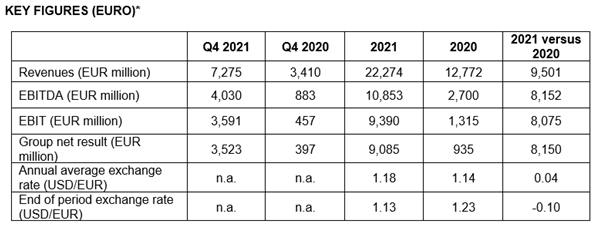

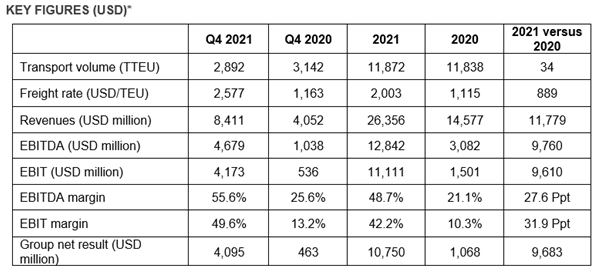

Hapag-Lloyd has reported strong financial performance in 2021, with revenues rising to US$26.4 billion, driven by a higher average in the price of freight rates, which reached US$2,003/TEU, compared to US$1,115/TEU in 2020.

In addition, the German ocean carrier achieved increased earnings before interest, taxes, depreciation, and amortisation (EBITDA) of more than US$12.8 billion in 2021, while the earnings before interest and taxes (EBIT) also rose to US$11.1 billion, and the group’s net result improved to around US$10.8 billion.

The main drivers of these positive business developments are improved freight rates resulting from strong demand for goods exported from Asia, according to a statement.

Furthermore, the group’s net debt was completely paid off in 2021. At the end of the year, the liquidity stood at approximately US$8.7 billion, thereby exceeding financial debt, with the result that Hapag-Lloyd had net liquidity of around US$2.5 billion as of 31 December 2021.

The company’s container volumes were also increased by 1 million TEU over 2020 due to the strained supply chains, completing at 11.9 million TEU.

At the same time, transport expenses rose significantly by 17.1% to US$12.2 billion. Hapag-Lloyd stated that this was particularly due to higher bunker prices and charter rates, as well as increased demurrage and storage fees.

Rolf Habben Jansen, CEO of Hapag-Lloyd, commented that 2021 was a “successful year”, with massive investments in modern vessels and new containers, and a strengthened financial and asset position.

“However, transport expenses have unfortunately also risen significantly, mainly due to the bottlenecks in the global supply chains,” he noted.

Looking ahead, the Hamburg-based container line expects that earnings will be strong in the first half of 2022 and that the strained situation in the global supply chains will ease by the second half of the year, “which should lead to a beginning normalisation of earnings.”

EBITDA is expected to be in the range of US$12 to US$14 billion and EBIT is expected to be in the range of US$10 to US$12 billion. “This forecast, however, is uncertain due to the ongoing Covid-19 pandemic and current developments in Ukraine,” said Hapag-Lloyd.

“The 2022 financial year has gotten off to a successful start for us, but the disruptions in the supply chains have not eased materially yet,” stated Jansen, adding, “We all face the terrible war in Ukraine. We stand united with the international community, have stopped our bookings to and from Russia, and call for de-escalation and peace.”