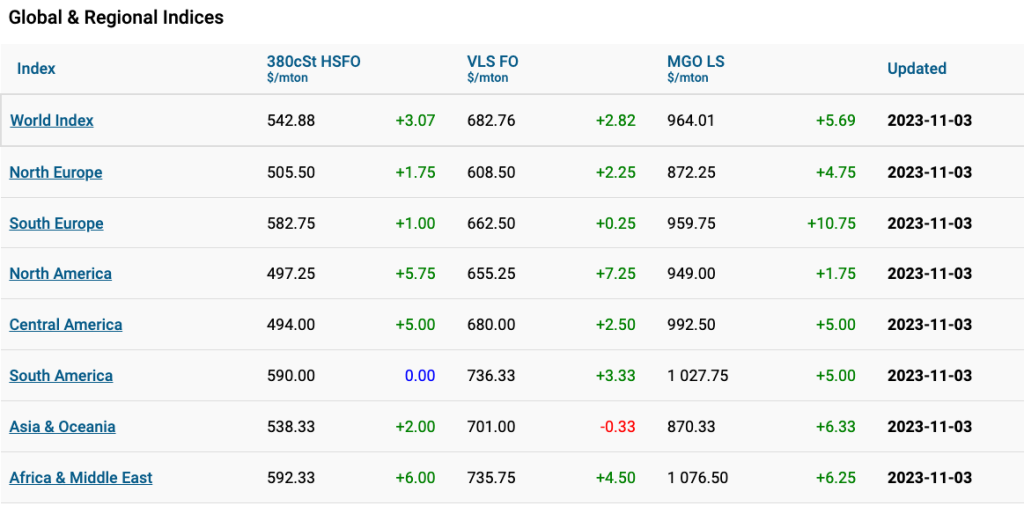

During the 44th week of the year, the 380 HSFO index dropped by US$28 to US$534.56/MT, the MGO index decreased by US$29.73 to US$957.20/MT, while the VLSFO index gained US$1.06 reaching US$672.58/MT.

“At the time of writing, market trends remain uncertain,” pointed out a MABUX spokesperson.

