In early January, the benchmark gas prices in Europe hit their lowest level since August of the previous year. Traders are optimistic that the abundant gas stored will suffice to meet demand until the spring season.

Presently, European gas storage stands at 83% capacity, a satisfactory level for this time of the year. Despite this, European buyers are not solely dependent on stored gas, as they continue to secure LNG, with a robust supply from the US making storage utilisation during the winter months an optional choice.

Concurrently, gas demand has seen a significant decline across most of Europe, primarily attributed to elevated prices and government policies.

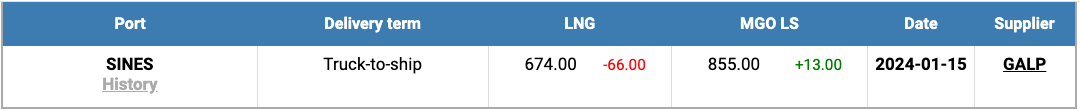

The price of LNG as bunker fuel at the port of Sines in Portugal has experienced a consistent decline, reaching US$674/MT on 15 January. Simultaneously, the price difference between LNG and conventional fuel on the same date favoured LNG, with a margin of US$181 compared to US$92 the previous week. On that day, MGO LS was quoted at US$855/MT in the port of Sines.

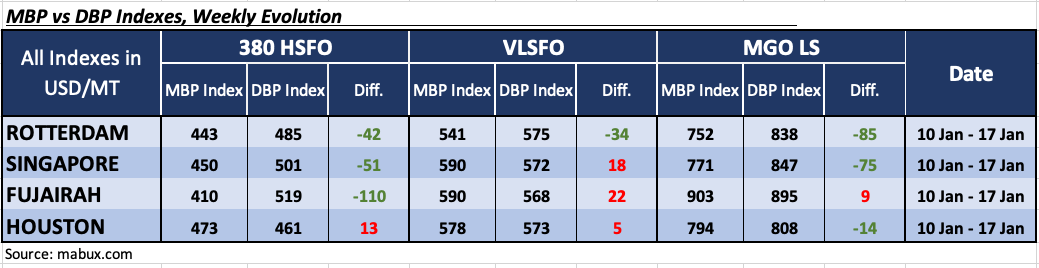

In the third week, the MDI index (which compares market bunker prices through the MABUX MBP Index with the MABUX digital bunker benchmark in the MABUX DBP Index) indicated the following trends in four specific ports: Rotterdam, Singapore, Fujairah, and Houston:

Within the 380 HSFO segment, Houston remained the only port with overvalued prices, experiencing a 24-point decrease in the average weekly overpricing. The other three ports were situated in the undercharge zone. Rotterdam’s weekly average underpricing increased by 6 points, Singapore saw a 20-point rise, and Fujairah exceeded the US$100 mark again with a 15-point increase in the MDI index.

In the VLSFO segment, the MDI indicated a shift for Houston into the overcharge zone, aligning with Singapore and Fujairah. The weekly average decreased by 11 points in Singapore and 19 points in Fujairah, while Houston experienced an 8-point increase. Rotterdam remained the only undervalued port in this bunker fuel segment, with the weekly average showing a 16-point increase.

For the MGO LS segment, Fujairah stood as the only overpriced port, with a 12-point decrease in the weekly average. The remaining three selected ports were deemed undervalued, with Rotterdam showing a 17-point increase in underpricing, Singapore with a 5-point rise, and Houston with a 1-point increase in the average level of underpricing.

Sergey Ivanov, director of MABUX, commented, “We expect that the current escalation of tensions in the Middle East and the ongoing conflict in Ukraine could provoke an increase in global bunker prices next week.”