A new report from the International Energy Agency (IEA) says there is a “viable pathway” to achieving net-zero emissions by 2050 within the energy sector, but it is a narrow one, requiring “an unprecedented transformation of how energy is produced, transported and used globally,” noted Marine Bunker Exchange (MABUX) in its weekly briefing.

As per the report, climate pledges made by governments to date, even if fully achieved, would fall “well short” of what is needed to cut CO2 emissions to net-zero by 2050 and offer “an even chance” of keeping the global temperature increase to 1.5°C. It also paints an energy landscape that will look very different by 2050. Global energy demand will be around 8% smaller than today, but it will serve an economy more than twice as large and a population with 2 billion more people.

The report also envisages ammonia, hydrogen and bioenergy demand rising from 0% of the marine energy market in 2020 to 8%, 2% and 7% respectively by 2030, and 46%, 17% and 21% respectively by 2050. Fossil oil takes up just over 15% of marine demand by 2050 in the lEA’s scenario, while fossil gas’s share is consistently less than 5% over the next three decades and negligible by 2050.

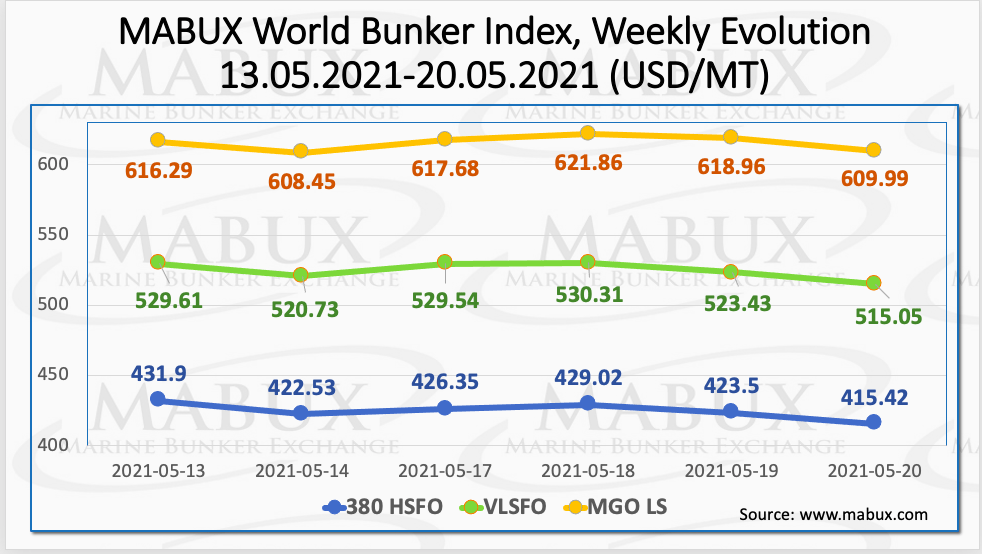

Meanwhile, during Week 20, the MABUX World Bunker Index has seen a firm downward movement with 380 HSFO index decreasing to US$415.42/mt, VLSFO Index declining to US$515.05/mt, while MGO Index falling to US$609.99/mt.

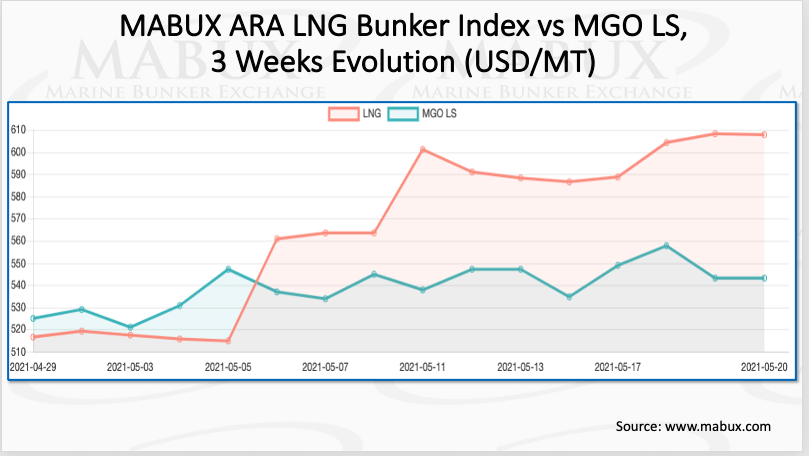

At the same time, the MABUX ARA LNG Bunker Index, calculated as the average price of LNG as a marine fuel in the Amsterdam Rotterdam Antwerp (ARA) region, has increased during the last three weeks from US$516.80/mt to US$607.67/mt.