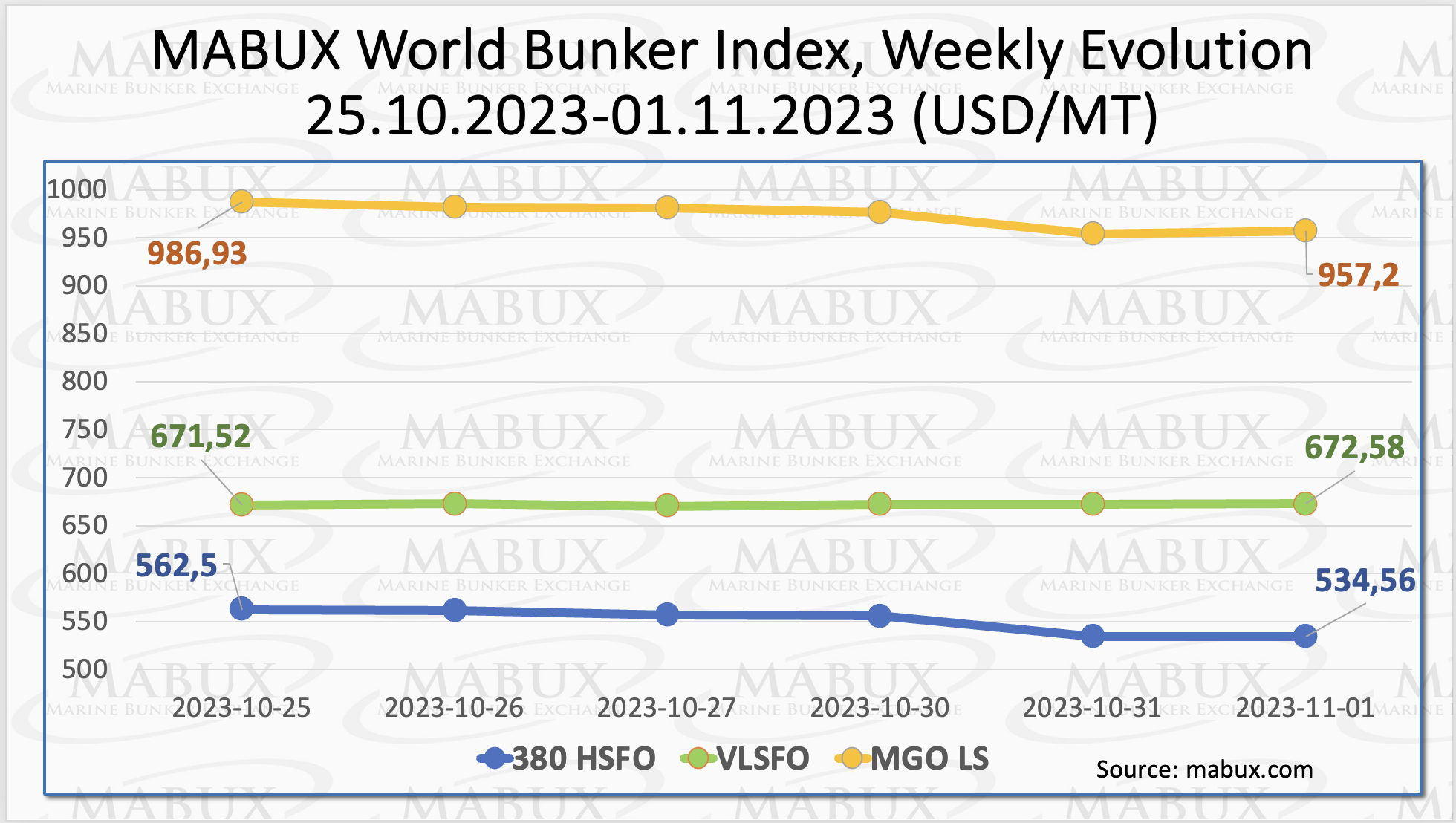

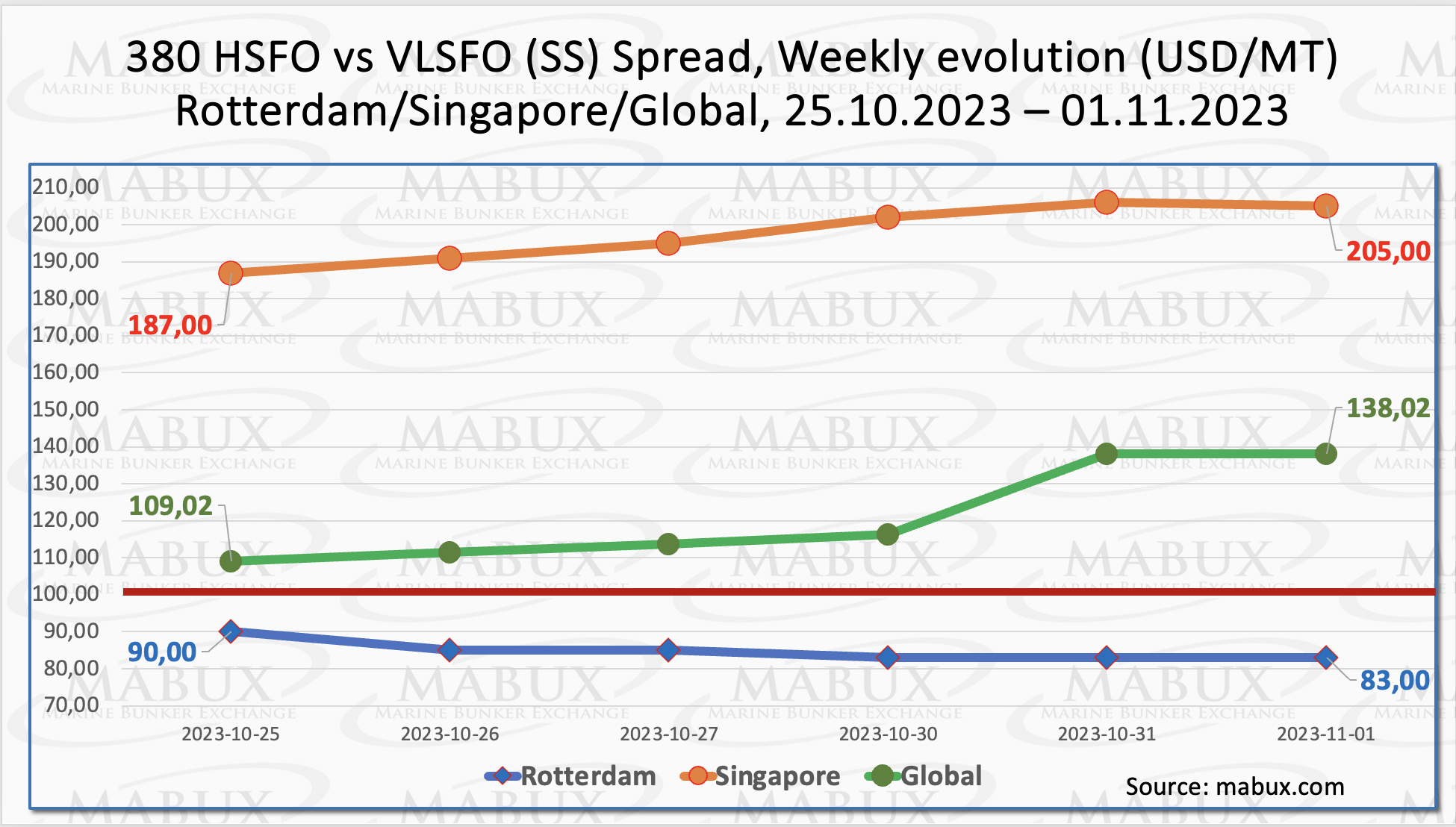

In addition, the Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO, increased significantly (+US$29) to US$138.02, remaining constantly over the US$100 mark, the SS breakeven point. At the same time, the weekly average climbed by US$11

In Rotterdam, on the other hand, the SS Spread fell by US$7, while the average value rose by US$1.16. As a result of relatively high prices for 380 HSFO, along with limited availability owing to shipping delays and congestion at oil terminals in the ARA region, the SS Spread in Rotterdam has remained stable below the US$100 mark.

