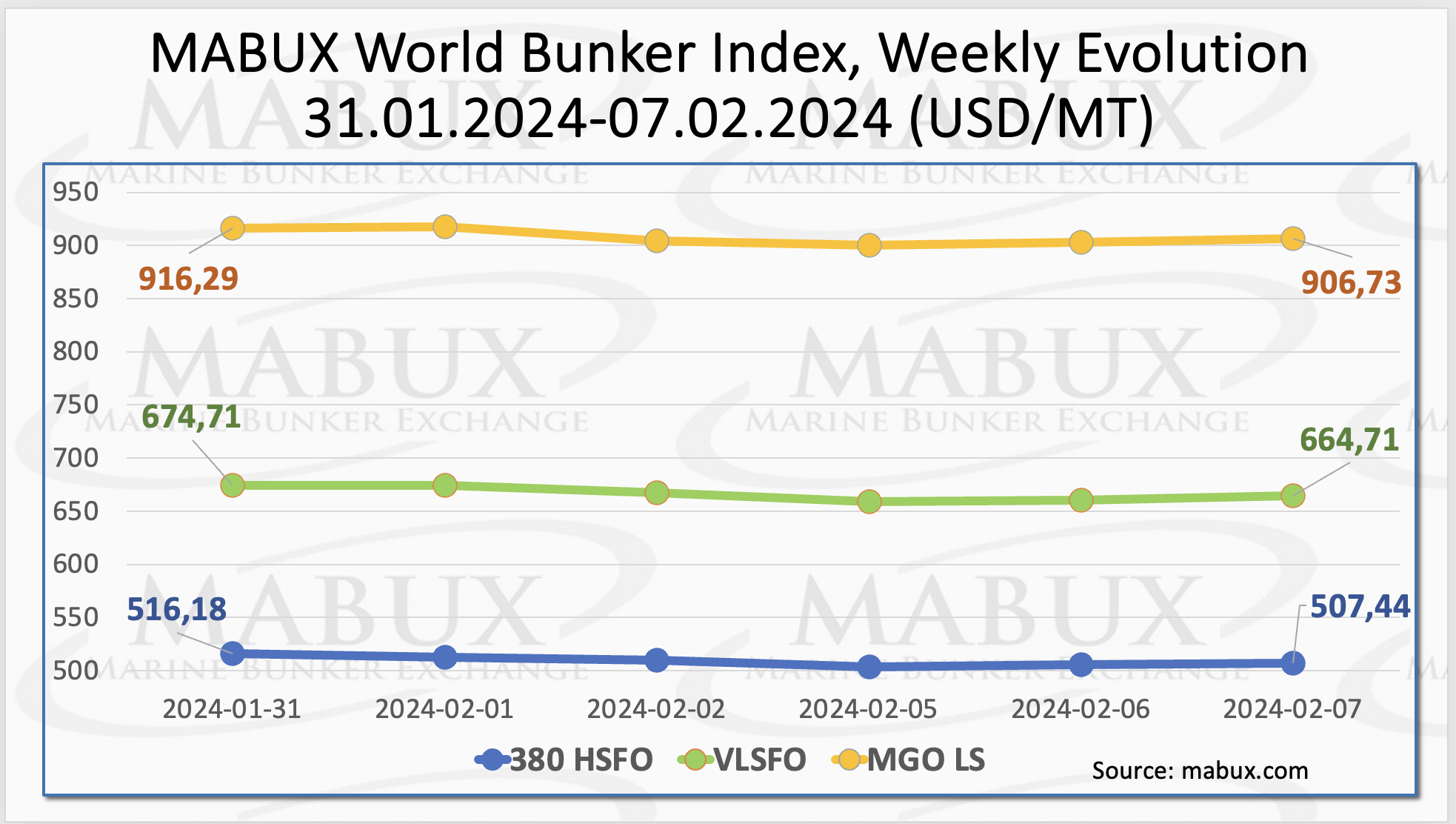

During the sixth week, the Marine Bunker Exchange (MABUX) global bunker indices experienced a modest decline.

The 380 HSFO index dropped by US$8.74 to US$507.44/MT, edging closer to the US$500 threshold. Similarly, the VLSFO index decreased by US$10 with a value of US$664.71/MT compared to US$674.71/MT last week. The MGO index saw a decline of US$9.56, falling from US$916.29/MT to US$906.73/MT.

