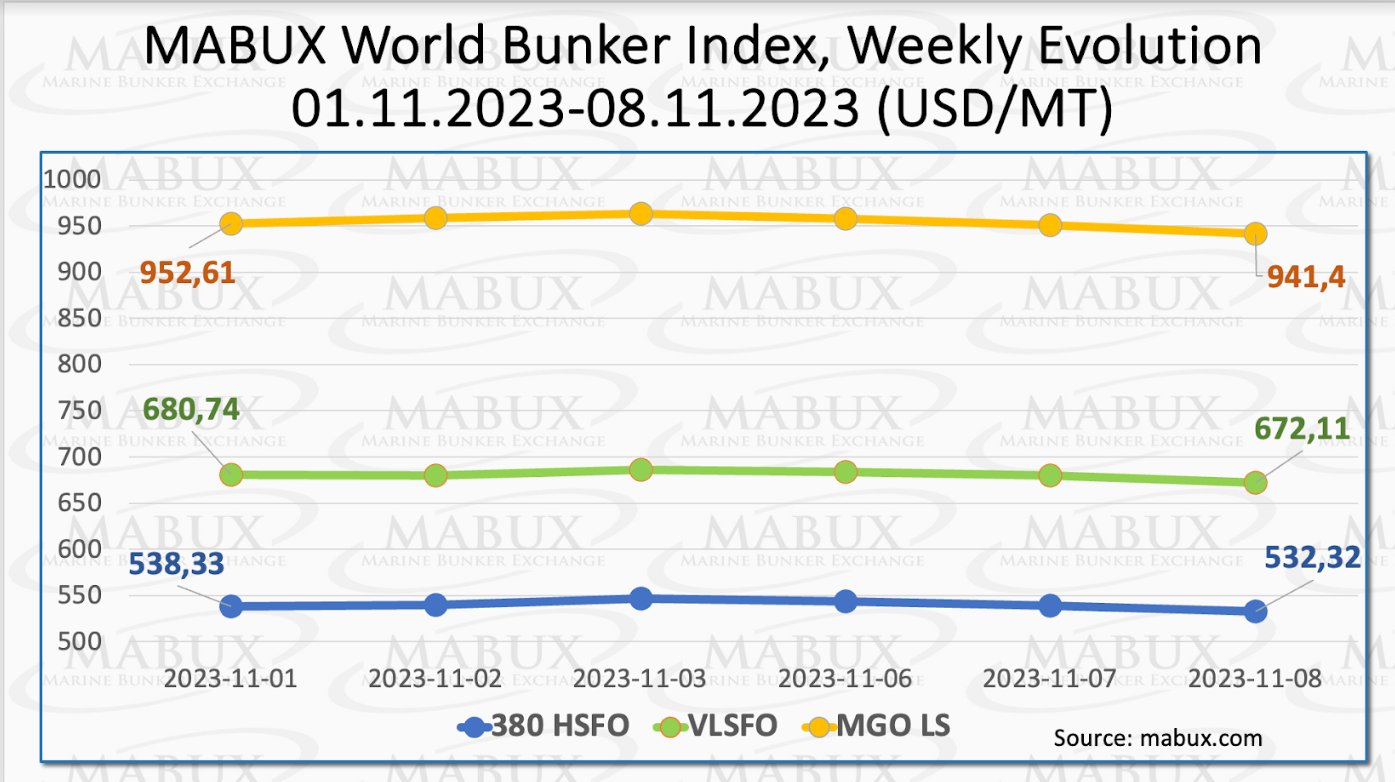

Marine Bunker Exchange (MABUX) global indices, following a brief period of moderate growth, once again shifted towards a downward trajectory.

The 380 HSFO index fell by US$6.01, the VLSFO index lost US$8.63 and the MGO index decreased by US$11.21.

“At the time of writing, the market displayed no consistent trend,” commented a MABUX official.

