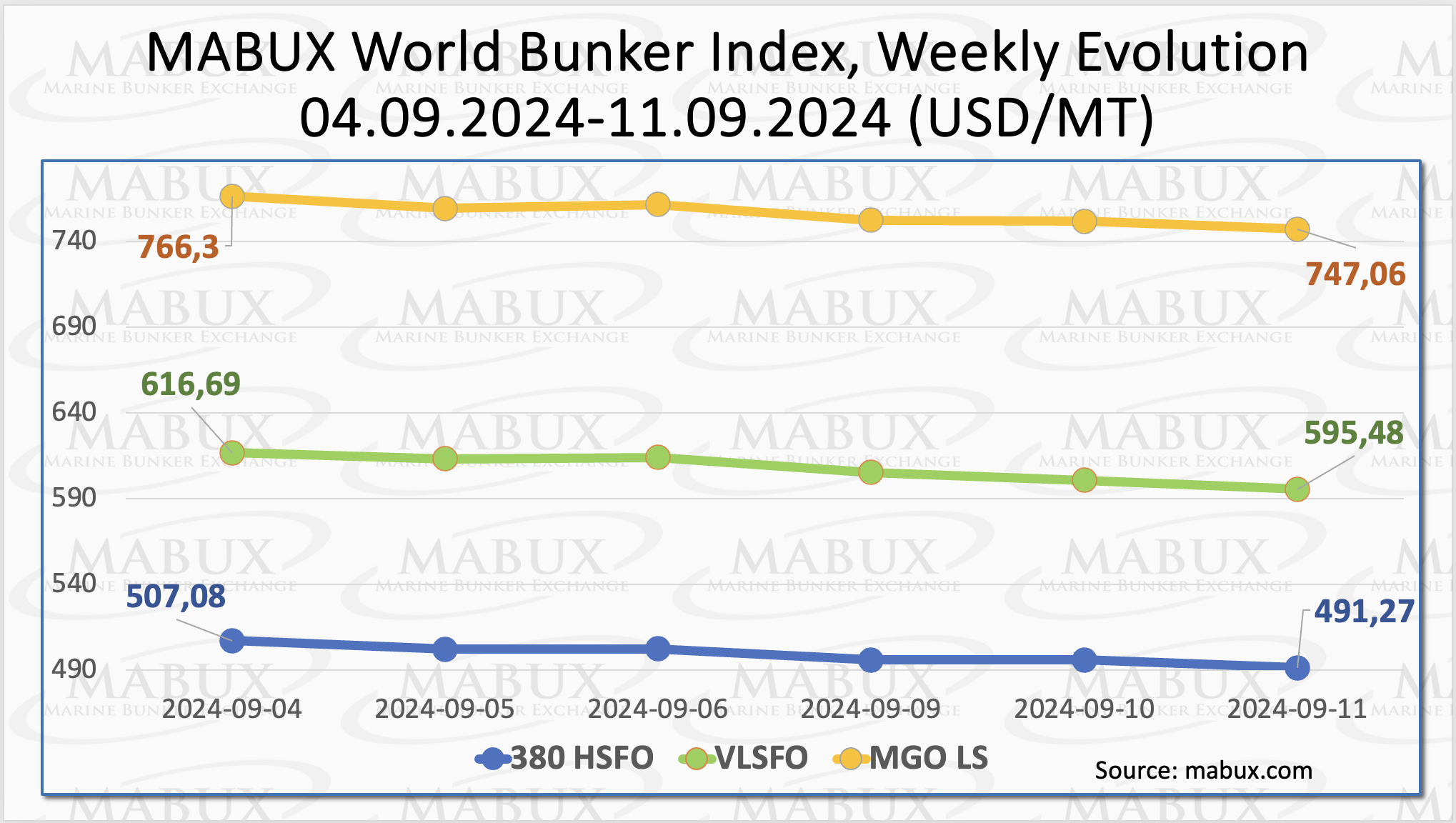

In the 37th week of the year, the Marine Bunker Exchange (MABUX) global indices continued their downward trend for the second week in a row.

The 380 HSFO index dropped by US$15.81 to US$491.27/MT, dipping below the US$500 threshold. The VLSFO index saw a decline of US$21.21 to US$595.48/MT, sliding under the US$600 mark. Meanwhile, the MGO index fell by US$19.24 to US$747.06/MT.

“At the time of writing, an upward correction was observed in the global bunker market,” pointed out a MABUX official.

