The global tariff shock caused by the Trump Administration’s policies may soon be followed by a significant new package of fees targeting Chinese-built or Chinese-flagged vessels.

According to a draft executive order, the United States is reportedly considering imposing docking fees at its ports on any ship belonging to a fleet that includes Chinese-built or Chinese-flagged vessels.

While there is still considerable uncertainty about the specifics — including how, when, and to what extent these fees will be implemented — it’s important to consider the potential financial impact on major ocean carriers.

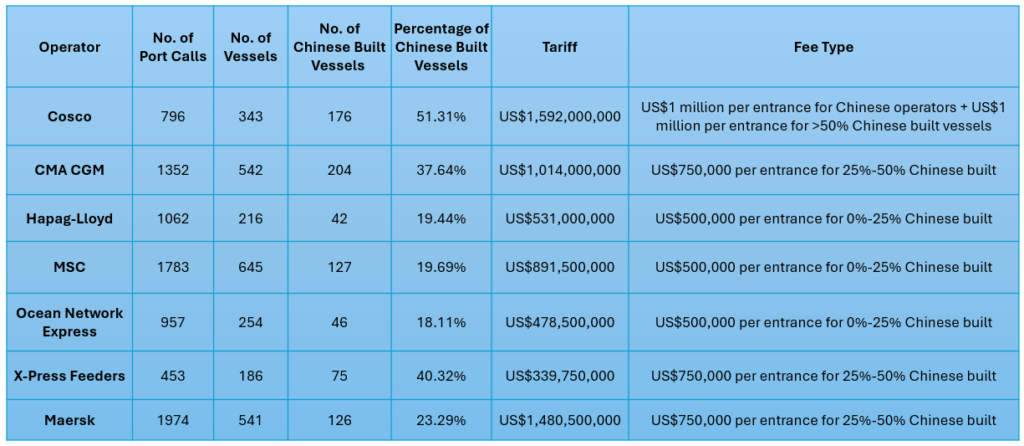

Based on VesselBot’s data, the table below illustrates the impact on each of the leading container shipping lines if the proposed fees had been implemented in 2024.

As shown in the table, Chinese state-owned COSCO would expectedly be the most affected ocean carrier, with an estimated fee of approximately US$1.6 billion. Maersk follows closely, with a total fee nearing US$1.5 billion. French container carrier CMA CGM would be the third carrier with fees over US$1 billion, while MSC’s tariffs would approach US$900 million.

To better understand the impact of these fees on each carrier, it’s useful to compare them with their overall revenues.

The results show that COSCO would experience the greatest impact, with these potential fees corresponding to 5% of its total revenue. Maersk follows with 3%, while Hapag-Lloyd’s and ONE’s fees would represent 2.5% of their revenues. CMA CGM’s total fees would account for 2% of its revenue.

“The impact on carriers could be considerable, particularly for smaller ones that won’t have the flexibility to shift vessels around,” pointed out Constantine Komodromos, Founder and CEO of VesselBot, a technology company that brings transparency to value chain emissions through its Supply Chain Sustainability Platform.

He went on to explain: “Larger carriers will have the advantage of using vessels that can help reduce their exposure to these service fees. Additionally, many larger carriers have indicated they may consider canceling some port calls at secondary ports. It remains to be seen whether and when these fees will be implemented, as well as how long they will last.”

Commenting on the broader implications of the proposed fees, Komodromos said: “If the service fee is implemented, especially on top of the existing tariffs, it could lead to a significant additional cost for shippers, which may ultimately be passed on to consumers, which could increase their cost of living.”