During the same period, MGO LS prices have risen US$18/mt, while since 6 May, the price of LNG as a marine fuel in Rotterdam has consistently exceeded the price of MGO LS by average US$45.

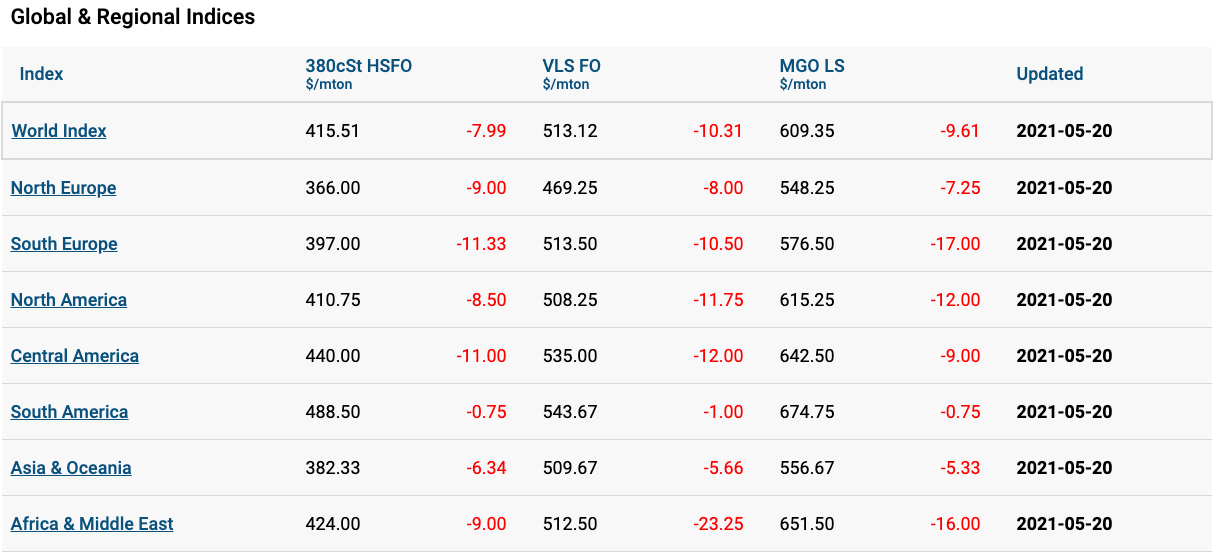

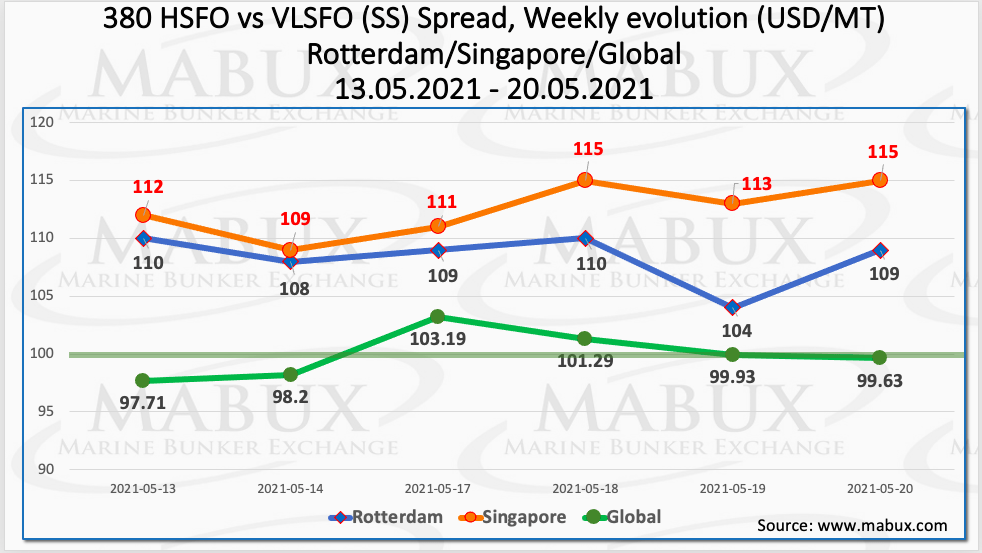

The average Global Scrubber Spread (SS) – the difference in price between 380 HSFO and VLSFO – increased to US$99.99.

In Rotterdam, SS declined slightly during the week, but its average increased to US$108.33. In Singapore, the SS rose by US$3, but its average value remained practically unchanged at US$112.5.

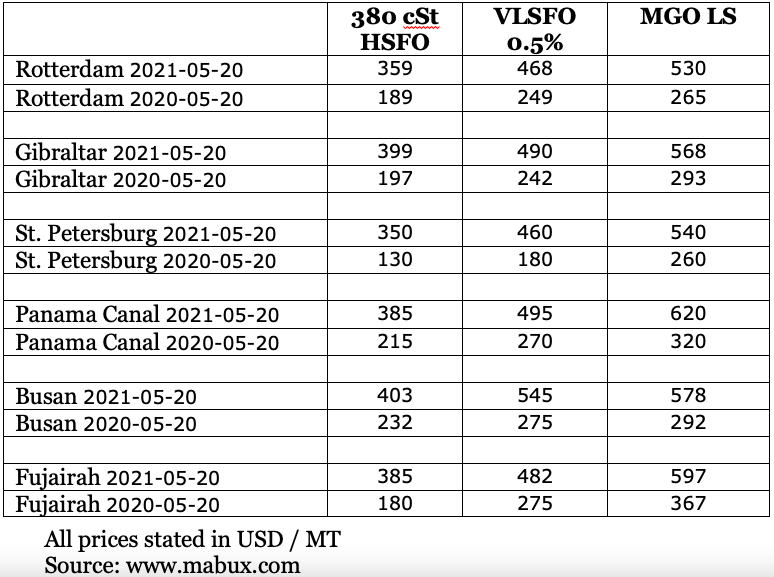

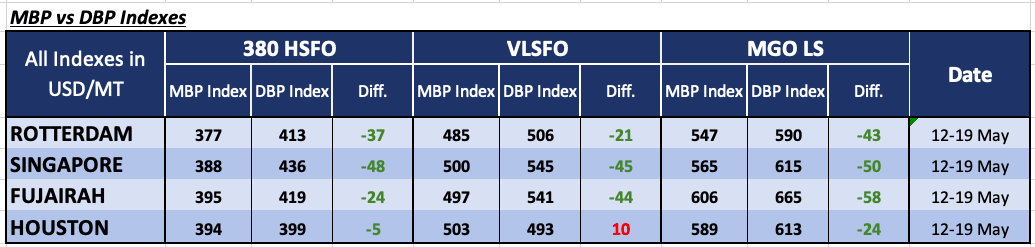

Furthermore, the correlation of MABUX MBP Index (Market Bunker Prices) vs MABUX DBP Index (MABUX Digital Benchmark) in the four largest global hubs showed this week that 380 HSFO fuel remained undercharged in all four selected ports ranging from US$5 in Houston and US$24 in Fujairah to US$37 in Rotterdam and US$48 in Singapore.

“The size of underpricing in all four selected ports increased slightly,” underlined MABUX.

The underpricing margins of VLSFO, according to the MABUX DBP Index, also slightly increased: in Rotterdam, the registered undercharge was US$21, in Fujairah – US$44, in Singapore – US$45, while in Houston, on the contrary, the margin of VLSFO overcharge rose to US$10.

MABUX DBP Index also recorded an undercharge of MGO LS fuel at all selected ports ranging from US$24 in Houston to US$43 in Rotterdam, US$50 in Singapore and US$58 in Fujairah. In general, there are no major changes in the global bunker market so far, according to MABUX.