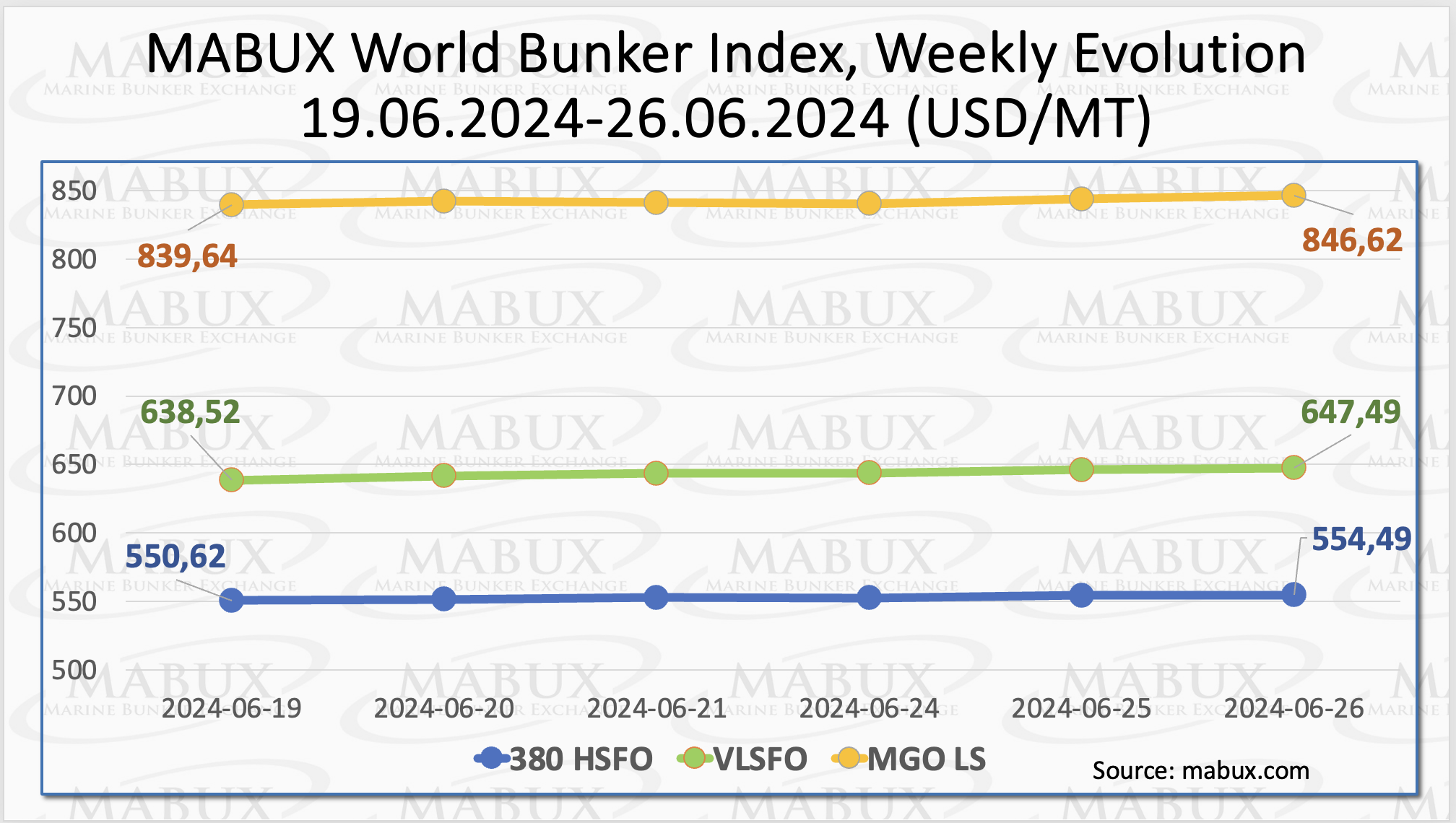

During the 26th week of the year, the Marine Bunker Exchange (MABUX) global bunker indices showed moderate upward movement.

The 380 HSFO index increased to US$554.49/MT, the VLSFO index rose to US$647.49/MT and the MGO index climbed to US$846.62/MT.

“At the time of writing, a slight upward trajectory continued in the global bunker

market,” noted a MABUX official.

