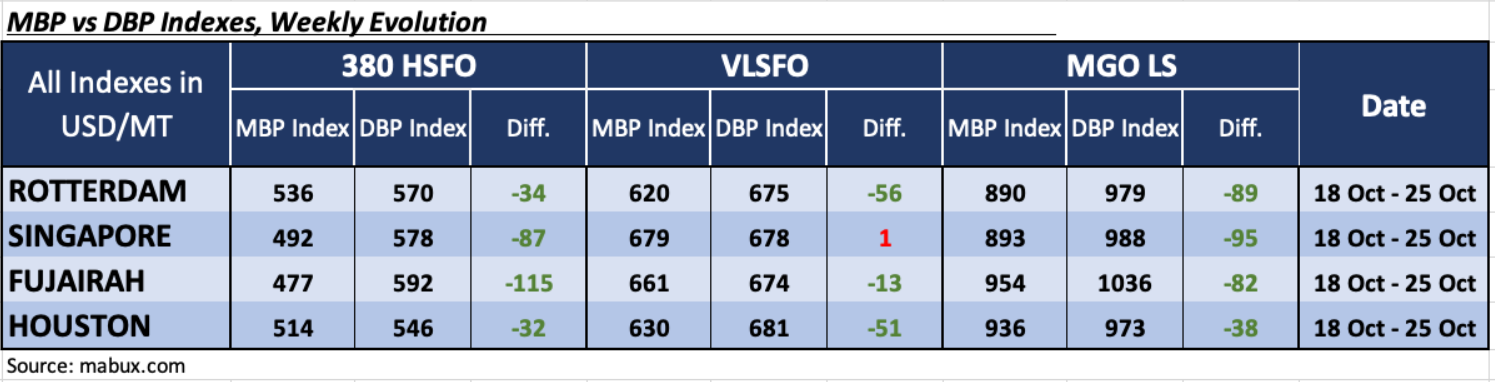

During Week 43, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs. the MABUX digital bunker benchmark (MABUX DBP Index)) registered the following trends in four selected ports, Rotterdam, Singapore, Fujairah and Houston:

In the 380 HSFO segment, all four ports continued to be undervalued. The average weekly undercharging increased by 5 points in Rotterdam, 5 points in Singapore, 11 points in Fujairah and 5 points in Houston. In Fujairah, the overprice level of this fuel type still exceeded the US$100 mark.

For the VLSFO segment, Singapore remained in the overpricing zone according to the MDI, with its weekly average decreasing by 6 points. In the other three ports, VLSFO was underestimated.

Undervaluation weekly average increased by 4 points in Rotterdam and 7 points in Fujairah, but decreased by 1 point in Houston. Singapore is nearing a 100% correlation between market prices and the digital benchmark.

In the MGO LS segment, the weekly average level of undervaluation showed a decrease in Rotterdam by 4 points, in Fujairah by 17 points and in Houston by 9 points. In Singapore, the weekly average MDI index remained unchanged.

“We expect that amid high volatility triggered by the ongoing conflict in the Middle East,

significant irregular fluctuations will continue to prevail in the global bunker market in the

coming week,” commented Sergey Ivanov, director of MABUX.