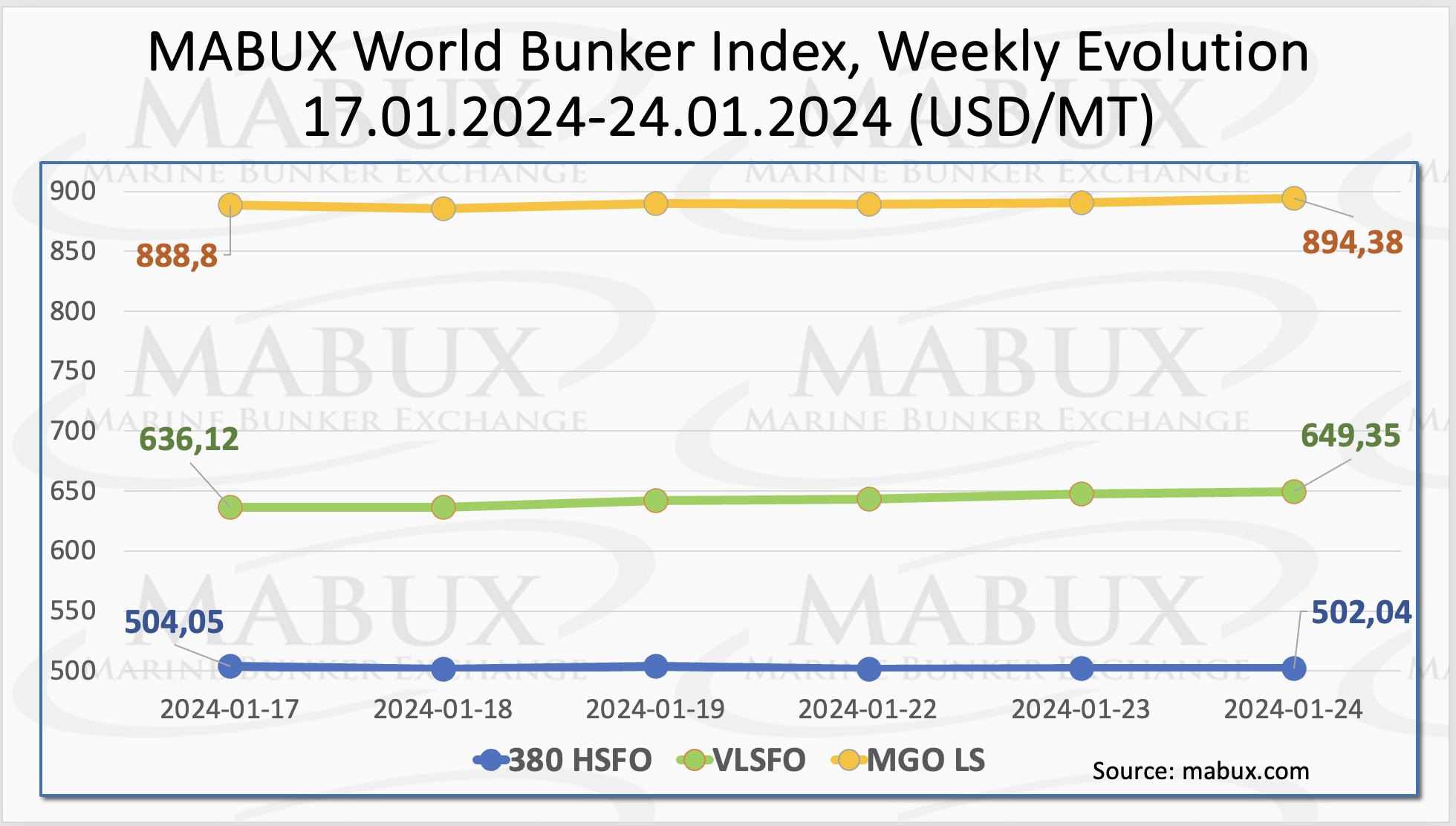

During the fourth week of the year, the Marine Bunker Exchange (MABUX) global bunker indices exhibited fluctuating movements without a distinct pattern.

