Global schedule reliability improved by 3.8 percentage points month-over-month in May 2024, reaching a year-to-date high of 55.8%.

However, year-over-year, schedule reliability decreased by 11 percentage points, a trend observed across trade lanes, with 29 lanes showing a decline. Among the few trade lanes that recorded an improvement, the Asia to North America West Coast (NAWC) route saw the most significant increase.

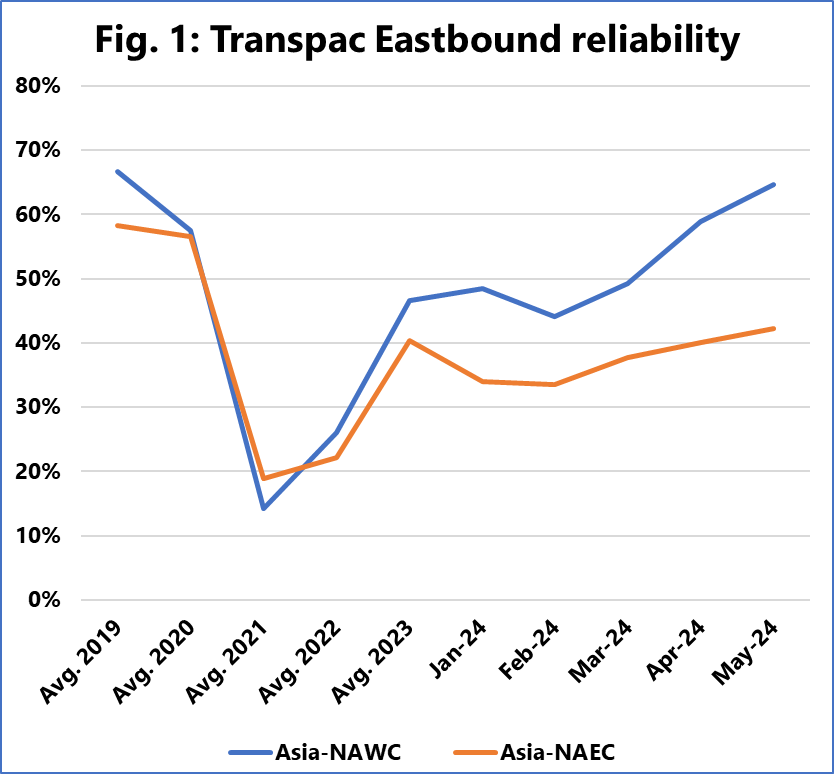

Figure 1 illustrates the development of schedule reliability for this trade lane on a monthly basis for 2024, along with the average annual reliability from 2019 to 2023. It also displays the performance for the Asia to North America East Coast (NAEC) route, given the close commercial ties between these two lanes.

While the Asia-NAWC trade lane has shown substantial improvement, nearing pre-pandemic average performance, the Asia-NAEC trade lane has not seen similar gains. The performance gap between these two trade lanes, which started widening in 2023, has continued to grow.

“This means that North American importers who use an East Coast routing, are increasingly struggling with much larger disruptions in the supply chain, than if they had routed cargo via the West Coast,” stated Alan Murphy, CEO of Sea-Intelligence.

Among the poorly performing trade lanes in May 2024, the Asia-Middle East route experienced one of the largest year-over-year declines.

Compared to the 2019 full-year average, this trade lane has seen the most significant drop in schedule reliability, falling below the pandemic lows. This indicates that the Red Sea crisis is significantly affecting schedule reliability in the region.