The International Energy Agency (IEA) has launched a new online resource aiming to bring together key energy and emissions indicators that will provide an overview of the progress being made towards net zero emissions both globally and for individual countries.

The IEA’s Energy Transitions hub includes a range of crucial metrics on emissions and clean energy from the array of global energy, ‘freely available to everyone’ data that will be updated regularly and collected, processed and published by the Agency.

In addition, the new hub will also offer users a gateway to the IEA’s major energy transition tracking resources that combines data and analysis to provide insights into key global trends.

This includes the Sustainable Recovery Tracker, which assesses the amount of recovery spending going towards clean energy investments, and the implications for energy emissions, transitions and employment, according to a statement.

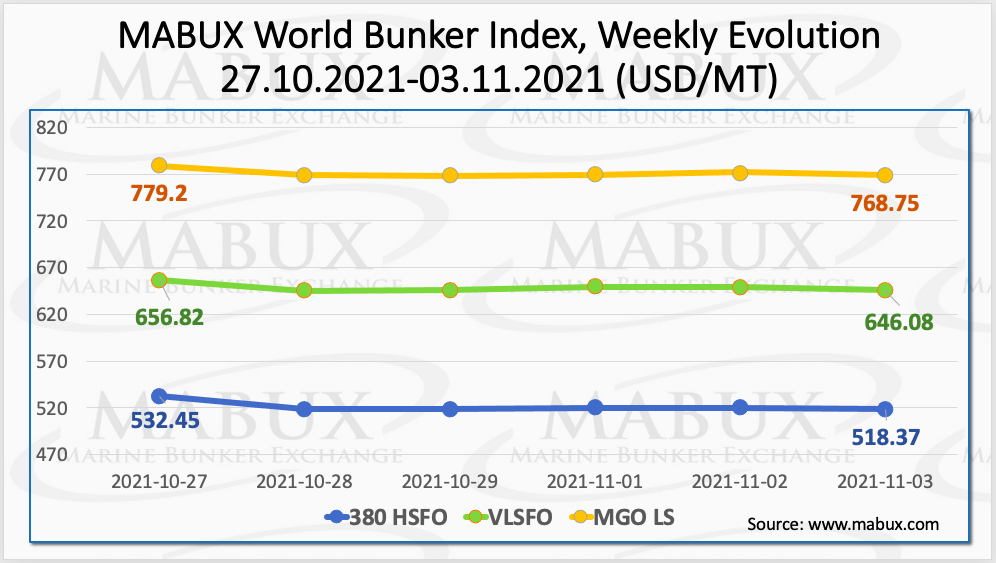

On week 44, the Marine Bunker Exchange (MABUX) World Bunker Index turned into a directional decline. The 380 HSFO Index dropped to US$518.37/MT. The VLSFO Index also decreased to US$646.08/MT, while the MGO Index declined to US$768.75/MT.

The gas prices in Europe retreat from all times highs amid a prospect of higher LNG supplies and potential higher supplies from Russia following Putin’s statement last week.

Gas prices have lowered for the whole curve in 2022 and there is further downside potential when Nord Stream 2 starts its operation. However, the market is likely to stay volatile in medium term and the demand will be largely driven by the weather and renewables output, according to MABUX officials.