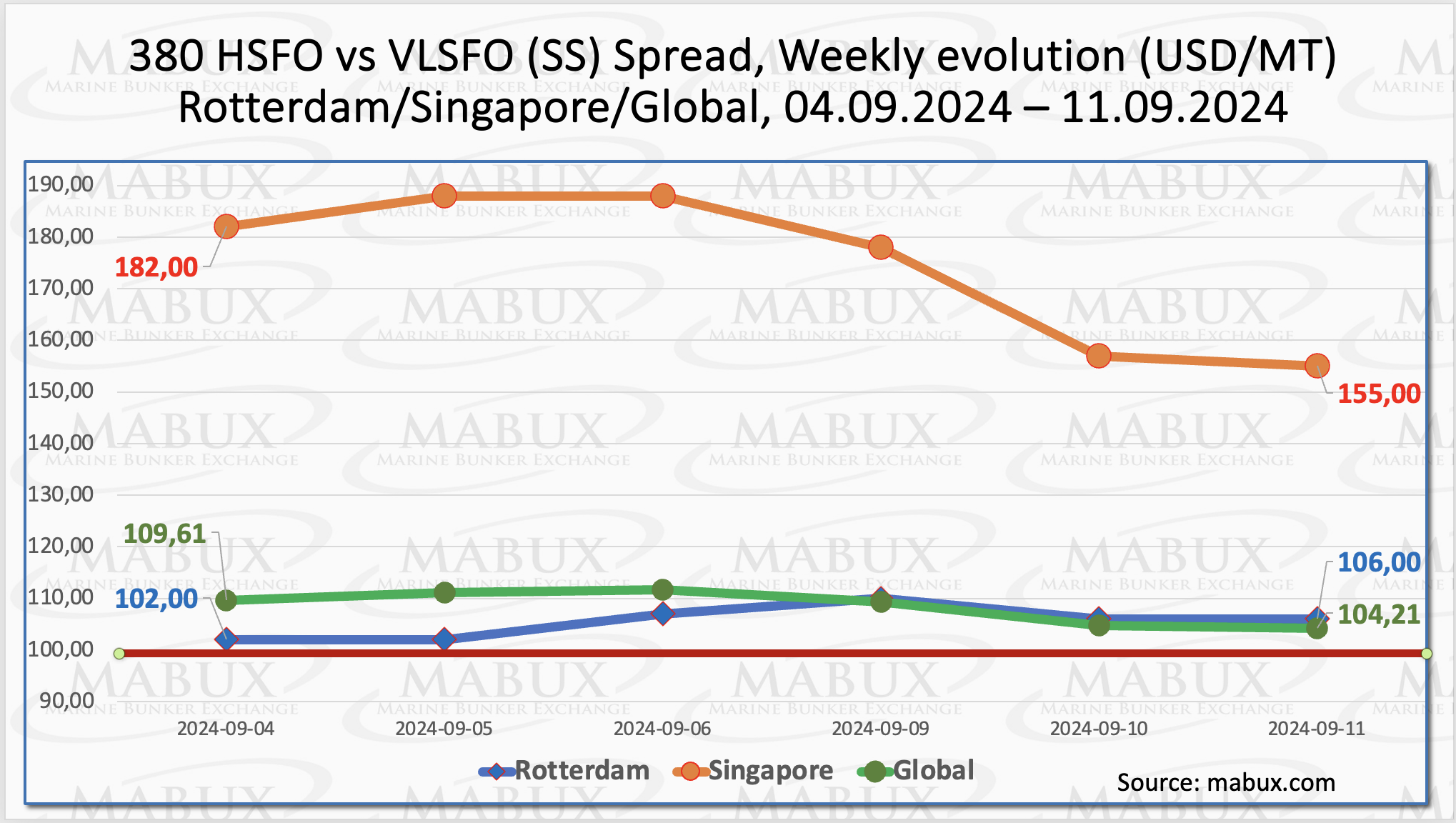

The MABUX Global Scrubber Spread (SS), which represents the price difference between 380 HSFO and VLSFO, narrowed by US$5.51 to US$104.21, approaching the breakeven point of US$100.

However, the weekly average increased by US$1.02. In Rotterdam, the SS Spread rose by US$4, remaining above the US$100 mark at US$106, up from US$102 last week. The weekly average there widened by US$6.50. In Singapore, the 380 HSFO/VLSFO price spread sharply decreased by US$27 to US$155, although the weekly average in the port increased by US$7.50.

“The upward dynamics of the SS Spread appear to have lost momentum, with global and port-specific indices showing mixed changes, which are expected to continue next week,” explained a MABUX spokesperson.

