Maritime data provider and analyst, Sea Intelligence has seen a sharp increase in double sailings during the last weeks in its latest report.

Double sailing is the situation when two or more vessels are sailing within the same week on the same service string.

“What happens is that both the origin and destination ports are placed under higher strain in the week of two vessels. Under normal market conditions, such shifts would be of limited market impact, as ports are able to absorb such fluctuations within normal operations,” explains Sea Intelligence, which pointed out that in recent weeks, many ports are severely congested and hence do not have such buffers.

Sea Intelligence measured the development in double-sailings as a rolling three-week average. On Asia-North America West Coast (NAWC), they found that from 2012 to mid-2020, the norm was to have an average of two such double-departures in the trade per week, and hence presumably ports can handle this. In late summer 2020, a rapid escalation is noted to around 5-6 double departures and increase in mid-June 2021 to 13.

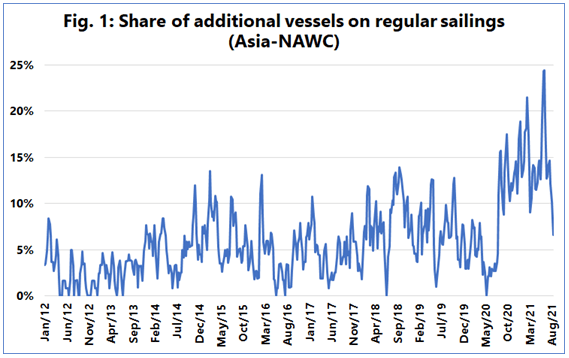

“To make this measure comparable across trades, we re-calculated the data as a ratio between the number of double-departures and the planned number of departures,” said Sea Intelligence. For Asia-NAWC, this is shown in the following figure.

The share of double departure in July-September 2021 abates somewhat, but this is because the operational changes leading to double-departures often happen relatively close to vessel departure, and hence the share going forward could further increase, according to Sea Intelligence, which said that the trend for Asia-North America East Coast (NAEC) is also similar to that of Asia-NAWC.

On the other hand, on the Asia-Europe trade the double-departure ratio is slightly lower than the one seen in the Transpacific trade. Sea Intelligence saw double-departures to North Europe start to escalate from November 2020 and from January 2021 to the Mediterranean.

What the data shows, is the extreme increase in operational instability related to the number of vessels deployed on each individual week, seen in relation to normal planned operations.

“This, in turn, creates large peaks and troughs in terms of port operations, and hence all else equal, this development will serve to further complicate port congestion issues, rather than alleviate them,” concluded Sea Intelligence.