Higher freight rates caused by increased demand combined with lower bunker prices have led Hapag-Lloyd to a positive financial result in the first quarter of the year, according to the company’s CEO, Rolf Habben Jansen.

Despite the decline of 2.6% in its volumes during Q1 2021, when the carrier handled approximately 3 million TEU, Hapag-Lloyd saw increased revenues and earnings compared with the same period last year.

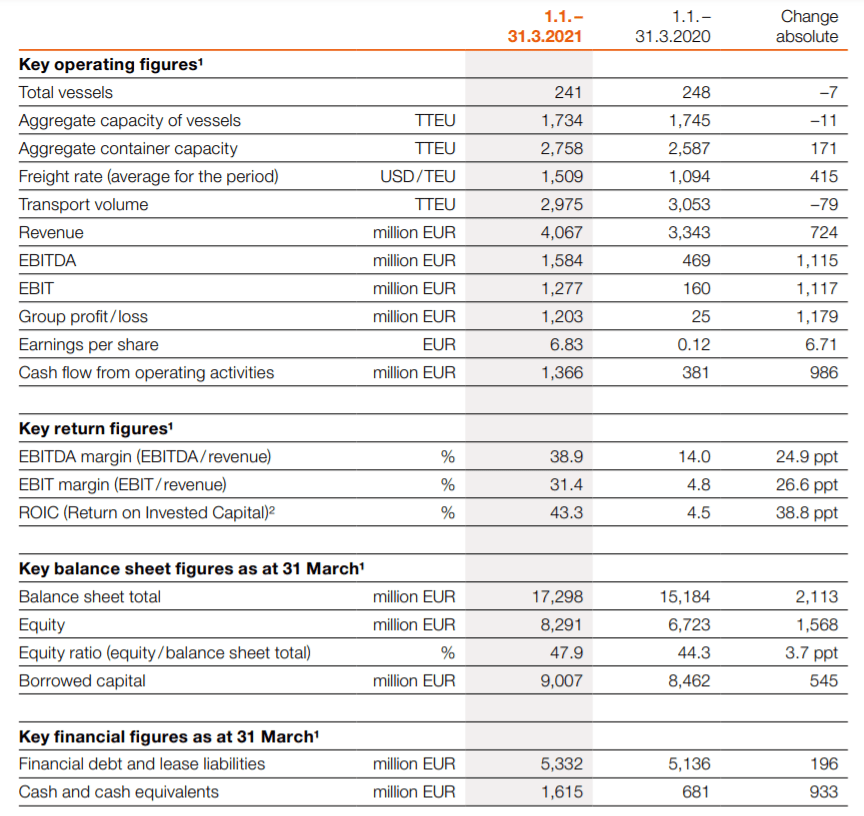

The Hamburg-based container line concluded the first quarter of 2021 with earnings before interest, taxes, depreciation and amortisation (EBITDA) of US$1.9 billion, while its EBIT rose to US$1.5 billion and the group net result improved to around US$1.5 billion.

Company revenues significantly increased in the first three months of this year by 33% to US$4.9 billion, due to higher average freight rates, which increased by approximately 38% to reach US$1,509/TEU, while in Q1 2020 the average rate was US$1,094/TEU.

Hapag-Lloyd Key Figures – Financial Report Q1 2021

2. The return on invested capital (ROIC) is calculated as the ratio of net operating profit after taxes (NOPAT) to invested capital (assets excluding cash and cash equivalents less liabilities excluding financial debt). This key operating figure is calculated on an annualised basis and in US dollars.

The fall in the carrier’s container volumes was due to demand-related congestion at port and hinterland facilities in many places as well as to a resulting shortage of freely available ships and containers, according to Hapag-Lloyd’s statement.

The German firm expects that the EBITDA and EBIT for the current 2021 financial year as a whole will clearly surpass the prior-year level. Moreover, while the positive earnings trend is likely to continue in the second quarter of 2021, a gradual normalisation is currently expected in the second half of the year.

“While we remain optimistic for 2021 as a whole, the ramifications of the Covid-19 pandemic and the congested supply chains continue to present a huge challenge to all market participants,” said Rolf Habben Jansen.

At the moment, Hapag-Lloyd owns 112 vessels and charters 129 ships, while it provides a total of 121 services.