The 380 HSFO index experienced a decline of US$2.01, settling at US$502.04/MT and approaching the US$500 mark. In contrast, the VLSFO index witnessed a rise of US$13.23, reaching US$649.35/MT. Additionally, the MGO index recorded an increase of US$5.58, reaching US$894.38/MT.

“At the time of writing, there was still no clear trend in the market,” stated a MABUX official.

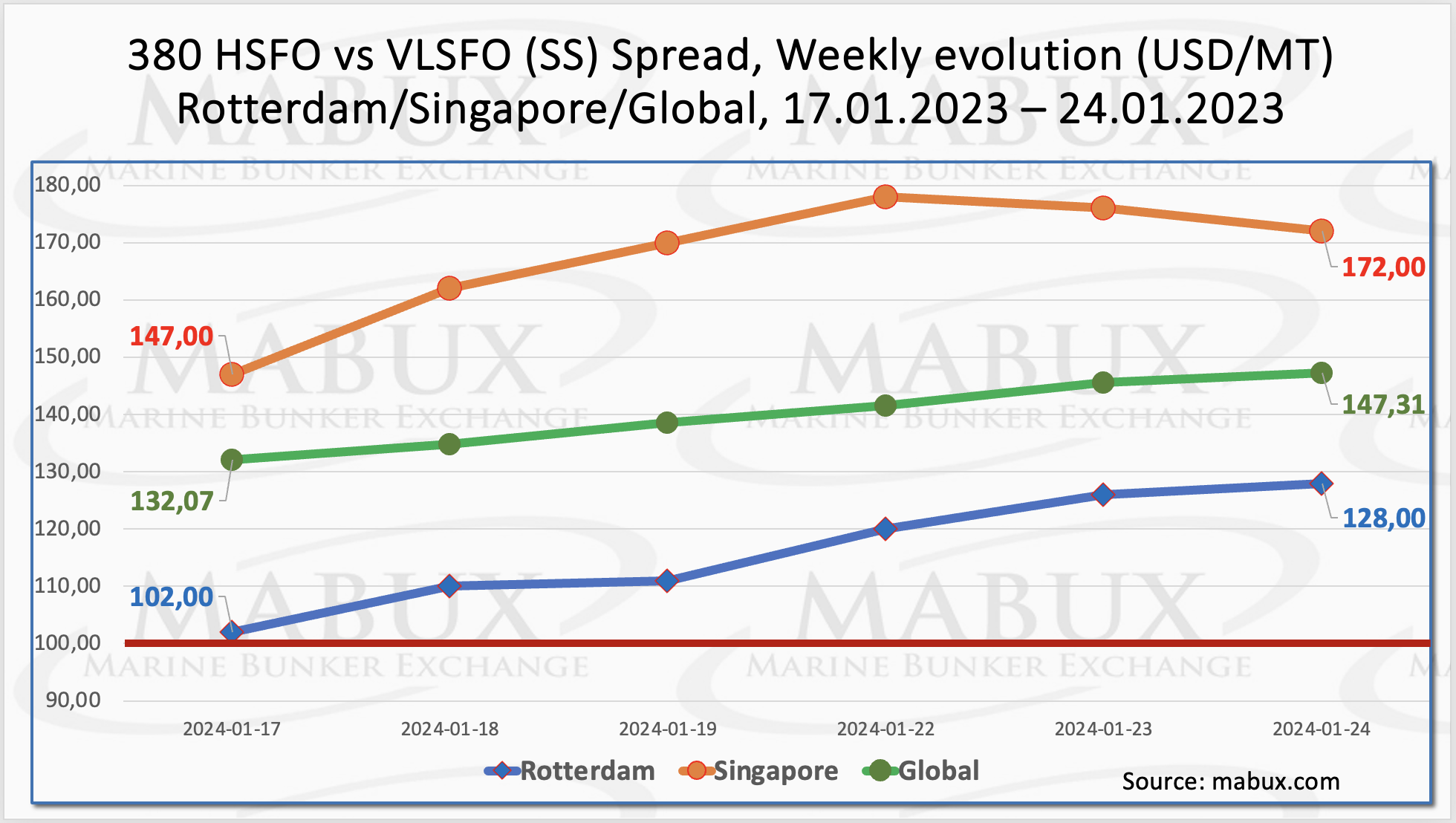

The Global Scrubber Spread (SS), denoting the price gap between 380 HSFO and VLSFO, continued to broaden, reaching a positive US$15.24. The weekly average SS also saw an uptick of US$10.18. Rotterdam witnessed a notable increase in SS Spread, rising by US$26.00 to US$128. The weekly average in Rotterdam also escalated by US$18.34. In Singapore, the 380 HSFO/VLSFO price difference expanded by US$25 to US$172, accompanied by a weekly average surge of US$28.33.

