Hapag-Lloyd has achieved significant growth in its financial results in 2022, compared to corresponding numbers one year earlier, while the German carrier’s container volumes have remained steady.

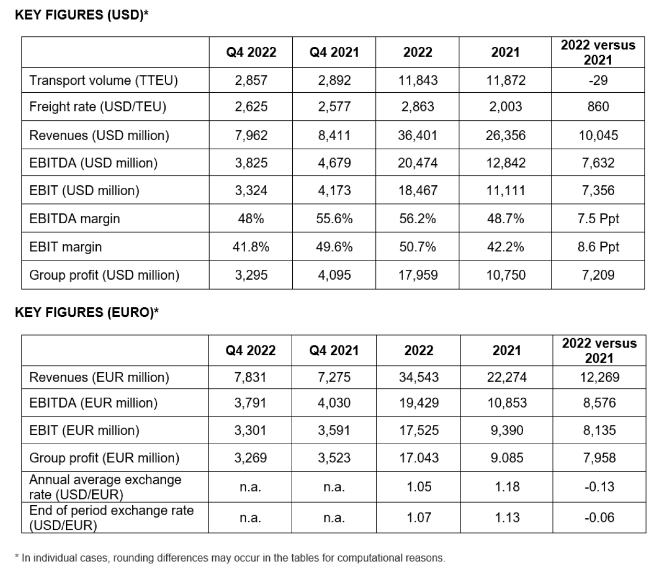

According to the company’s annual report, Hapag-Lloyd’s earnings before interest, taxes, depreciation, and amortization (EBITDA) increased to US$20.5 billion, earnings before interest and taxes (EBIT) grew to US$18.5 billion and the profit for 2022 improved to US$18 billion.

At the same time, Hapag-Lloyd’s revenues climbed to US$36.4 billion, which can mainly be attributed to an increase in the average freight rate, to US$2,863/TEU from US$2,003/TEU in 2021.

Additionally, the Hamburg-headquartered box line saw its annual container volumes remain at the same levels with 2021, moving 11.8 million TEUs from 11.9 million TEUs.

Rolf Habben Jansen, CEO of Hapag-Lloyd AG, commented, “Overall, we look back on a very successful 2022 with exceptionally strong results. This has enabled us to strengthen our financial resilience and asset structure once again. In addition, we have improved the quality of service for our customers and invested in terminals and infrastructure as well as in the efficiency of our fleet. However, costs – such as for fuel, charter vessels and container handling – have risen significantly.”

Due to strong company profit, equity has grown to €28 billion and the equity ratio has risen to over 70%. For these reasons, the executive board and supervisory board of Hapag-Lloyd AG have decided to propose to the Annual General Meeting that a dividend of €63 per share be paid out for the 2022 financial year, which corresponds to a total payout of €11.1 billion.

Hapag-Lloyd expects earnings to gradually normalise in the current 2023 financial year. EBITDA is expected to be in the range of US$4.3 to 6.5 billion and EBIT to be in the range of US$2.1 to 4.3 billion.

Rolf Habben Jansen noted, “We have got the current financial year off to a decent start, but the economy has cooled and a significant decrease in earnings remains inevitable. So we will continue to act flexibly in the market and keep a close eye on our costs.”