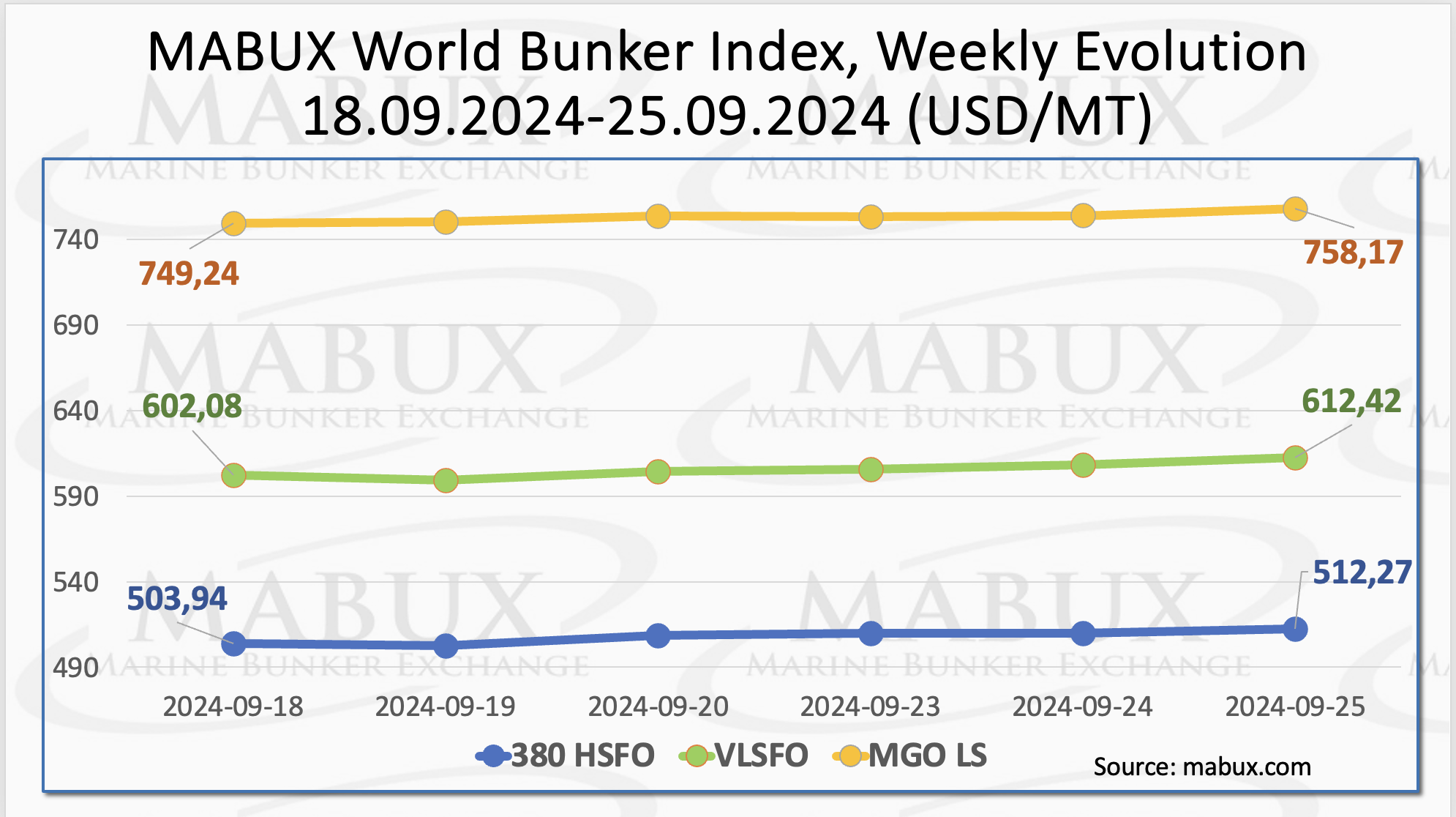

During the 39th week of the year, the Marine Bunker Exchange (MABUX) indices saw moderate growth.

The 380 HSFO index increased by US$8.33 to US$512.27/MT, remaining near the US$500 threshold. The VLSFO index climbed by US$10.34, reaching US$612.42/MT. Similarly, the MGO index went up by US$8.93 to US$758.17/MT.

“At the time of writing, there were no significant shifts in the global bunker market indices,” stated a MABUX official.