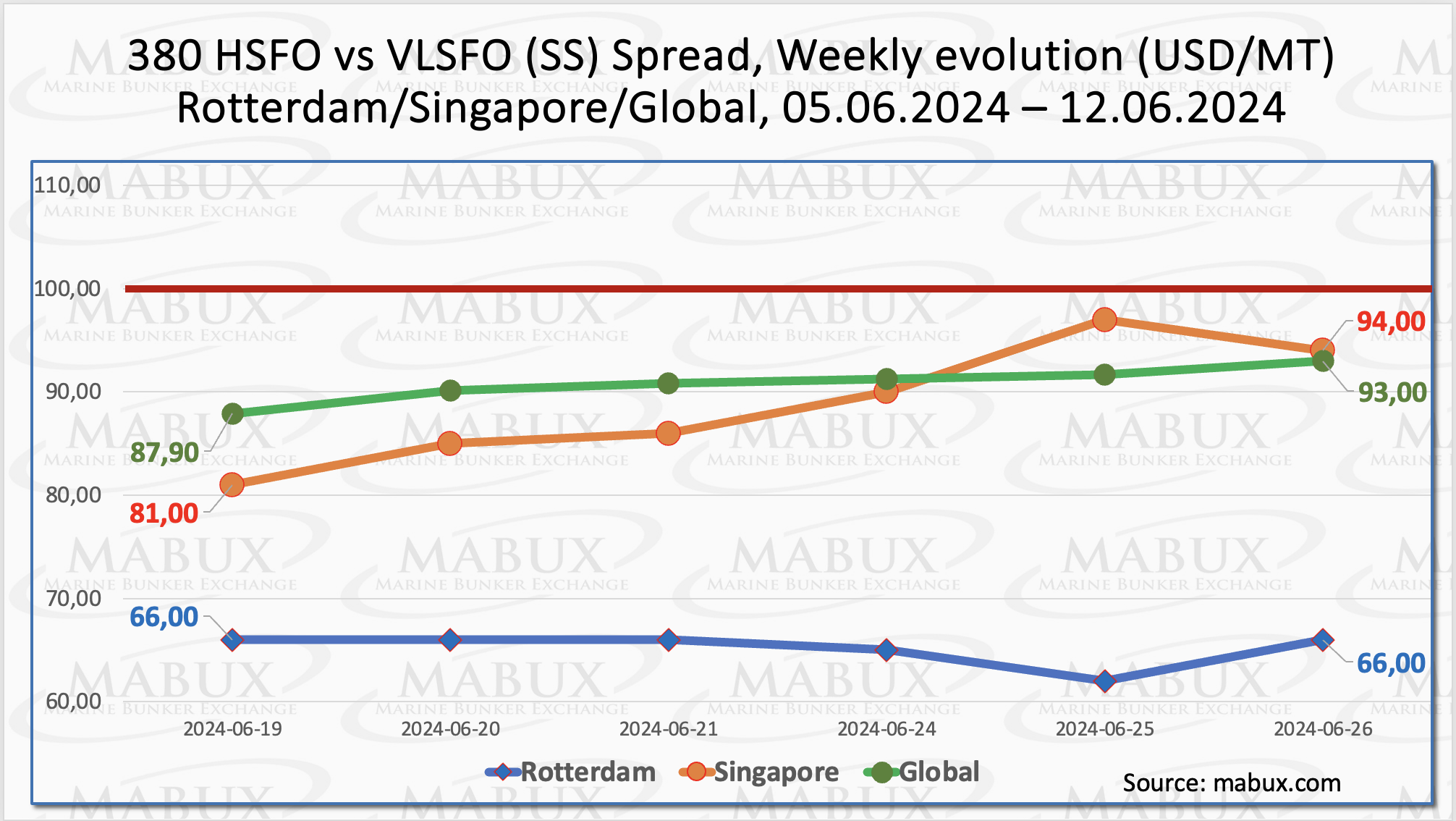

The MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – resumed moderate growth, increasing by US$5.10 to US$93.00, up from US$87.90 last week, approaching the US$100 mark (SS Breakeven). The weekly average rose by a modest US$0.52.

In Rotterdam, SS Spread values remained steady at US$66.00, although the weekly average widened by US$3.17. In Singapore, the price difference between 380 HSFO and VLSFO continued to grow, increasing by US$13 to US$94 from US$81 last week, also nearing the US$100 mark. The weekly average at the port increased by US$8.

Overall, the SS Spread continues its moderate upward correction. We anticipate the SS Spread Global Index as well as the SS Spread Singapore Index will surpass the US$100 mark next week.

