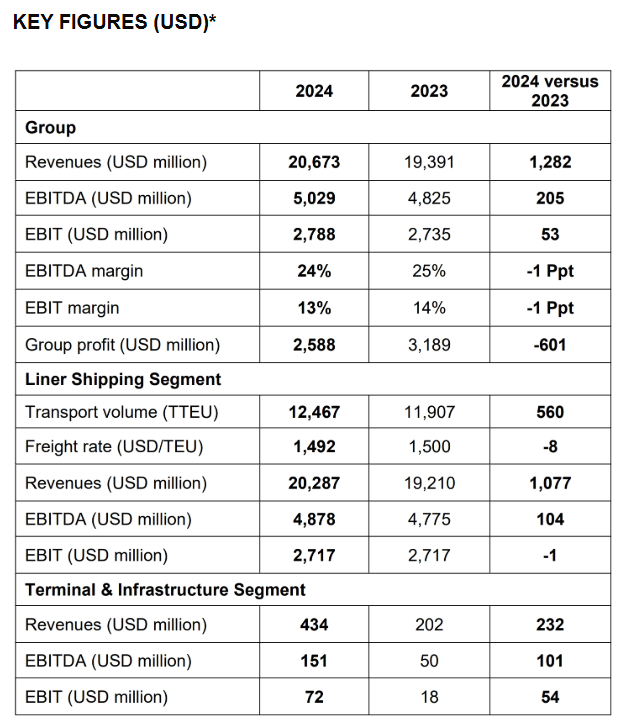

German ocean carrier Hapag-Lloyd reported a slight increase in its 2024 earnings, with EBITDA rising to US$5 billion and EBIT improving to US$2.8 billion. At the same time, Hapag-Lloyd boosted its revenue to US$20.7 billion compared to US$19.4 billion in 2023.

However, the company’s profit decreased to US$2.6 billion from US$3.2 billion in the previous year. Moreover, EBITDA and EBIT margins both declined by 1% to 24% and 13%, respectively.

.

“In a challenging market environment, we achieved solid results and further increased customer satisfaction. We have further consolidated and expanded our terminal business under the Hanseatic Global Terminals brand. We have worked hard to further improve processes which will yield results in the years to come and stepped up our investments in digitalization and training of our people. Finally, we launched the largest newbuild program in our company’s history, which will enable us to further modernize and decarbonize our fleet,” stated Rolf Habben Jansen, CEO of Hapag-Lloyd AG.

Meanwhile, the Hamburg-based container carrier increased its box volumes by 4.7% to 12.5 million TEUs, while the average freight rate remained stable at US$1,492/TEU (2023: US$1,500/TEU).

Based on these earnings, the Executive Board and Supervisory Board of Hapag-Lloyd AG will propose to the Annual General Meeting a dividend of €8.20 (around US$8.9) per share for the 2024 financial year – this corresponds to a total payout of €1.4 billion (around US$1.5 billion).

For the 2025 financial year, the Executive Board expects the Group EBITDA to be in the range of US$2.5 to 4 billion and the Group EBIT to be in the range of US$0 to 1.5 billion.

“In 2025, we are off to a very good start with Gemini, but the economic and geopolitical environment remains fragile. In this context, we anticipate earnings in 2025 to be lower than in 2024,” said Rolf Habben Jansen.

Hapag-Lloyd’s boss continued: “In the first half of the current year, we will implement our Gemini network and expect to set new standards in terms of schedule reliability. We will continue to develop Hanseatic Global Terminals and await to further grow our inland business. At the same time, we will keep a very close eye on our unit costs and focus on becoming even more efficient and climate-friendly.”