“This consistent upward trajectory in SS Spread underlines the growing profitability of the HSFO+scrubber combination,” pointed out a MABUX representative.

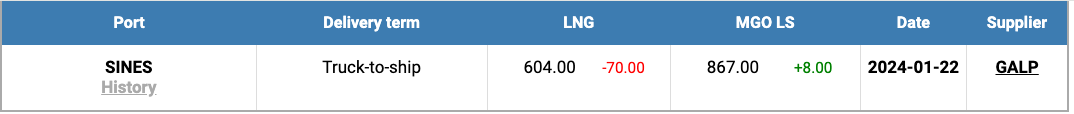

Last week, benchmark gas prices in Europe reached a two-year low due to elevated inventories and a decline in industrial gas demand. Despite the recent intense cold weather across much of Europe and a temporary suspension of Red Sea LNG traffic, the market remains well-supplied, ensuring sufficient natural gas storage for the remaining winter season. As of 16 January, European Union gas storage facilities were operating at 77.9% capacity, significantly exceeding the 5-year average of 68% for this time of year.

In the port of Sines in Portugal, the price of LNG as bunker fuel continued its descent, hitting US$604/MT on 22 January, reflecting a decrease of US$70 compared to the previous week. Concurrently, on 22 January, the price difference between LNG and traditional fuel widened, favouring LNG by US$263, as opposed to the US$181 gap observed a week earlier. On the same day, MGO LS was priced at US$867/MT in the port of Sines.

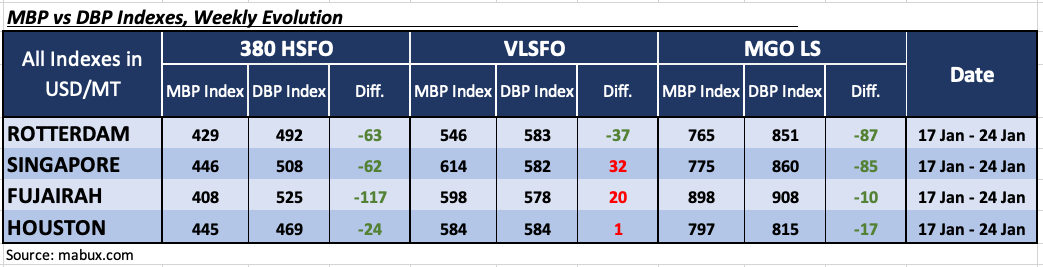

In the fourth week, the MDI index, which compares market bunker prices (MABUX MBP Index) to the MABUX digital bunker benchmark (MABUX DBP Index), revealed the following trends in four key ports: Rotterdam, Singapore, Fujairah, and Houston.

In the 380 HSFO segment, Houston entered the undervalued category, aligning with the other three selected ports. The weekly average underpricing expanded by 21 points in Rotterdam, 11 points in Singapore, 7 points in Fujairah, and 37 points in Houston. Notably, the MDI index in Fujairah consistently surpassed the US$100 threshold.

For the VLSFO segment, the MDI indicated that Singapore, Fujairah, and Houston were in the overcharge zone, with Houston approaching a 100% correlation between market price and the digital benchmark. Weekly average overprice premiums increased by 14 points in Singapore while decreasing by 2 points in Fujairah and 4 points in Houston. Rotterdam remained the only underpriced port in this bunker fuel segment, with the weekly average ratio growing by another 3 points.

In the MGO LS segment, Fujairah shifted into the undercharge zone, indicating the undervaluation of this fuel type in all four selected ports. Average weekly premiums of underestimation increased by 2 points in Rotterdam, 10 points in Singapore, 19 points in Fujairah, and 3 points in Houston.

“We expect the global bunker market to maintain the potential for an uptrend in bunker

prices next week,” stated Sergey Ivanov, director of MABUX.