“Presently, the market is showing signs of a moderate upward correction,” stated a MABUX spokesperson.

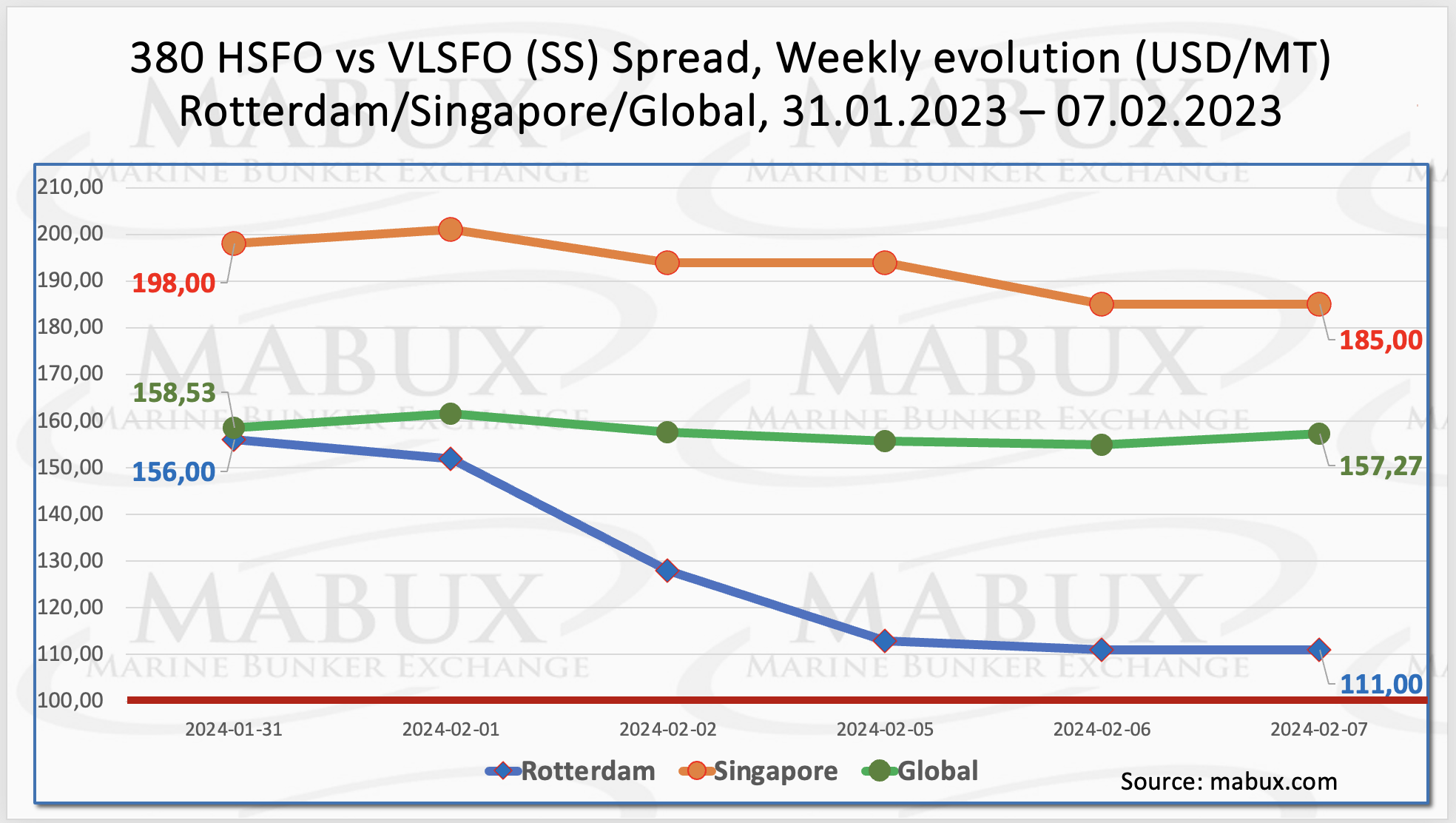

The Global Scrubber Spread (SS), representing the price gap between 380 HSFO and VLSFO, saw a slight decrease of US$1.26. However, the weekly average increased by US$3.28. In Rotterdam, the SS Spread notably dropped by US$45, approaching the US$100 mark, while the weekly average rose by a marginal US$0.17. Meanwhile, in Singapore, the price difference for 380 HSFO/VLSFO decreased by US$13, briefly surpassing the US$200 mark during the week. The weekly average decreased by US$1.34. Observations during the week indicated signs of a shift in the SS Spread trend towards reduction.

