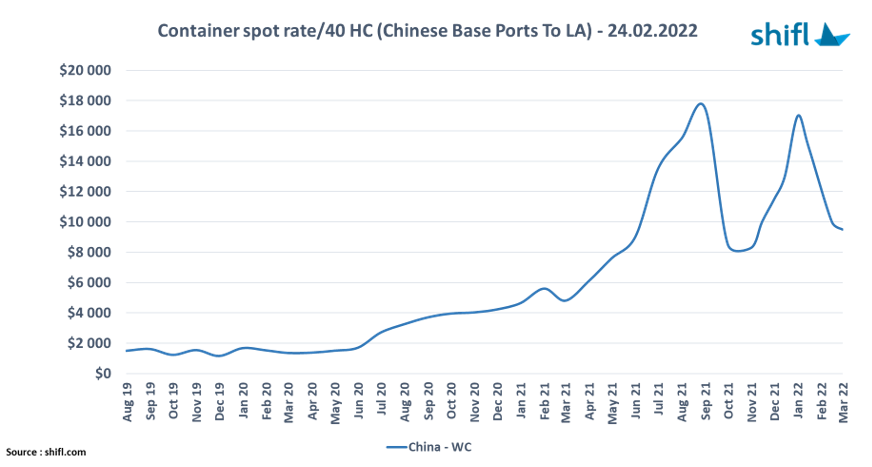

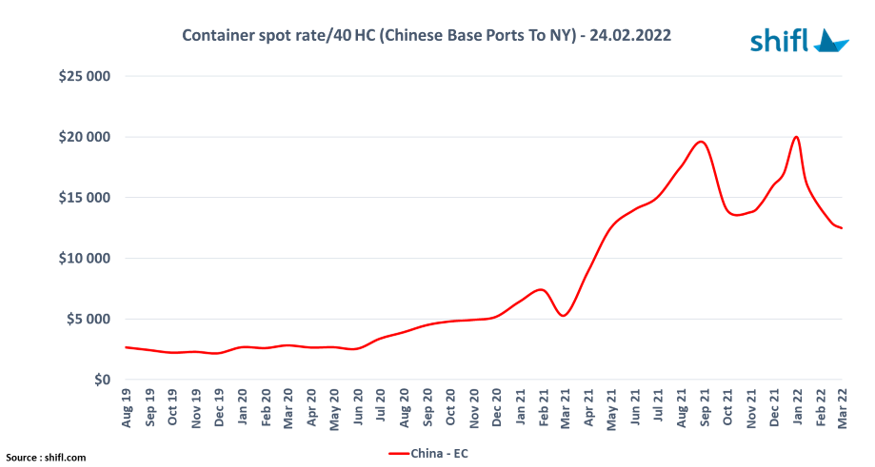

Container spot rates between Chinese base ports and the US West and East Coast are seeing a steady decline since they peaked in January in the run-up to the Chinese New Year (CNY) on 1 February.

Particularly, according to a study by the digital freight forwarding platform Shifl, the spot freight rates for a 40’ high cube container moving from Chinese base ports to Los Angeles have fallen roughly 44% from 1 January, while spot rates to the port of New York show a similar drop of around 38% over the same period.

“Spot rates have stabilised after an uptick prior to CNY. We hope they will remain stable and continue downwards as we move into the year although they would still be notably higher than the pre-pandemic rates,” said Shabsie Levy, CEO and founder of Shifl.

Significant macroeconomic factors impacting spot prices

High container spot prices will only remain justified as long as retail demand follows through. However, several growing challenges will likely pull the brakes on freight prices.

One of the foremost factors is US retail inventory volumes, which will determine retailer urgency in Transpacific imports. Federal Reserve Economic Data (FRED) economic data on retail inventories shows the metric has surged spectacularly over January, indicating overstocked retail supplies that were meant for the holiday season.

Inventory strength is a bellwether to understanding the immediate future of US retail imports, with high inventory stocking levels reflecting a slowdown in demand for Asian imports, according to Shifl.

Census Bureau’s data on non-seasonally adjusted real sales for retail trade, excluding auto vehicles and parts sales, shows it fell by 22% month-over-month in January.

“A particularly strong increase in consumer price inflation (CPI) over ’21 and the termination of stimulus checks and higher spend on travel and restaurants can be alarmist to the retail consumer base,” stated Levy.

“This could push consumers to tighten their spending and further exacerbate the fall in retail sales. Taking these factors into account, spot prices will likely not cause the level of pain it meted out to shippers last year,” added Levy.