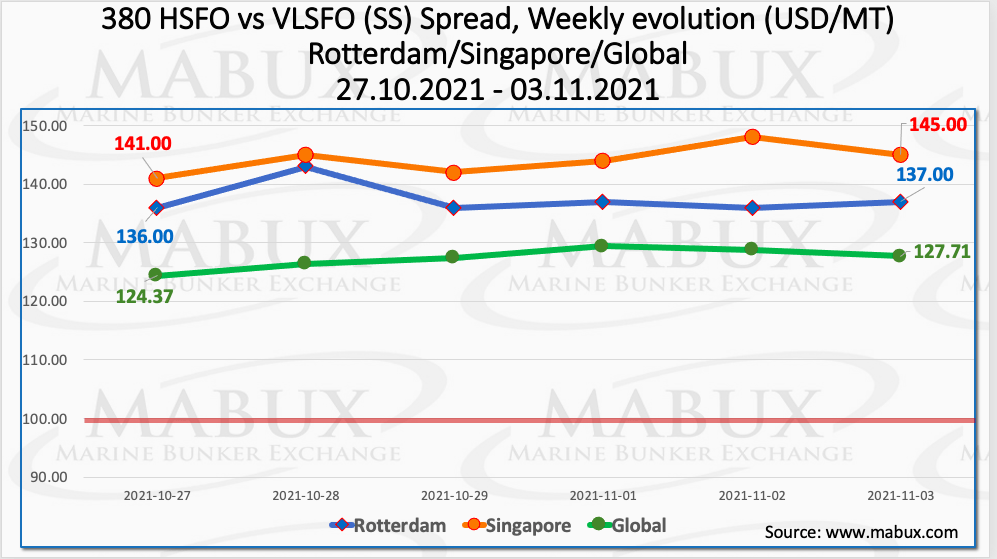

The average weekly Global Scrubber Spread (SS), the difference in price between 380 HSFO and VLSFO, continued to rise moderately during the week, reaching US$127.35.

Moreover, the weekly SS Spread average in Rotterdam also rose to US$137.50, while the SS Spread average in Singapore increased to US$144.17. “In general, all SS Spread indicators are currently consistently above the psychological mark of US$100,” commented MABUX.

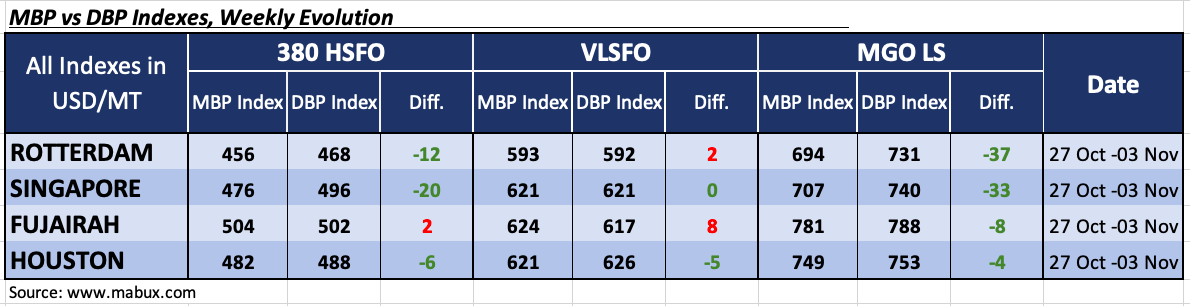

Regarding the correlation of Market Bunker Prices (MABUX MBP Index) vs MABUX Digital Benchmark (MABUX DBP Index) in the four global largest hubs over the past week, it showed that 380 HSFO fuel grade was overvalued only in the port of Fujairah with plus US$2.

In all other ports, MABUX MBP / DBP Index registered underestimation: in Rotterdam, by minus US$12, in Singapore by minus US$20 and in Houston by minus US$6. MABUX representatives assumed that the underpricing trend of the 380 HSFO will continue next week.

Furthermore, VLSFO fuel grade, according to the MABUX MBP / DBP Index, was overpriced at two of the four selected ports. In Rotterdam, the overvaluation margin was plus US$2 and in Fujairah, plus US$8. In Singapore, there was a 100% MABUX MBP / DBP Index’s correlation and in Houston this type of fuel was underestimated by minus US$5.

In general, the VLSFO indicators for all selected ports are close to the 100% correlation mark.

Last but not least, on week 44, the MABUX MBP / DBP Index continued to register an undercharge of MGO LS fuel at all selected ports with the minimum rate in Houston (minus US$4) and with the maximum in Rotterdam (minus US$37).