Orders of new container vessels are up by ~52% year-on-year with 254 new contracts placed in 2024, compared to 167 in the corresponding period of 2023 according to a new report by VesselsValue, the data intelligence arm of maritime data and freight management solutions provider Veson Nautical.

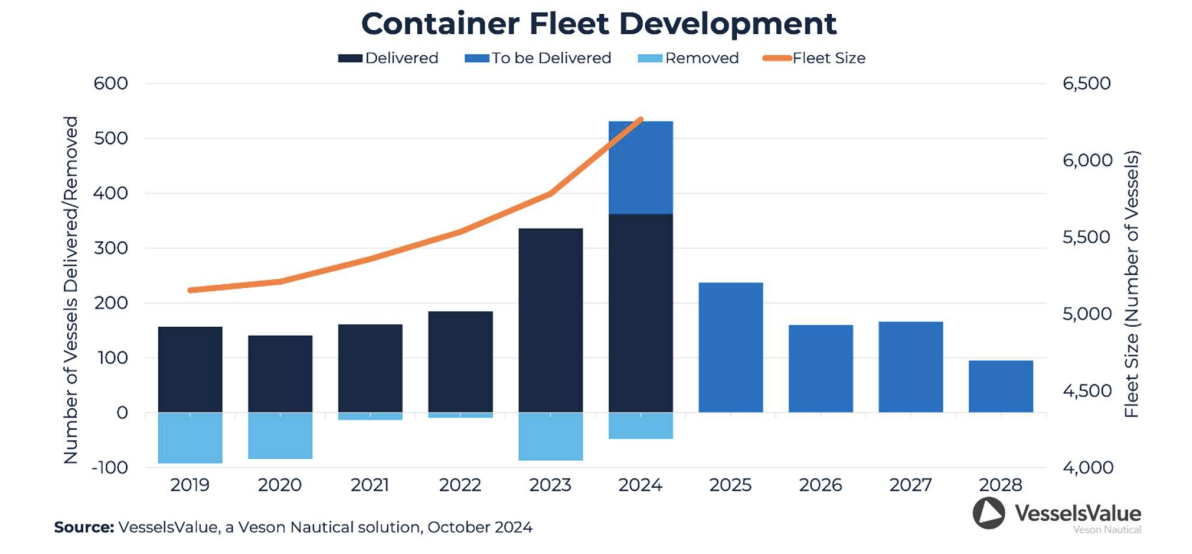

The report, titled ‘Golden Age: Container shipping’s post-covid boom continues’, states that in addition to the huge uptick in orders, 2024 has seen 362 new container vessels entering the market with a further 169 to be set to be delivered in the last few months of the year.

“Thanks to the post-covid container boom, 2024 looks set to be a record-breaking year in terms of new container vessels entering the market,” commented Rebecca Galanopoulos Senior Content Analyst at VesselsValue, “The huge rise in new orders this year means that this trend looks set to continue for the next few years.”

Galanopoulos adds that removals also remain low with just 48 container vessels sent for demolition so far in 2024, a fall of ~45% year-on-year.

Values for Container new buildings are currently at an all-time high. For example, New Panamax newbuilding values for vessels of 15,000 TEU have continued to rise since the start of the year and are currently at US$210.50 mil, compared to US$158.52 mil this time last year, this is an increase of c.33% year-on-year. In the Post Panamax sector of 7,000 TEU, values surpassed the previous record set in 2010 earlier this year and have continued to rise from that point.

At the moment, New Panamax new buildings are valued at US$114.7 mil, an increase of c.32% year-on-year from US$87.03 mil. Newbuilding costs in this sector have risen due to increased demand, limited yard availability, climbing material costs and competition from other ship types occupying available spaces.

So far this year, Container newbuilding orders are up by c. 52% year-on-year with 254 new

contracts placed this year, compared to 167 in the first 10 months of 2023. The majority of

orders placed this year were in the New Panamax sector, accounting for c.41%, followed by Post Panamaxes with a share of c.27 and in third place, ULCVs with c.22%.

In addition, there have been a considerable amount of newly delivered Container vessels

entering the fleet over the last few years, thanks to the post-covid Container boom. 2024,

represents a record year for new Container vessels entering the market, so far this year there have been 362 vessels delivered, with a further 169 set to be delivered in the last few months of the year.

At the same time, due to the firm earnings this year, removals remain low with just 48 Container ships sent for demolition, a fall of c.45% year-on-year. The average age of the total Container fleet is 12 years of age, and with older vessels in abundant supply as a result of the previous ordering boom of the 2000’s there is some potential to scrap, should earnings fall once again.

Although 2023 saw Container earnings dip from the highs of 2021-2022, as the market returned to normal following the boom period of the covid lockdowns. Since the start of 2024, Container earnings have firmed once again and are currently up year-on-year across all sectors. This is due to the additional ton-mile demand which has arisen as a result of the hostilities in the Red Sea, which has forced vessels to travel longer distances around the Cape of Good Hope.

There are also several other factors contributing to the elevated TC rates at the moment such as GRI’s (General Rate Increases) set to go live from the middle of November and along with a strike in Canada and strong volumes traded. In the Post-Panamax sector, earnings are currently double the figure seen this time last year.

One-year time charter rates for Post Panamaxes have been hovering around the US$72,000/Day mark since July, this is an increase of 100% from the same time last year, where rates were around US$36,000/Day.

Notable recent new building contracts include 10 x New Panamax Container vessels of 16,000 TEU ordered by Moller Maersk, scheduled to be built at Hanwha Ocean and delivered in 2027, contracted for US$209.58 mil each, VV value US$225.51 mil each.

Also, 6 x New Panamax Container ships of 13,600 TEU and 10 x ULCVs of 16,000 TEU, ordered by Seaspan, are scheduled to be built at Hudong Zhonghua and delivered between 2027-29.

This article was written by Rebecca Galanopoulos, Senior Content Analyst at VesselsValue