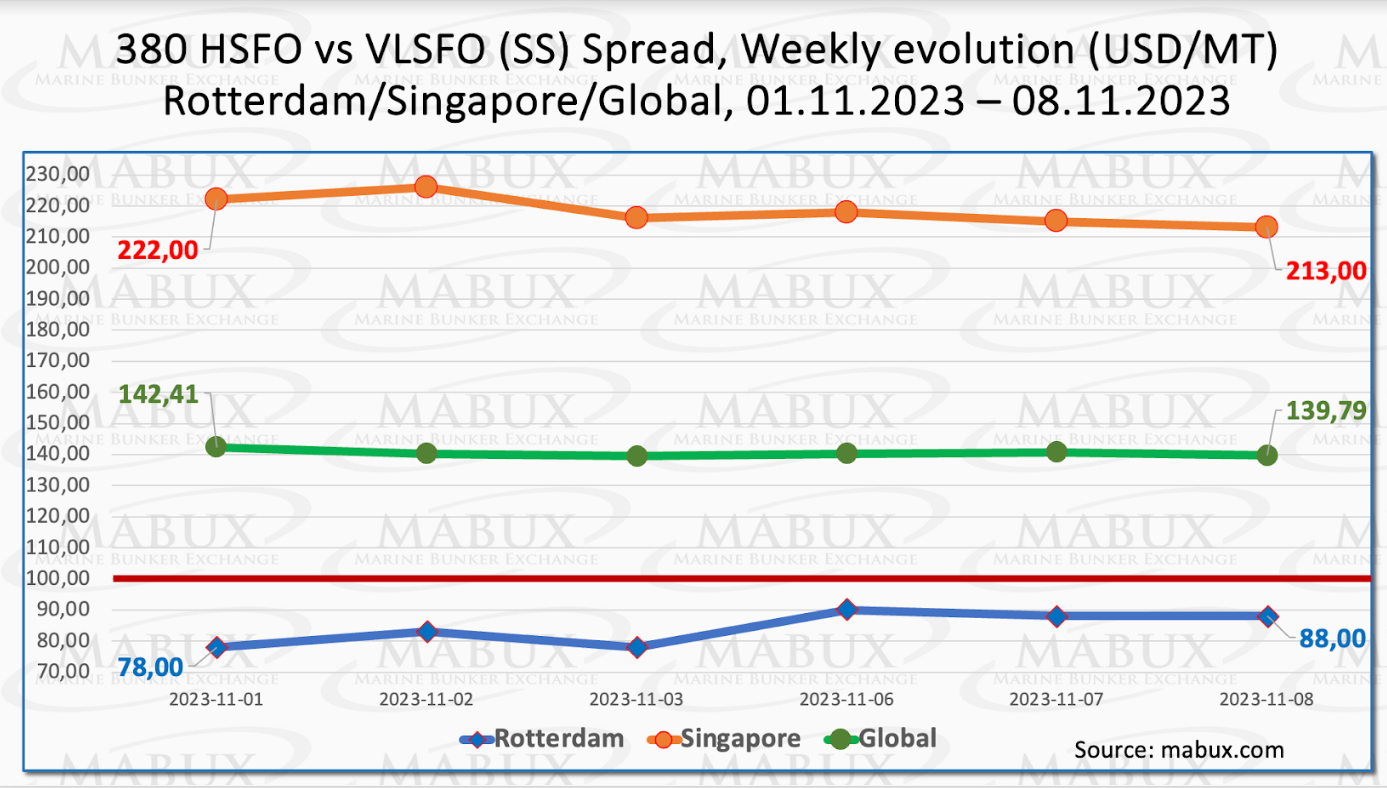

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – slightly

decreased, minus US$2.62. Meantime, the weekly average increased by US$19.33.

In Rotterdam, the SS Spread rose by US$10, while the weekly average remained nearly unchanged at minus US$0.66. In Singapore, the price difference between 380 HSFO and VLSFO decreased by US$9, and the weekly average showed an increase of US$20.66.

“We expect that, due to the high volatility in the market, SS Spread will not have a sustainable trend in the coming week,” noted a MABUX representative.

European countries have begun storing gas in Ukraine as their own storage caverns reach

capacity due to the regasified LNG acquired earlier this year. Nearly 30 LNG tankers are en

route to European ports and are scheduled to arrive by the end of the month. Among them

are three Russian vessels transporting liquefied gas, despite the EU’s prior assertions of

reducing dependence on Russian hydrocarbons.

Nevertheless, gas consumption in the EU is expected to remain limited, regardless of the gas in storage or new LNG shipments. One contributing factor is the tight global LNG market, which has arisen as Europe transitions to liquefied fuel to replace over 100 billion cubic meters of Russian pipeline gas that is no longer available.

Moreover, it appears premature to reiterate last year’s declarations that the EU could entirely do without gas and solely rely on wind, solar, nuclear, hydro, and possibly hydrogen in their energy mix.

