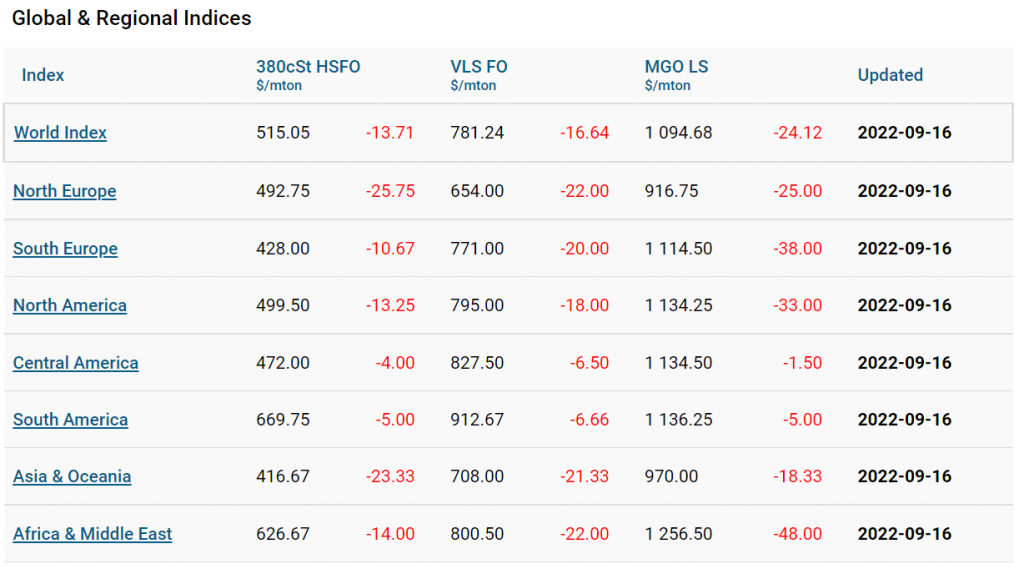

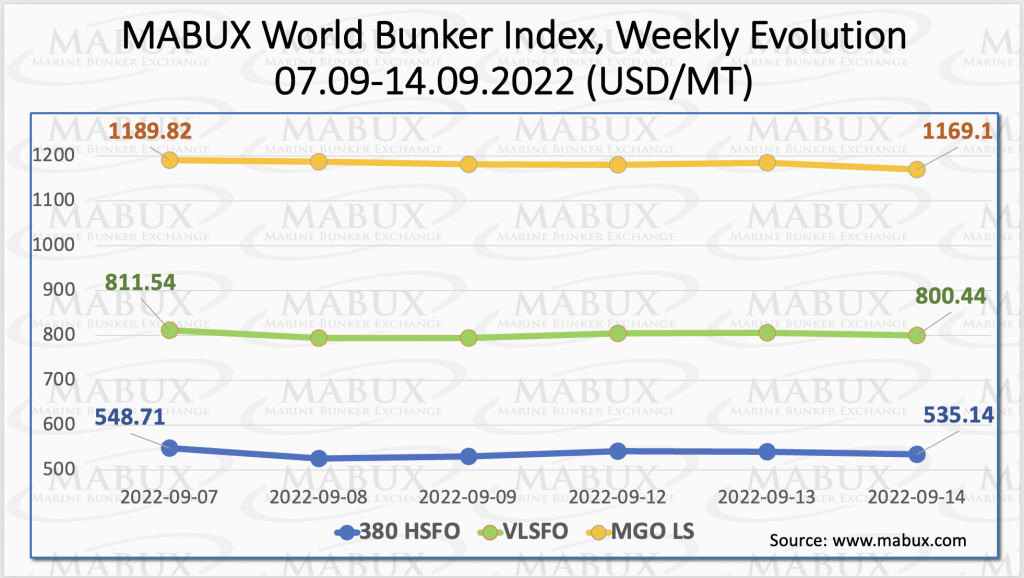

Over Week 37, Marine Bunker Exchange (MABUX) has reported that global bunker indices continued moderate sliding downward.

The 380 HSFO index fell to US$535.14/mt, the VLSFO index decreased to US$800.44/mt and the MGO index dropped to US1,169.10/mt.