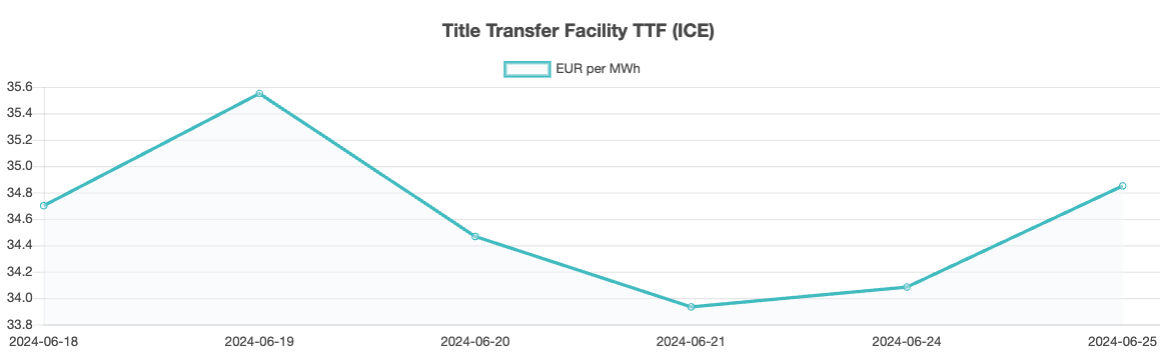

The European gas market remains characterized by sluggish inventory builds and heightened vulnerability to supply disruptions. Recent sudden outages and scheduled maintenance in Norway, coupled with potential further reductions in Russian pipeline supply, have maintained Dutch TTF Natural Gas Futures around US$37 per megawatt-hour.

According to forecasts from StanChart, although interruptions in Europe’s gas supply may be brief, prices are expected to remain elevated due to slower-than-usual inventory accumulation. In Week 26, the European gas benchmark TTF continued its moderate ascent, increasing by 0.153 EUR/MWh to reach 34.853 EUR/MWh, up from 34.700 EUR/MWh last week.

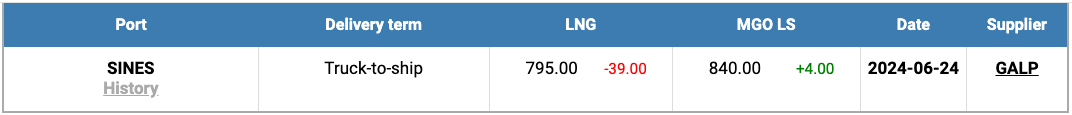

As of June 24, the price of LNG as bunker fuel in the port of Sines, Portugal, decreased to US$795/MT, marking a decline of US$39 from the previous week. This change underscores a US$45 advantage of LNG over conventional fuel, contrasting with a US$20 advantage observed for MGO LS just a week earlier, which was priced at US$840/MT on the same day in the port of Sines.

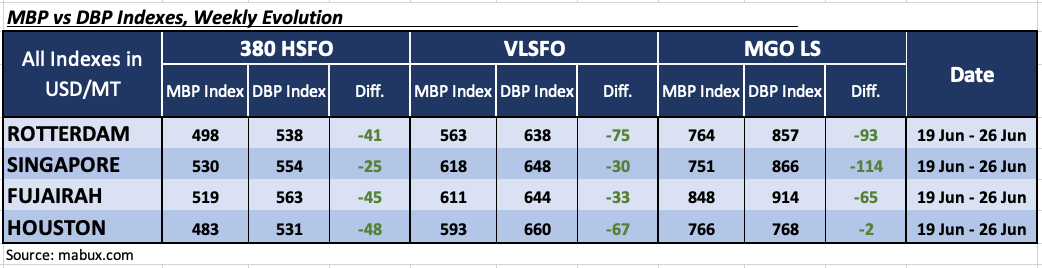

During Week 26, the MDI index (the correlation ratio between market bunker prices (MABUX MBP Index) and MABUX digital bunker benchmark (MABUX DBP Index)) continued to indicate undervaluation across all fuel segments in the world’s four largest hubs: Rotterdam, Singapore, Fujairah, and Houston:

In the 380 HSFO segment, weekly average undervaluation increased by 2 points in Rotterdam, 4 points in Singapore, 5 points in Fujairah, and 7 points in Houston.

In the VLSFO segment, average weekly undervaluation levels rose by 1 point in Fujairah, while decreasing by 1 point in Singapore and 3 points in Houston. The MDI index remained unchanged in Rotterdam.

In the MGO LS segment, weekly averages increased by 7 points in Rotterdam, 4 points in Singapore, and 23 points in Fujairah, but decreased by 13 points in Houston. The MDI index in Houston approached the 100% correlation mark between the market price and the MABUX digital benchmark, while in Singapore, it consistently remained above the US$100 mark.

“We expect the steady upward trend in the global bunker market to continue next week,” stated Sergey Ivanov, director at MABUX.