The price difference between 380 HSFO and VLSFO in Singapore has climbed by US$18, reaching the US$200 mark. The weekly average climbed by US$10.34 as well.

“We expect SS Spread will continue to rise moderately in the upcoming week,” commented the MABUX official.

According to Montel, LNG imports into northwest Europe are projected to surge by 30% in November compared to October, driven by anticipated higher demand at the start of the heating season.

In the coming month, northwest Europe is expected to receive approximately 243 million cubic meters per day (mcm/day) of LNG, destined for the Netherlands, France, Germany, and the UK. These estimates for November indicate a 15% decrease compared to the same month in 2022.

Furthermore, weather conditions and forecasts will be important factors impacting LNG imports into Europe in the coming months. They will have a huge impact on European gas use this winter and are currently the most critical factors in the equation.

Gas consumption in Europe has fallen in the last year as a result of energy conservation initiatives and lower industrial demand, which may be attributed to high energy prices and demand limits.

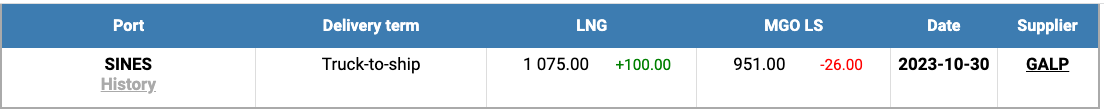

On 30 October, the cost of LNG as bunker fuel at the port of Sines, Portugal, increased, hitting US$1,075 per metric ton. This marks a considerable US$100 gain over the previous week.

Notably, the price balance between LNG and conventional fuel changed back in favour of MGO on 30 October, with a US$124 advantage, compared to an US$8 advantage in favour of LNG just one week before. MGO LS was quoted at US$951/MT in the port of Sines on that day.

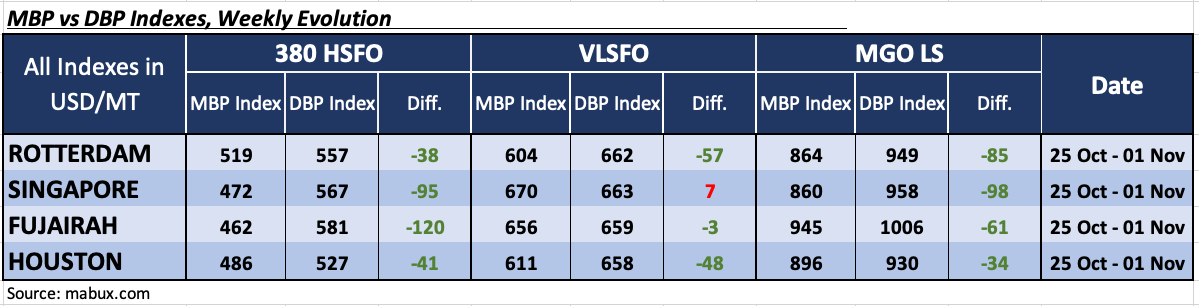

The MDI index (the ratio of market bunker prices (MABUX MBP Index) to the MABUX digital bunker benchmark (MABUX DBP Index) indicated the following patterns in the following ports during Week 44: Rotterdam, Singapore, Fujairah, and Houston

All four ports in the 380 HSFO category remained undervalued. The average weekly underpricing in Rotterdam climbed by 4 points, Singapore by 8 points, Fujairah by 5 points, and Houston by 9 points. The underpricing level of this fuel type in Fujairah still topped the US$100 mark.

According to MDI, Singapore is the only overvalued port in the VLSFO sector. During the week, the average overpricing climbed by 6 points. VLSFO was underestimated at the other three ports. In Rotterdam, the weekly undercharge average increased by one point, although dropped by 10 points in Fujairah and 3 points in Houston. Fujairah was close to the 100% correlation between market prices and the digital benchmark.

In the MGO LS segment, all ports showed undervaluation, with the weekly average declining in Rotterdam by 4 points, in Fujairah by 11 points and in Houston by 4 points. In Singapore, the average MDI index rose by 3 points.

“The escalation of the conflict in the Middle East is contributing to a high level of volatility in the global bunker market, hindering the formation of sustained trends. We expect the bunker indices to continue significant irregular fluctuations in the coming week,” stated Sergey Ivanov, director of MABUX.