In January, liquefied natural gas (LNG) supplies into the EU’s gas transportation system from terminals hit a three-month low, totalling 10.65 billion cubic meters. This represents a 6% decrease compared to December figures and a similar decline compared to the same period in 2023.

Selections from underground gas storage facilities (UGS) in 2024 took the lead among gas production sources in Europe, constituting 41% of the total. LNG held the second position with a 23% share, while supplies from the North Sea ranked third at 19%. Contributions from the East, including Russian gas, stood at 7.2%, North Africa at 6%, and the UK accounted for just 2% of overall gas supplies.

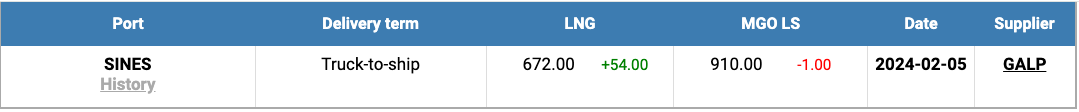

In the port of Sines (Portugal), the price of LNG as bunker fuel saw a moderate increase, reaching US$672/MT on 5 February, up by US$54 compared to the previous week. Simultaneously, the price difference between LNG and conventional fuel slightly narrowed on 5 February, favouring LNG by US$238, compared to the US$300 difference the previous week. On the same day, MGO LS was quoted at US$910/MT in the port of Sines.

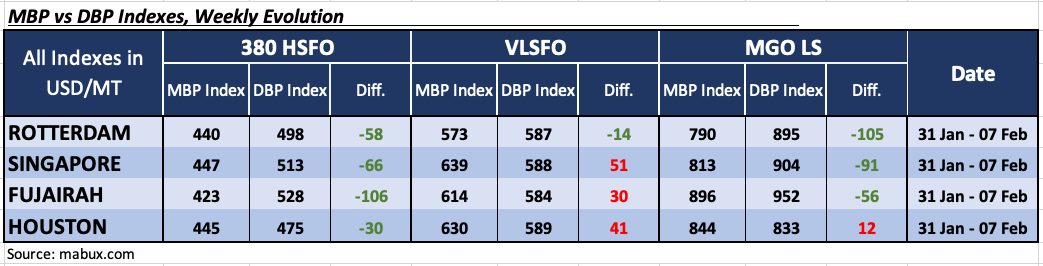

During the sixth week, the MDI index, which measures the ratio of market bunker prices (MABUX MBP Index) versus the MABUX digital bunker benchmark (MABUX DBP Index), exhibited the following trends in four key ports: Rotterdam, Singapore, Fujairah, and Houston.

In the 380 HSFO segment, all four selected ports remained in the undervalued zone. The weekly average underpricing decreased by 7 points in Rotterdam, 3 points in Singapore, 12 points in Fujairah, and 9 points in Houston. Notably, the MDI index in Fujairah remained above the US$100 mark.

Regarding the VLSFO segment, the MDI indicated that three ports—Singapore, Fujairah, and Houston—were in the overcharge zone. Weekly average overprice premiums increased by 5 points in Singapore, 7 points in Fujairah, and 36 points in Houston. Rotterdam remained the sole port with undercharged status, with the weekly average undervaluation level decreasing by 16 points.

In the MGO LS segment, Houston shifted into the overvalued zone, becoming the only overpriced port in this bunker segment. The average weekly premium increased by 29 points. Conversely, the other three selected ports remained underpriced. Average weekly underprice margins saw an increase of 9 points in Rotterdam, 1 point in Singapore, and 10 points in Fujairah.

“It is anticipated that the world bunker indices have stabilized at current levels, with no

firm trend expected in the market next week,” noted Sergey Ivanov, director of MABUX.