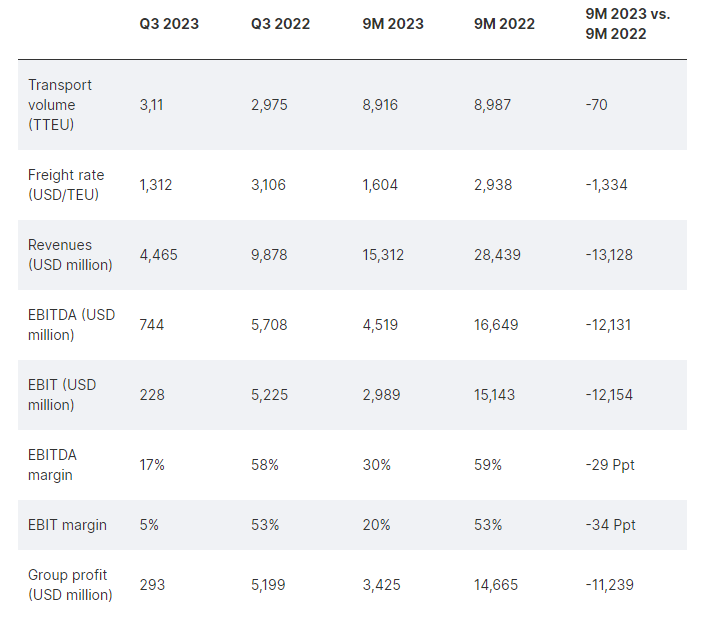

Hapag-Lloyd ended the first nine months of the year with Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) of US$4.5 billion and Earnings Before Interest and Taxes (EBIT) of US$3 billion, while the company’s profit reached US$3.4 billion.

Because of a major shift in market conditions, these results are much lower than the prior-year level, noted the German ocean carrier, whose business activities have been separated for the first time, with the expansion of its terminal business, into Liner Shipping and Terminal & Infrastructure sectors.

Additionally, Hapag-Lloyd’s revenue fell to US$15.2 billion, owing to a reduced average freight rate of US$1,604/TEU. This fell even further in the third quarter of 2023 to US$1,312/TEU, and was much lower in numerous deals as compared to the same period in the previous year.

“Freight rates are below the prior-year level and, as expected, fell again in the third quarter – which is reflected in much lower earnings,” said Rolf Habben Jansen, CEO of Hapag-Lloyd AG.

In contrast, transport volumes increased a bit in the third quarter, climbing by a little under 5% to 3,110,000 TEUs. As a result, Hapag-Lloyd’s total volumes of 8,916,000 TEUs in the first nine months of the year were close to last year levels.

“Thanks to an increase in transport volumes in the third quarter, volumes are roughly flat for the nine months compared to 2022,” confirmed Rolf Habben Jansen.

Transport expenses fell 11% year-over-year to US$9.6 billion, owing mostly to the continuous normalisation of global supply chains and a reduced average bunker consumption price of US$611 per tonne.

Furthermore, Hapag-Lloyd updated its forecast for the full year 2023, which it released on 2 March. The company’s EBITDA is now forecast at the US$4.5 – 5.5 billion range and EBIT at the US$2.4 – 3.4 billion range.

“Given the numerous geopolitical crises, continuous inflationary pressures, and many clients’ continued high inventory levels, this prediction is open to uncertainty,” pointed out the Hamburg-based carrier in a statement.

Rolf Habben Jansen stated, “We have continued to implement our strategic agenda, expanded our terminal portfolio, and boosted customer satisfaction again through quality improvements.”