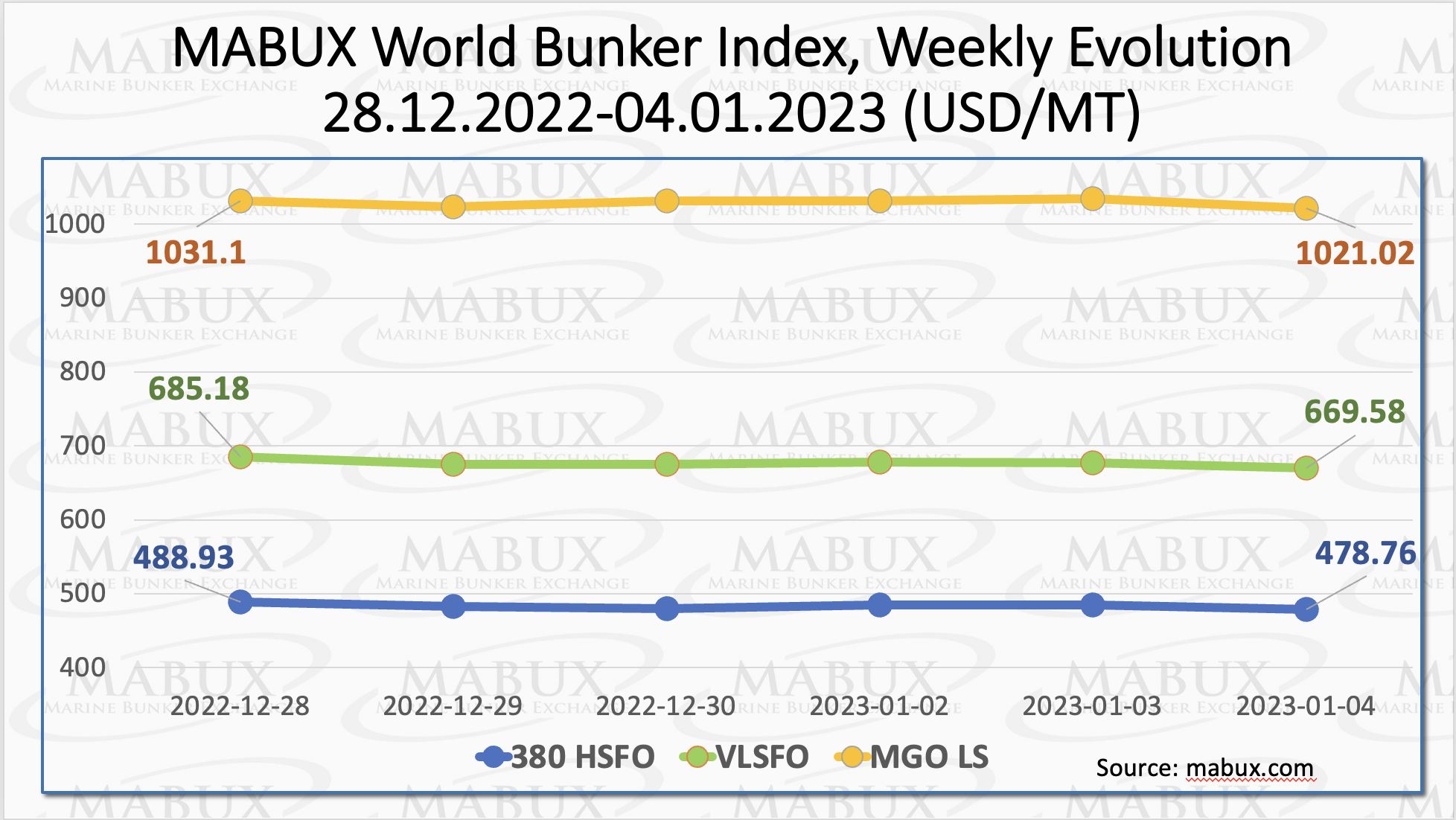

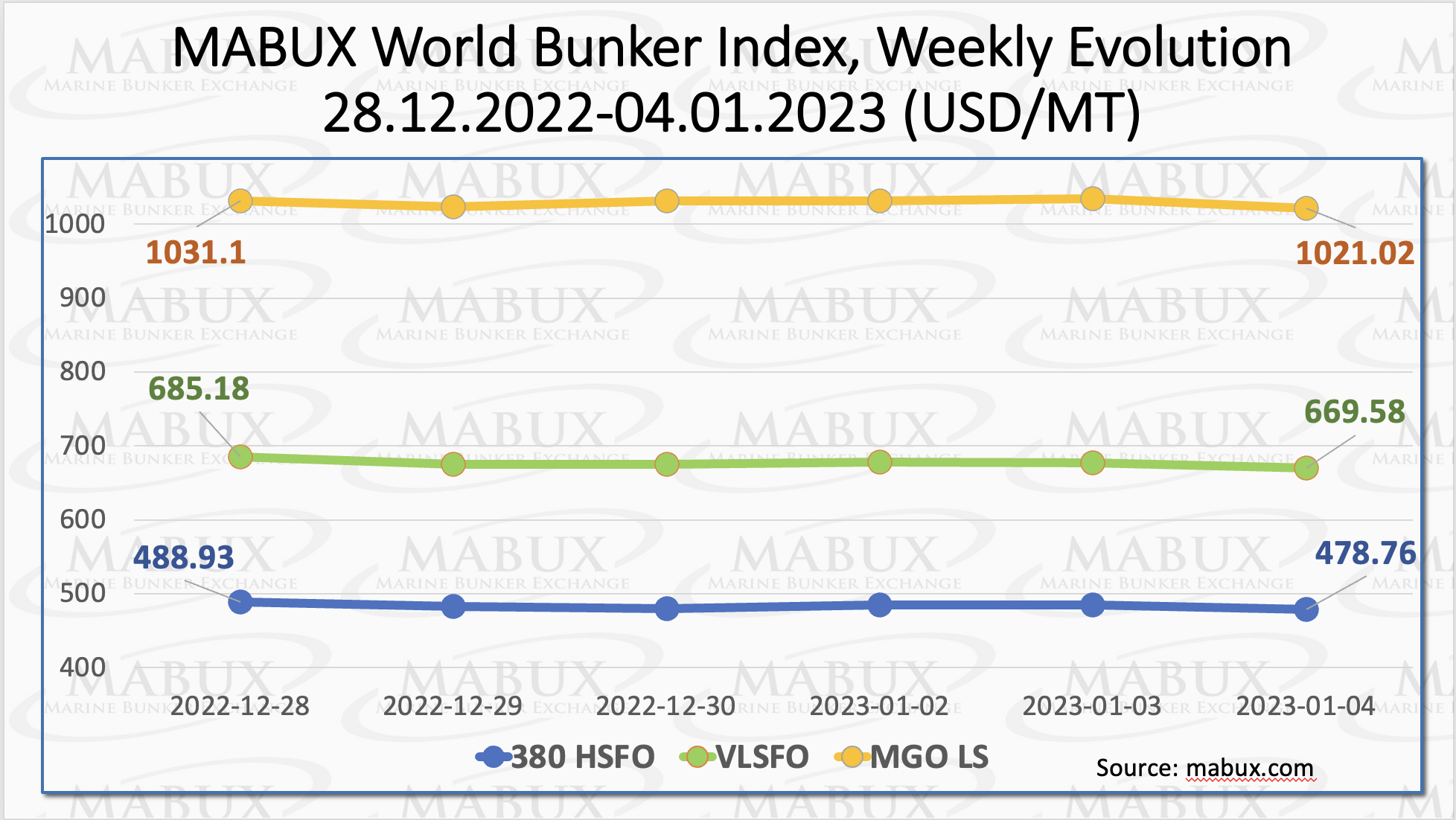

According to the weekly outlook of Marine Bunker Exchange (MABUX) for fuel prices, global bunker indices after taking a short pause began to decline again.

The 380 HSFO index fell to US$478.76/MT, the VLSFO index lost US$15.60 to reach US$669.58/MT and the MGO index also decreased to US$1,021.02/MT.

“At the moment, the downward trend in the global bunker market continues,” said a MABUX official.

Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – turned into a narrowing trend over the first week of the year falling to US$190.82. In Rotterdam, SS Spread was down US$4 to US$151. In Singapore, the price difference of 380 HSFO/VLSFO also showed a slight decrease of US$2 to US$210.

“We expect SS Spread may continue its moderate decline next week,” commented a MABUX official.

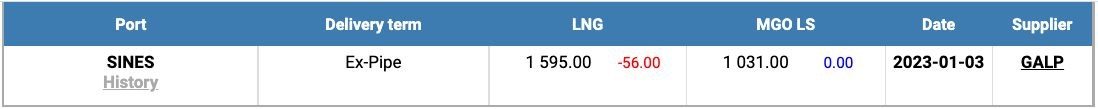

Natural gas prices in Europe have plunged over the past few months. Meantime, 60 LNG tankers, or ~10% of the LNG vessels in the world, are currently sailing or anchored around Northwest Europe, the Mediterranean, and the Iberian Peninsula. Such vessels are considered floating LNG storage since they cannot unload, something that is impacting the price of natural gas and freight rates.