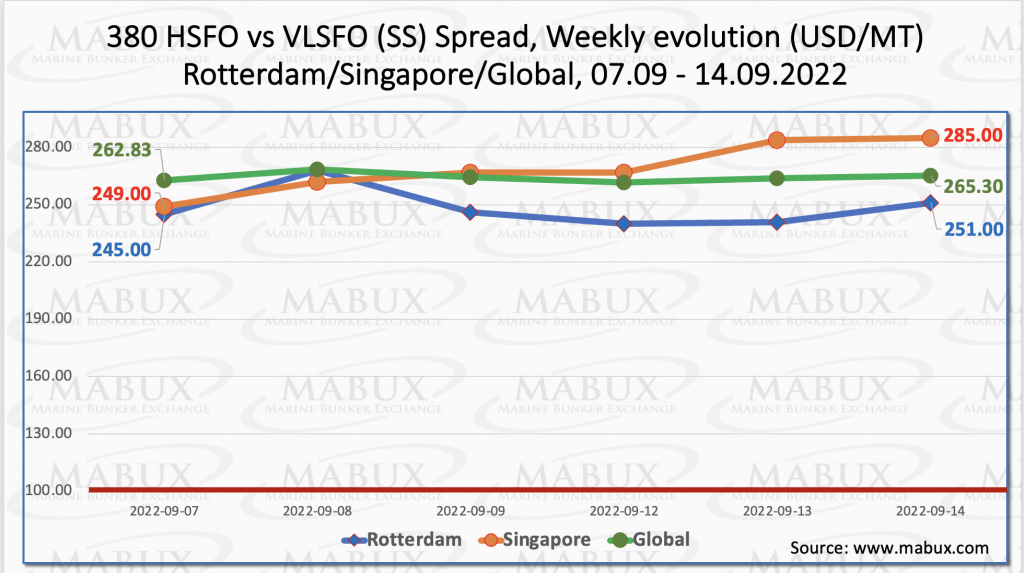

Meanwhile, the Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – stopped the downward trend and showed a moderate increase of US$6 over Week 37 reaching US$264.43.

In Rotterdam, the average SS Spread rose more considerably at US$248.50, while in Singapore, the average weekly price differential of 380 HSFO/VLSFO increased to US$269.

The indicators of the Global SS Spread and the values of SS Spread in the largest hubs have converged significantly and are practically at the same level, according to MAUX report.

MABUX went on to note that higher nuclear power generation in France and more solar and wind supply out of Germany eased Europe’s prompt power prices this week. Despite the brief relief, the European Union continues to consider ways of capping power and, possibly, gas prices in a bid to help struggling consumers and businesses.

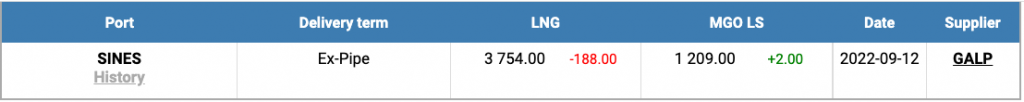

The price for LNG as a bunker fuel at the port of Sines in Portugal fell on 12 September by another US$188/mt to US$3,754/mt. LNG prices are still more than three times higher than the most expensive type of traditional bunker fuel: the price of MGO LS at the port of Sines was quoted on 14 September at US$1,209/mt.

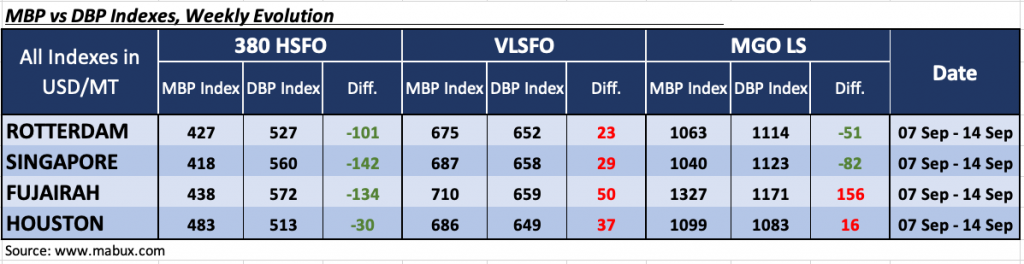

Furthermore, during Week 37, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an underpricing of 380 HSFO fuel grade in all four selected ports.

The underestimation margins continued to grow and amounted for Rotterdam minus US$101, Singapore – minus US$142, Fujairah – minus US$134 and Houston – minus US$30.

VLSFO fuel grade, according to MDI, remained, on the contrary, overpriced in all selected ports: plus US$23 in Rotterdam, plus US$29 in Singapore, plus US$50 in Fujairah and plus US$37 in Houston. In this fuel segment, the MDI index did not have any firm dynamics, according to MABUX with the overprice premium up in Rotterdam and Singapore, but down in Fujairah and Houston.

In the MGO LS segment, MDI registered overpricing in two ports out of four selected over Week 37: Fujairah – plus US$150 and Houston – plus US$18. In Rotterdam and Singapore, MGO LS fuel remained undervalued: minus US$51 and minus US$82, respectively. Undercharge margins as well as overcharge ones rose slightly in all ports except Houston, said MABUX.

“The global bunker market is still in a state of high volatility with no sustainable trend, which entails irregular fluctuations of bunker indices about the present levels,” commented Sergey Ivanov, director of MABUX.