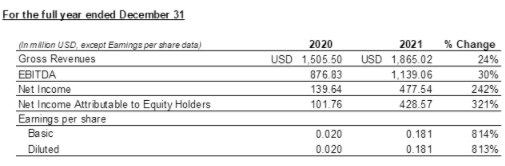

The Manila-headquartered terminal operator International Container Terminal Services (ICTSI) has closed 2021 by marking strong financial and operational figures, with net income jumping to US$477.54 million, which translates to a year-on-year increase of 242%.

Additionally, ICTSI’s revenues from port operations completed US$1.87 billion, representing a year-on-year increase of 24%, which was mainly attributed to volume growth and improvement in trade activities at most terminals, tariff adjustments at certain terminals, new contracts with shipping lines and services, higher revenues from ancillary services, the contribution of new terminals and the net favourable impact of foreign exchange at certain terminals.

During the same period, income attributable to equity holders completed US$428.57 million, marking a significant growth of 321%, according to the company’s data.

Consolidated earnings before interest, taxes, depreciation and amortisation (EBITDA) also reached US$1.14 billion in 2021, which translates to an increase of 30% over the previous year, mainly driven by higher revenues and the contribution of new terminals, and partially tapered by the increase in cash operating expenses. Concurrently, the EBITDA margin increased to 61% in 2021 from 58% in 2020.

ICTSI has also reported that consolidated cash operating expenses totalled US$523.33 million in 2021, representing an increase of 15% over 2020, which was mainly due to an increase in prices and consumption of fuel and power and higher contracted services, additional costs associated with the new terminals, and unfavourable foreign exchange effect of terminals in Melbourne, Manzanillo and Yantai.

In the meantime, consolidated financing charges and other expenses decreased by 47% to US$170.54 million in 2021, while capital expenditures, excluding capitalised borrowing costs, amounted to US$165 million.

In 2021, ICTSI handled more than 11.16 million TEU in its terminals globally, representing an increase of 10% compared to 2020, which was mainly driven by improvement in trade activities as economies recovered from the impact of the Covid-19 pandemic and the lockdown restrictions.