The price of LNG as bunker fuel in the port of Sines (Portugal) continued to decline and reached US$1,595/MT as of 3 January.

Thus, the LNG price continues to approach the cost of conventional bunker fuel grade, on 3 January, the price of MGO LS at the port of Sines was quoted at US$1,031/MT.

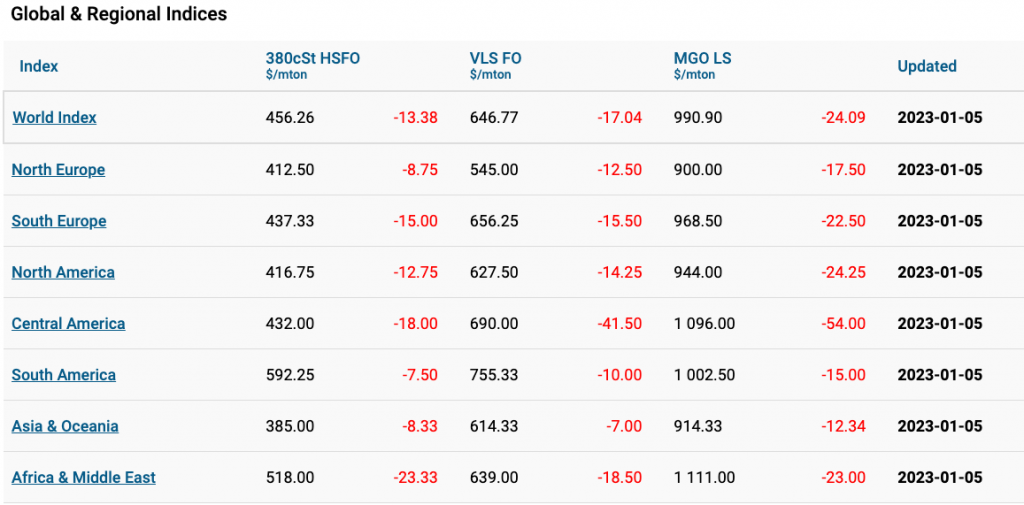

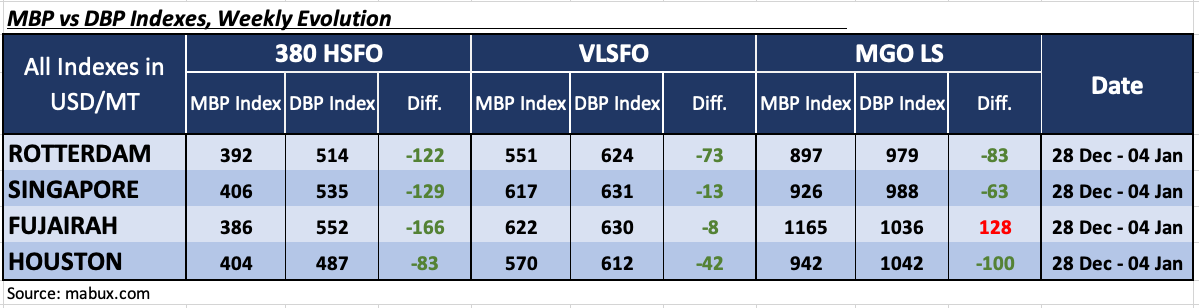

During the first week of 2023, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) remained underestimated in all four selected ports for 380 HSFO. Meantime, the underestimation average showed an increase in all ports and amounted to: in Rotterdam – minus US$122, Singapore – minus US$129, Fujairah – minus US$166 and in Houston – minus US$83.

In the VLSFO segment, according to MDI, Singapore and Fujairah moved back into the

underprice zone. Thus, this type of fuel is currently undervalued in all four selected ports.

Underprice ratio widened slightly over the week: Rotterdam – minus US$73, Singapore – minus US$13, Fujairah – minus US$8 and Houston – minus US$42.

In the MGO LS segment, Fujairah remains the only overvalued port: plus US$128. In all other ports, the MDI index recorded an undervaluation of MGO LS: Rotterdam – minus US$83, Singapore – minus US$63 and Houston – minus US$100.

“Oil edged lower during the week, weighed down by concerns about weak demand due to the state of the global economy and rising COVID cases in China. We expect bunker prices will follow crude oil general trend and drift lower next week,” commented Sergey Ivanov, director of MABUX.