At the end of the 14th week of the year, the global bunker indices of Marine Bunker Exchange (MABUX) maintained a moderate upward trend.

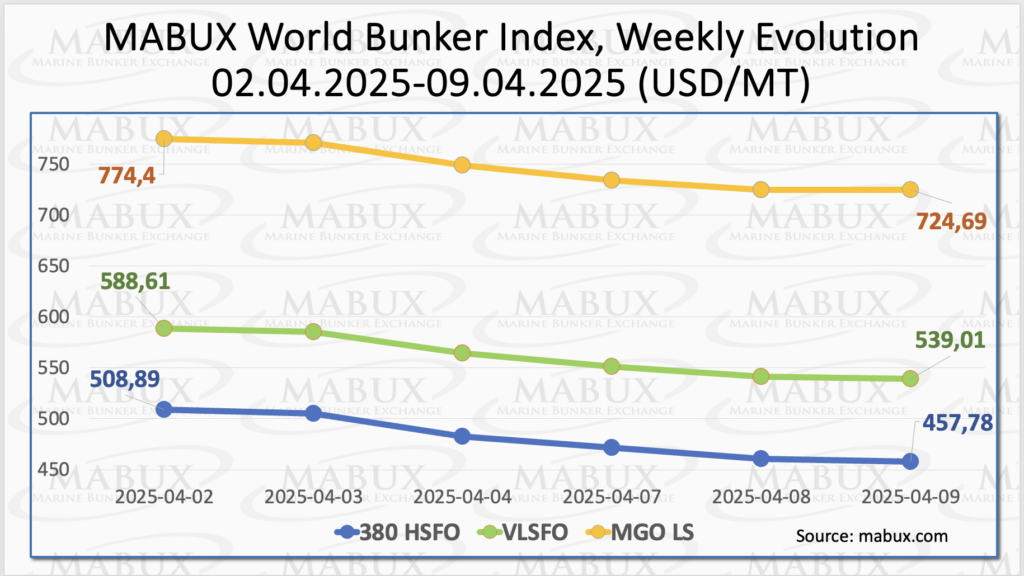

The 380 HSFO index increased by 5.94 USD, rising from 503.31 USD/MT last week to 508.53 USD/MT, the VLSFO index edged up by 3.85 USD, remaining at 587.68 USD/MT, while the MGO index climbed by 5.94 USD, from 768.81 USD/MT last week to 774.75 USD/MT.

“However, at the time of writing, there were indications that prices were beginning to trend downward,” noted a MABUX analyst.

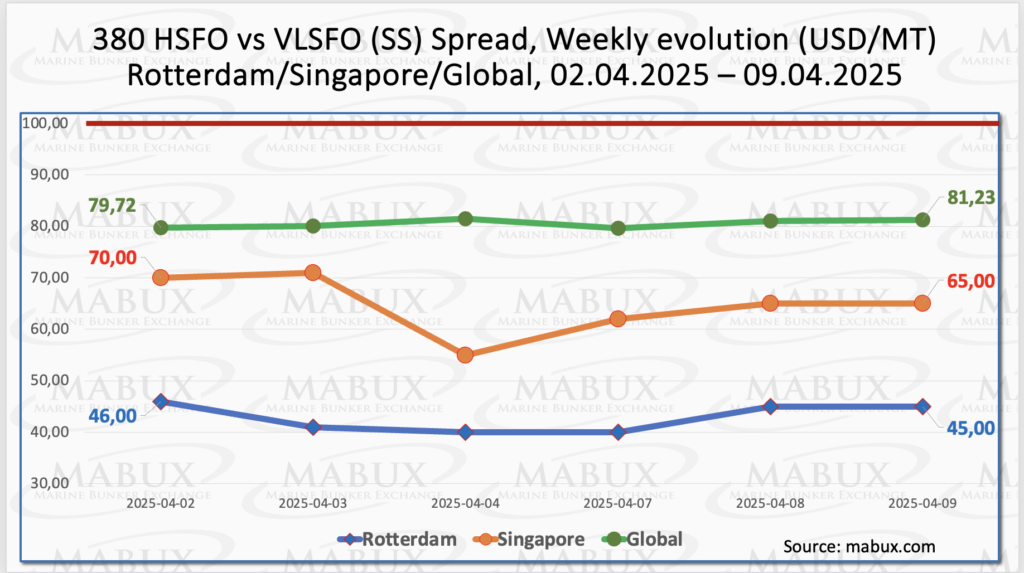

The MABUX Global Scrubber Spread (SS)—the price difference between 380 HSFO and VLSFO—continued its moderate decline, dropping by $1.37 from $80.52 last week to $79.15. The weekly average of the index also saw a slight decrease of $0.15.

In Rotterdam, the SS Spread showed growth for the first time in four weeks, rising by $7.00 to $46.00. However, the weekly average in the Dutch port remained unchanged at $46.00.

Meanwhile, in Singapore, the 380 HSFO/VLSFO price difference increased by $15.00, climbing from $51.00 last week to $66.00, with the weekly average in the Asian port rising by $11.84. Overall, SS Spread dynamics indicate signs of a renewed upward trend.