Transit delays and container gate-out times coming down but continue to be of concern

While the number of vessels queued up around the West and East Coast ports has been reduced, the monthly throughput volumes continued to progress seen in the last few weeks, according to Shifl, which believes that this trend will be sustainable enough to get supply chains out of the ripple effect caused by months of disruptions and delays since the onset of the pandemic.

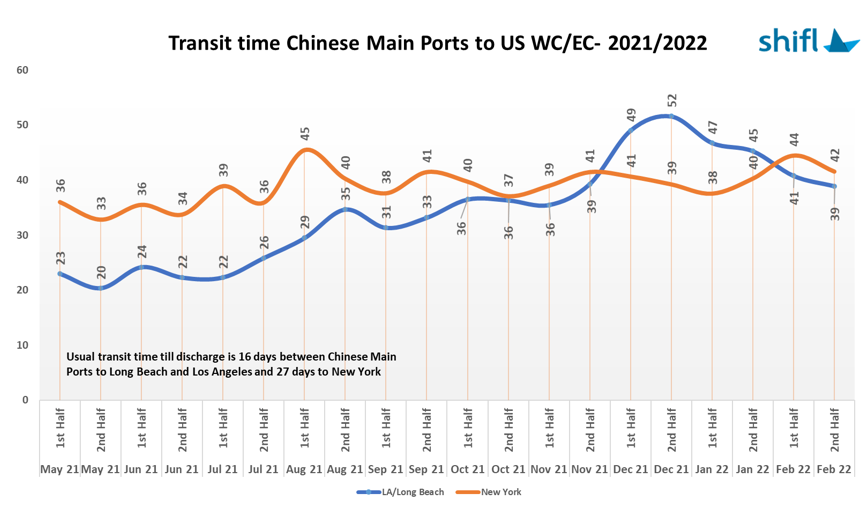

Albeit much higher than the pre-pandemic norm, transit times to the East Coast from China have maintained a similar trend for over a year now but seem to be going slightly down.

While the usual transit time till discharge was 27 days to the East Coast, it stood at 40 days at the end of January, going up slightly in the first half of February and seemingly coming down in the second half of the current month, according to the US-based digital platform.

Shifl’s market report shows that China to West Coast transit has been longer than East Coast transit since the second half of November 2021, peaking at 52 days in December 2021, reflecting how slower port operations are on the West than the East Coast, although it is a much longer transit route.

That said, transit times have actually improved across the West Coast, trending below East Coast transit times for the first time since November 2021. The transit time shrank by six days from the 47 days of transit in the first half of January.

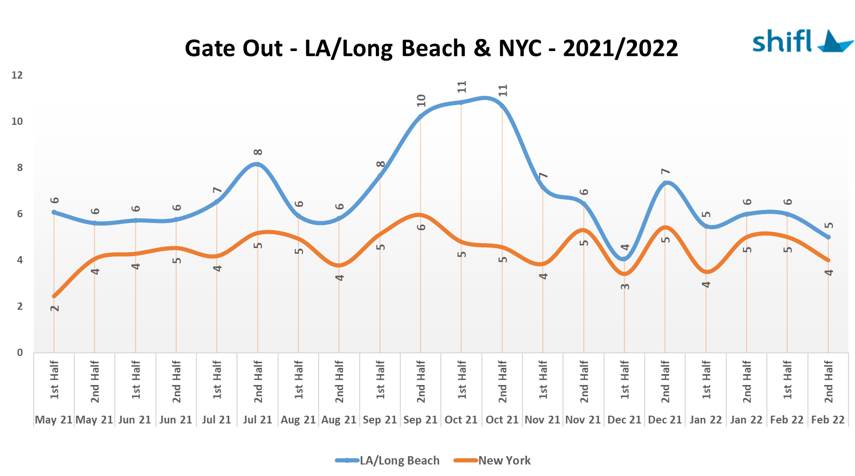

While the time that import containers dwell in the ports are still slightly on the higher side than normal the good news is that the gate out times are showing noticeable improvement dropping 40% from December 2021 highs on the West Coast and 25% on the East Coast for the same period.

According to Shifl’s report, general booking volumes and forecasts are down compared to the past year’s chaotic crunch indicating a possible start to the leaner season up to around June/July, after which the new peak season should start kicking in.

“We hope that a slow down will give the carriers and ports time to get out of the chaotic ripple effect that we are in and start the new peak season on a better and more sustainable note” concluded the boss of Shifl, Shabsie Levy.