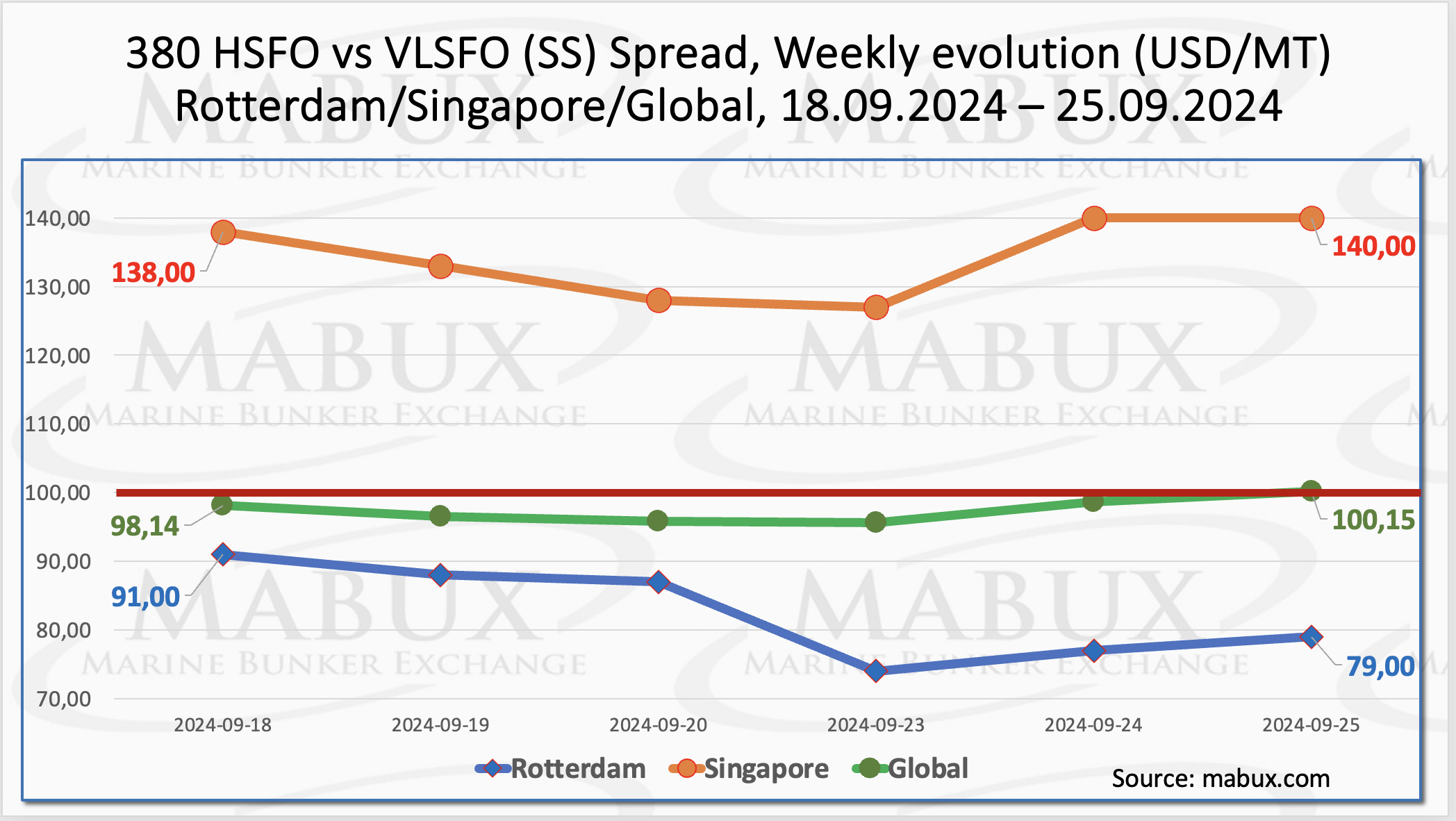

The MABUX Global Scrubber Spread (SS), representing the price gap between 380 HSFO and VLSFO, also grew by US$2.01 hitting the US$100 SS breakeven point.

However, the weekly average dipped by US$1.64. In Rotterdam, the SS Spread dropped by US$12.00, settling at US$79.00, down from US$91.00 the previous week, with the weekly average decreasing by US$14.33. In Singapore, the 380 HSFO/VLSFO price gap increased by US$2.00, from US$138.00 to US$140.00, though the weekly average in the port declined by US$6.50. The SS Spread continues to display mixed trends, a pattern expected to persist into next week.

According to the Institute for Energy Economics and Financial Analysis (IEEFA), Europe may have already reached its peak in LNG demand, with much of its growing LNG import infrastructure at risk of becoming stranded assets by the decade’s end. LNG imports to Europe, including the EU, UK, Norway, and Turkey, dropped by 20% year-on-year in the first half of 2024.

