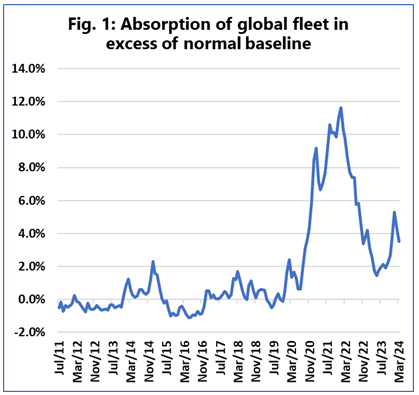

In March, the fleet absorption from vessel delays was 5.7% of the global fleet, translating to an improvement from the recent peak of 7.5% in January, according to the latest report by Danish shipping data analysis company Sea-Intelligence.

“When vessel delays occur, a percentage of the global vessel capacity is effectively absorbed and hence unavailable to the market,” explains Alan Murphy, CEO of Sea-Intelligence, adding that “historically, this percentage has tended to be within 1%-3%, with a few spikes in the 3%-5% range, on account of major disruptive events.”

It is noteworthy that at the peak of the Covid-19 pandemic, the most disruptive event in the world in the last years, this figure nearly touched 14%.

“Putting it in context, the Red Sea crisis is almost a non-event, compared to the pandemic disruptions,” points out Murphy. “It is important to note that this measures just the capacity absorbed from vessel delays and comes in addition to the capacity being absorbed by the longer route going around Africa.”

That said, there is always some “normal” background level of vessel delays, which absorbs part of the global capacity.

This background level should be removed from the calculation to better gauge the fleet capacity impact of specific events like the pandemic or the Red Sea crisis, according to the Danish analysts.

In the above figure, in which the background level has been removed, we can see how the impact of various types of delays in 2011-2019 had almost no real impact on the capacity availability in the market as a whole.

Murphy said, “We can also clearly see the pandemic impact peaking in January 2022, where 13.8% of global capacity was rendered unavailable. Here in early 2024, we did indeed have a small spike again, but it is rapidly being removed.”

He continued, “If the round-Africa services begin to operate at reliability levels matching the pre-pandemic era, then this absorbed capacity will be returned to the market, and we could see up to 4% additional capacity fed into the market in 2024. This would then come on top of the 9% of new vessel deliveries in 2024, further worsening the overcapacity challenge for the shipping lines.”