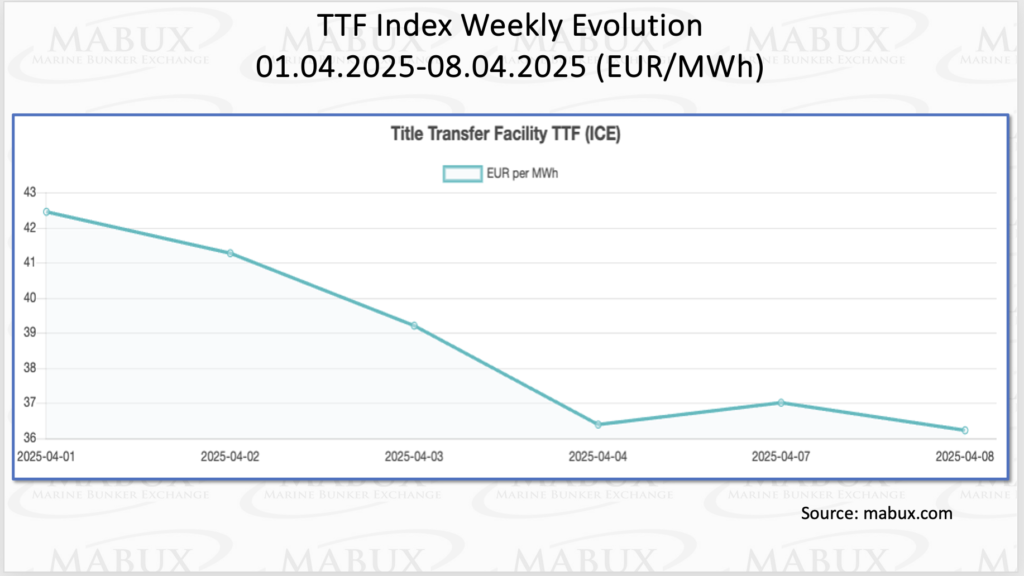

Europe is capitalizing on weak Asian demand for liquefied natural gas (LNG) to increase imports to their highest level for this time of year. Lower Asian demand and spot prices are prompting the resale of cargoes to Europe, which, as the heating season ends, must begin replenishing LNG stockpiles depleted by a winter colder than the previous three. Meanwhile, Europe has a short-term window to secure large LNG volumes, as China’s LNG imports are projected to decline this year—the first annual drop since 2022.

As of April 1, European regional storage facilities were 33.59% full, down 0.32% from the previous week and 37.74% lower than at the start of the year (71.33%). With rising average temperatures, gas extraction had virtually ceased. Meanwhile, the European gas benchmark, TTF, continued its moderate growth in Week 14, increasing by €0.895/MWh to €42.450/MWh from €41.555/MWh last week.

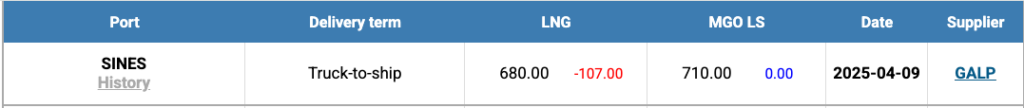

The price of LNG as a bunker fuel in the port of Sines (Portugal) experienced a sharp decline at the end of the week, dropping to 787 USD/MT from 874 USD/MT the previous week. Simultaneously, the price gap between LNG and conventional fuel narrowed by April 2, with MGO LS quoted at 736 USD/MT, resulting in a price difference of 51 USD in favor of MGO LS, compared to 147 USD the week prior.

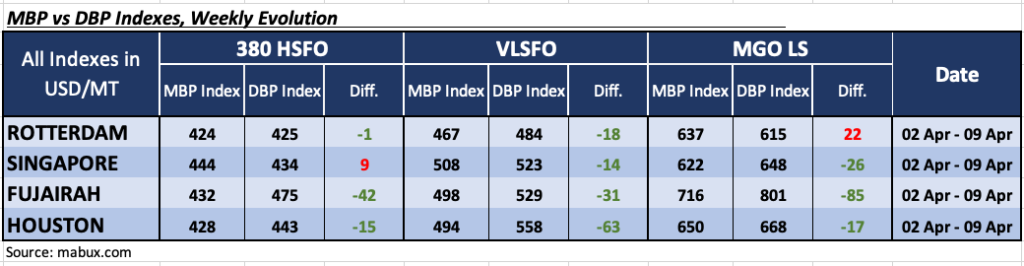

At the end of Week 14, the MABUX Market Differential Index (MDI)—which measures the ratio of market bunker prices (MBP) to the MABUX digital bunker benchmark (DBP)—continued its gradual shift towards fuel undervaluation in the 380 HSFO and VLSFO segments.

380 HSFO segment: Rotterdam and Singapore moved into the undervalued zone, meaning all four major ports were now undervalued. The weekly average MDI values increased as follows:

- Rotterdam: +8 points

- Singapore: +19 points

- Fujairah: +9 points

- Houston: +4 points

MDI values in Rotterdam and Singapore were close to the 100% correlation mark between MBP and DBP.

VLSFO segment: All four selected ports remained undervalued. The weekly average MDI values changed as follows:

- Rotterdam: +10 points

- Singapore: +8 points

- Houston: +12 points

- Fujairah: Unchanged

MGO LS segment: Rotterdam re-entered the overvalued zone, becoming the only overvalued port, with its weekly average MDI rising by 10 points. The other three ports remained undervalued, with the following increases:

- Singapore: +6 points

- Fujairah: +11 points

- Houston: +4 points

- Rotterdam remained near the 100% correlation mark between MBP and DBP.

Sergey Ivanov, Director of MABUX, commented: “The overall trend continues to shift toward undervaluation, with two additional ports in the 380 HSFO segment now classified as undervalued. We anticipate that this trend will dominate the global bunker market in the coming week.”

Ivanov added: “We anticipate the global bunker market remains relatively balanced, minimizing the likelihood of sharp price fluctuations. Next week, a moderate decline in indices is possible, while multidirectional price movements are expected to prevail.”