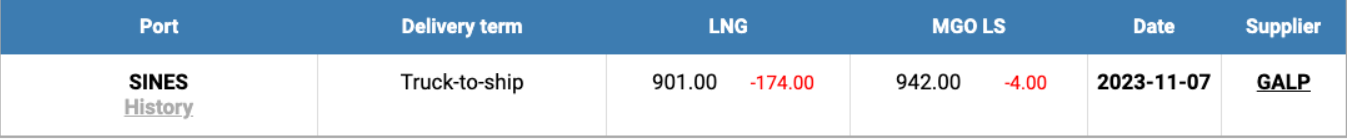

The price of LNG as bunker fuel at the port of Sines (Portugal) has resumed its decline,

dropping to US$901/MT on 7 November.

Thus, the price gap between LNG and conventional fuel on 7 November has once

again shifted in favor of LNG, US$41 versus US$124 in favor of MGO a week earlier. MGO

LS was quoted that day in the port of Sines at US$942/MT.

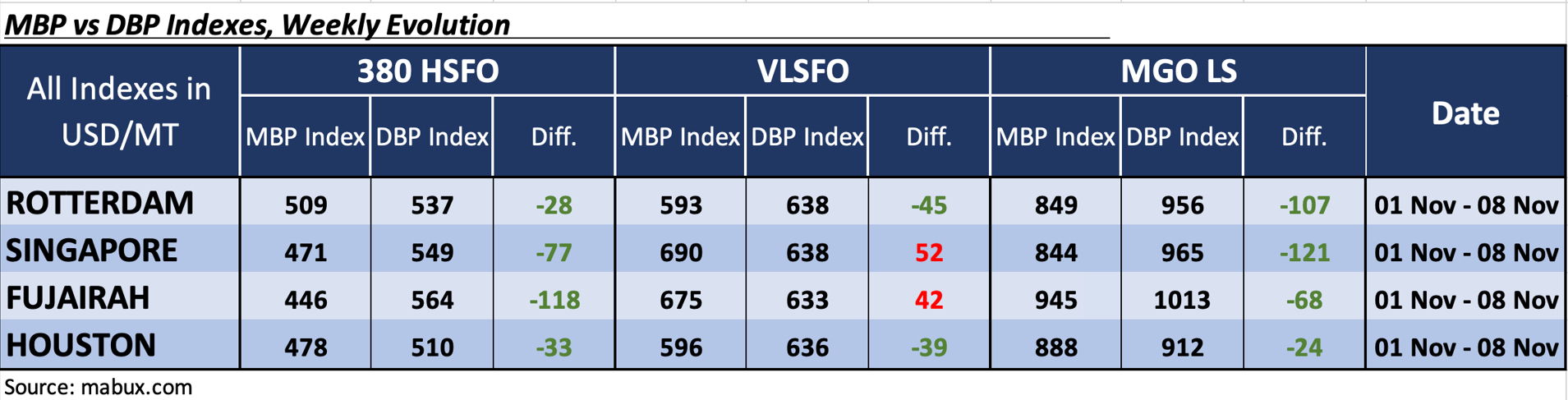

During Week 45, the MDI index (the ratio of market bunker prices (MABUX MBP Index) vs.

the MABUX digital bunker benchmark (MABUX DBP Index)) recorded the following trends in

four selected ports: Rotterdam, Singapore, Fujairah and Houston.

In the 380 HSFO segment, all four ports remained undervalued. The average weekly

underpricing fell by 10 points in Rotterdam, 18 points in Singapore, 2 points in Fujairah and

8 points in Houston. In Fujairah, the underpricing of this type of fuel continues to exceed the US$100 mark.

In the VLSFO segment, according to MDI, Fujairah moved into the overcharge zone, joining

Singapore. The average overpricing increased by 45 points in Singapore and 44 points in

Fujairah. In Rotterdam and Houston, VLSFO remained undervalued, with average weekly

levels decreasing by 12 points in Rotterdam and 9 points in Houston.

In the MGO LS segment, all ports were undervalued, with the weekly average increasing in

Rotterdam by 22 points, in Singapore by 23 points and in Fujairah by 7 points. In Houston,

the average MDI index decreased by 10 points. Overall, significant fluctuations in the MDI index point to considerable market volatility.

“The global bunker market remains highly unpredictable, preventing the formation of

stable trends. Irregular changes in bunker indices are expected to dominate the market in

the upcoming week,” commented Sergey Ivanov, director of MABUX.