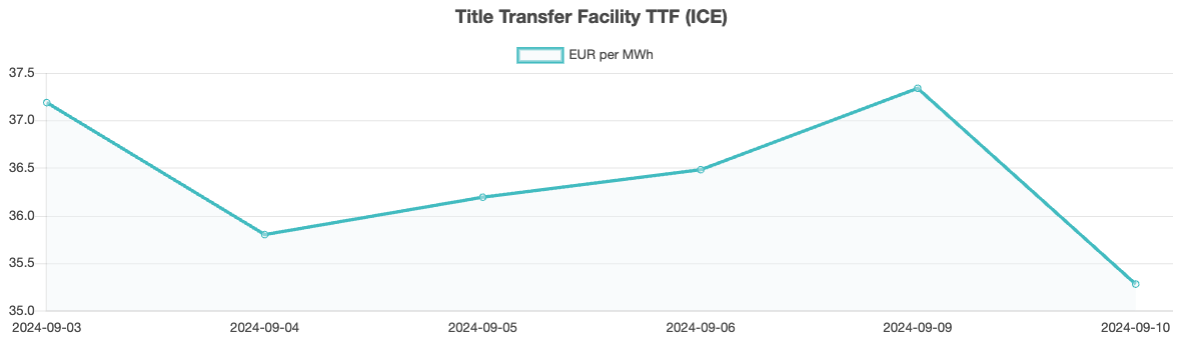

As of 10 September, European regional storage facilities were 93.09% full. By the end of Week 37, the European gas benchmark TTF decreased by 1.911 EUR/MWh, falling from 37.193 EUR/MWh to 35.282 EUR/MWh.

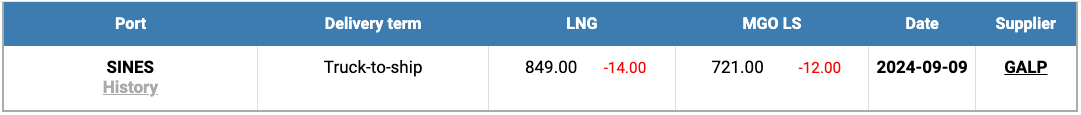

By 9 September, the price of LNG as bunker fuel in the port of Sines, Portugal, had dropped by US$14, reaching US$849/MT. The price gap between LNG and conventional fuel also widened, with MGO LS priced US$128 lower than LNG, compared to a US$112 difference the previous week. On that day, MGO LS was quoted at US$721/MT in Sines.

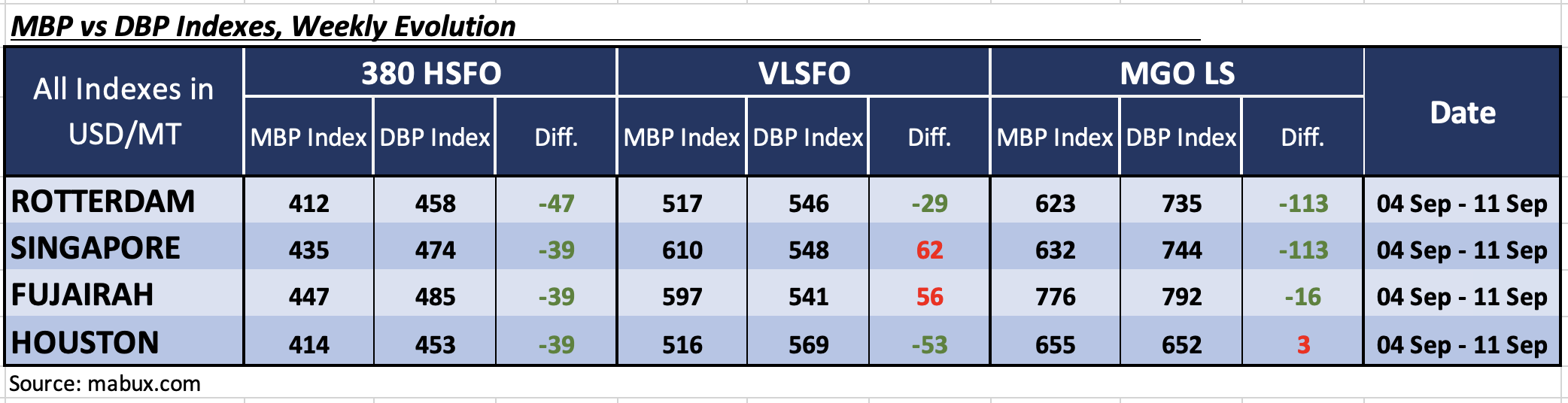

In Week 37 of 2024, the MDI index, which measures the correlation between market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index), showed the following trends in the four major global hubs: Rotterdam, Singapore, Fujairah, and Houston:

- 380 HSFO: All four ports were undervalued. Weekly averages increased by 4 bps in Rotterdam but dropped by 7 bps in Singapore, 29 bps in Fujairah, and 7 bps in Houston.

- VLSFO: Singapore and Fujairah remained overvalued, with weekly averages up by 25 bps and 30 bps, respectively. Rotterdam and Houston were undervalued, with weekly averages declining by 9 bps in Rotterdam and 8 bps in Houston.

- MGO LS: Houston shifted to the overvalued zone, becoming the only overpriced port, with a 6 bps increase in its weekly average. The other three ports remained undervalued, with the underpricing average falling by 3 bps in Rotterdam, 2 bps in Singapore, and 33 bps in Fujairah. MDI indices in Rotterdam and Singapore remained steady above the US$100 level.

“We expect the global bunker market will experience moderate, irregular fluctuations next

week, with no clear trend emerging,” stated Sergey Ivanov, Director of MABUX.