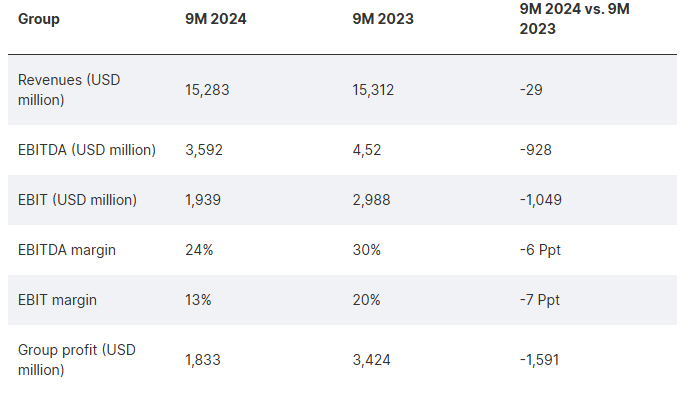

Hamburg-headquartered ocean carrier Hapag-Lloyd reported earnings before interest, taxes, depreciation, and amortisation (EBITDA) of US$3.6 billion, earnings before interest and taxes (EBIT) of US$1.9 billion and profit of US$1.8 billion in the first nine months of the year.

“In view of lower freight rates in the first half of the year and increased transport expenses due to the rerouting of ships around the Cape of Good Hope, these results are below the prior-year level, as expected,” noted the German company, adding, however, that “stronger demand and higher freight rates in the third quarter led to a significant increase in earnings compared to the previous quarters of 2024.”

The fifth-largest box line moved 9.3 million TEUs, translating to a 5% increase compared to the same period last year. The company’s container segment revenues fell by 2% to US$15 billion, mainly due to a lower average freight rate of US$1,467/TEU. Additionally, Hapag-Lloyd’s segment EBITDA decreased to US$3.5 billion and EBIT fell to US$1.9 billion.

Moreover, the company’s Terminals & Infrastructure segment recorded a significant increase in sales and earnings in the first nine months of 2024 with EBITDA rising to US$114 million and EBIT to US$56 million.

“The first nine months of 2024 were marked by unexpectedly strong demand,” pointed out Rolf Habben Jansen, CEO of Hapag-Lloyd.

Jansen went on to comment, “Despite the tense security situation in the Red Sea and the associated rerouting of ships, we were able to further increase our transport volume compared to the previous year and can look back on a good result overall. At the same time, we have commissioned an extensive newbuild program for 24 ships, with which we will further modernize and decarbonize our fleet and thereby secure our long-term competitiveness. In addition, we have made good progress in building up our terminal business under the Hanseatic Global Terminals brand. Looking ahead, we will continue to vigorously implement our Strategy 2030 while focusing on our growth and quality targets.”

In view of the recent higher-than-expected demand and improved freight rates – and despite increased transport expenses – the Executive Board of the company raised its forecast for the current financial year. The Group EBITDA is now expected to be in the range of US$ 4.6 to 5 billion and the Group EBIT to be in the range of US$ 2.4 to 2.8 billion.

“Given the highly volatile development of freight rates and persistent major geopolitical challenges, this forecast remains subject to uncertainty,” noted Hapag-Lloyd in its announcement.