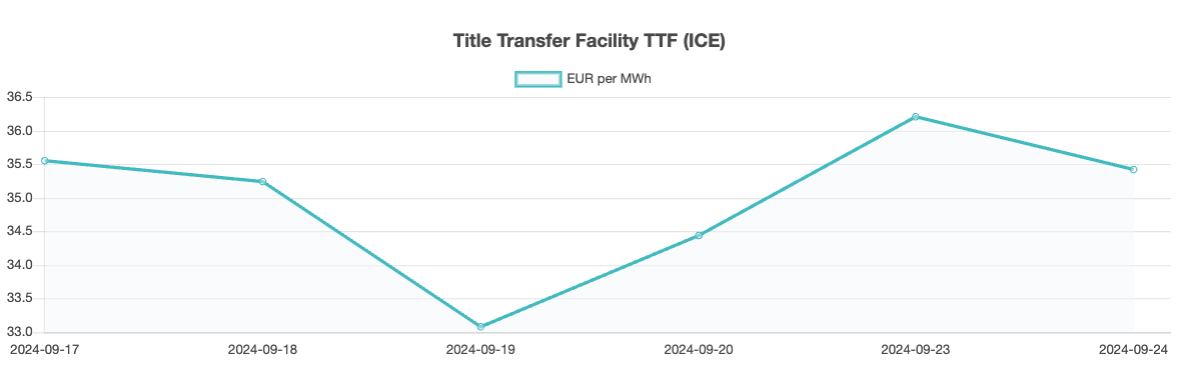

Despite the reduction, several European nations are still planning new LNG terminals. IEEFA projects that Europe could have an excess capacity of over 300 billion cubic meters (bcm) by 2030, as demand is predicted to fall below planned capacity. As of September 25, regional European storage facilities were 93.74% full. The European TTF gas benchmark showed little change for Week 39, with a slight decrease of EUR 0.134/MWh, closing at EUR 35.413/MWh, compared to EUR 35.547/MWh the previous week.

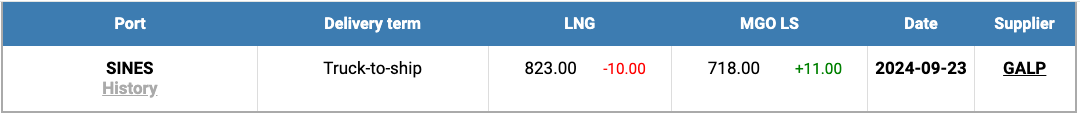

In Portugal’s Sines port, the price of LNG as bunker fuel fell by US$10 during the week, reaching US$823/MT on September 23. The price gap between LNG and conventional fuel narrowed, with a US$105 difference in favour of MGO LS on 23 September, down from US$136 the prior week. On the same day, MGO LS was priced at US$718/MT in Sines.

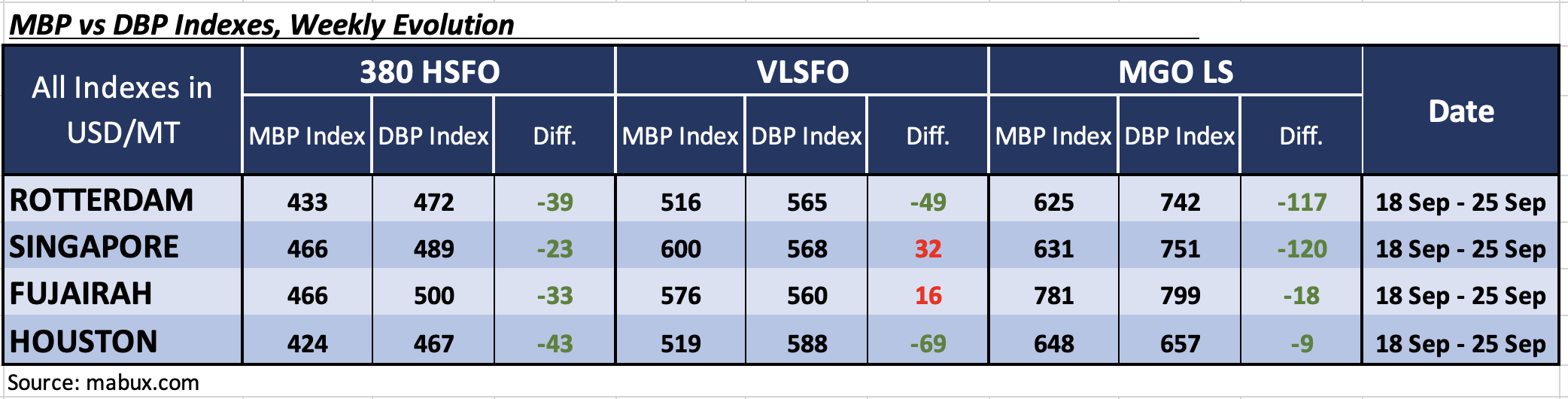

The MDI index, which tracks the correlation between market bunker prices (MABUX MBP Index) and the MABUX digital bunker benchmark (MABUX DBP Index), showed the following trends across the four major global hubs—Rotterdam, Singapore, Fujairah, and Houston—for Week 39:

- 380 HSFO segment: All four ports were undervalued. Weekly averages declined by 9 bps in Rotterdam and 7 bps in Singapore, while Fujairah saw a 12 bps increase. Houston’s MDI index remained unchanged.

- VLSFO segment: Singapore and Fujairah continued to be overvalued, with weekly averages dropping by 5 bps in Singapore and 19 bps in Fujairah. Rotterdam and Houston were undervalued, with weekly averages rising by 9 bps in Rotterdam and 3 bps in Houston.

- MGO LS segment: All four ports were overvalued. Weekly averages rose by 8 points in Rotterdam, 9 points in Singapore, 14 points in Fujairah, and 9 points in Houston. The MDI indices in Rotterdam and Singapore remained above the US$100 mark, while Houston’s index stayed close to the 100% correlation between market prices and the MABUX digital benchmark

“We expect the global bunker market to retain its growth potential, with bunker indices

showing a moderate upward trend next week,” stated Sergey Ivanov, Director, MABUX.