India is taking further steps to lower the footprint that their shipping trade leaves. It is understood that a number of measures will be introduced, including the ban of tankers and bulkers older than 25 years, and gas and container vessels older than 30 years, from making port calls in India. Furthermore, secondhand vessels purchased that are older than 20 years will be refused Indian flag registration.

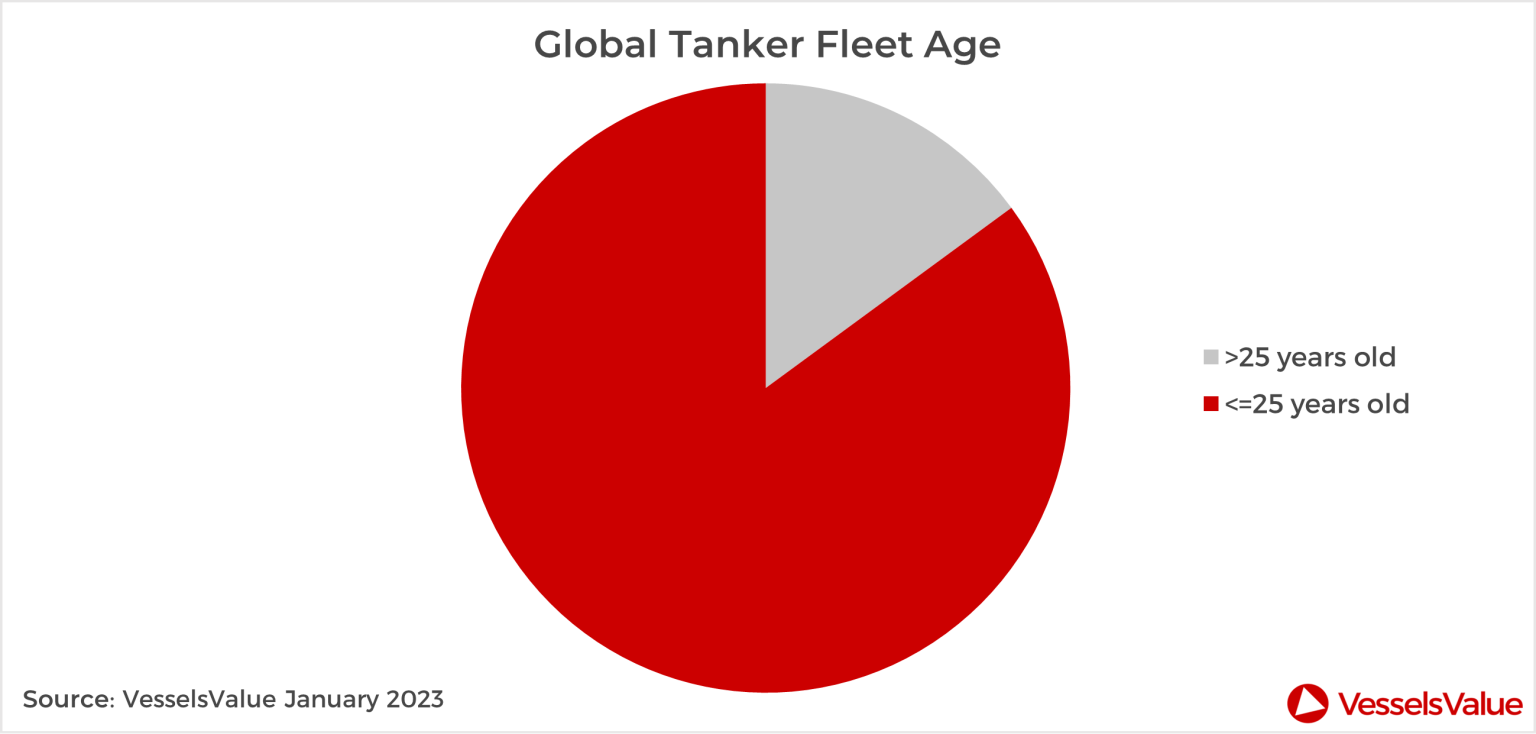

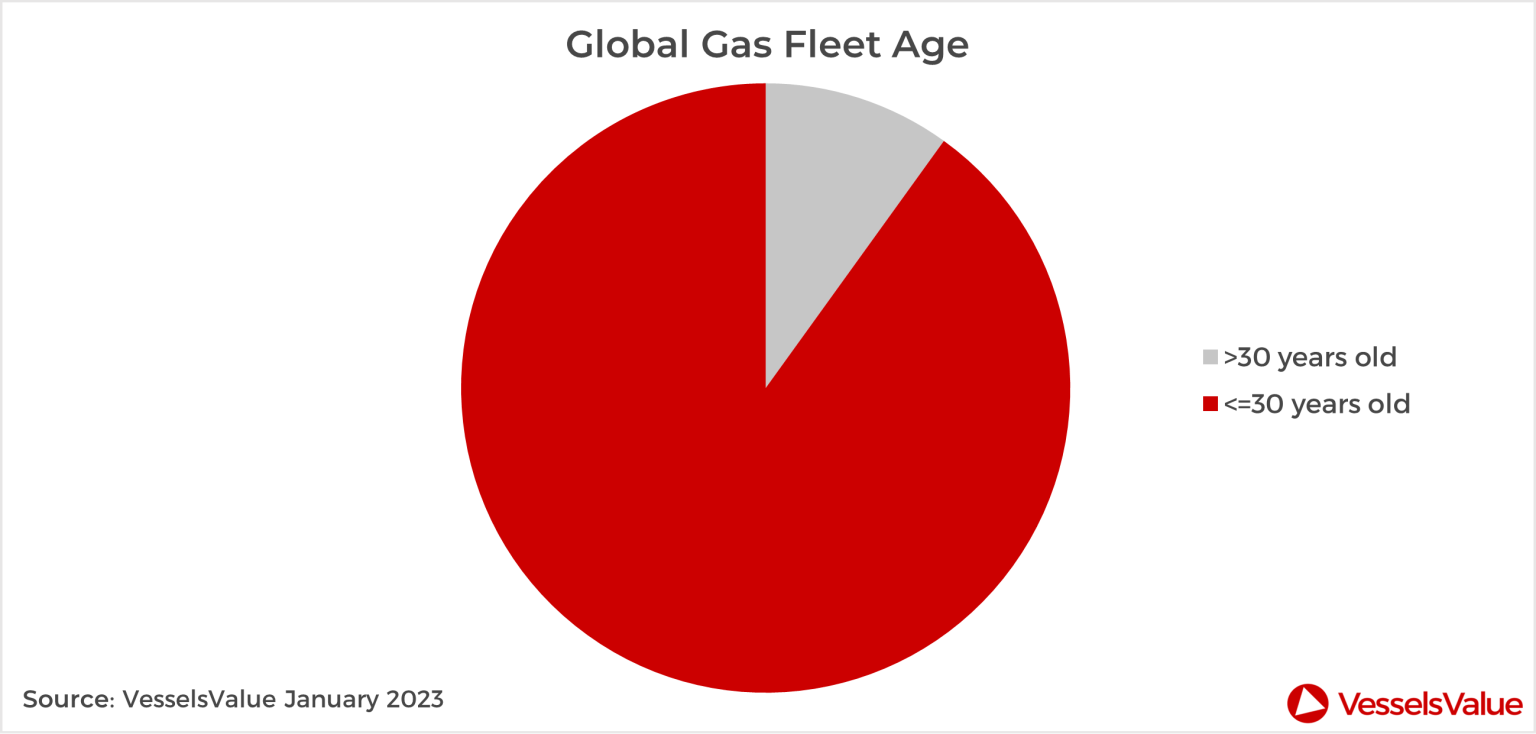

On the face of it, VesselsValue data shows that the portion of the Global fleet that would be excluded from trading with India is significant; 15% of the Tanker fleet and 10% of the Gas fleet will be taken out of the supply pool.

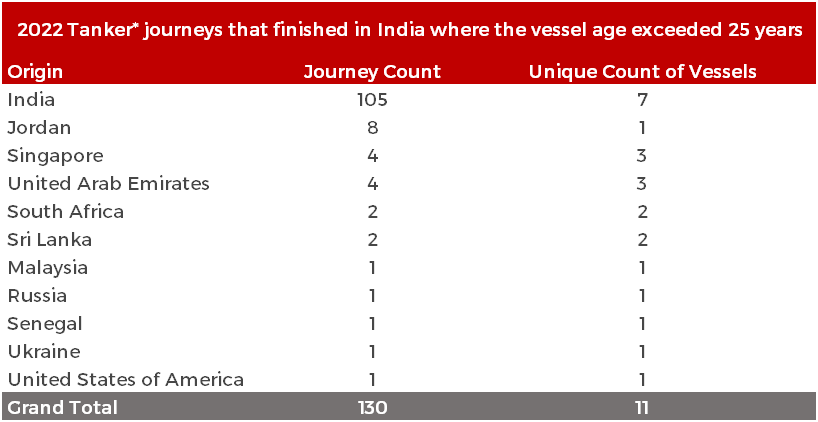

However, when observing the utilisation of these older vessels for journeys that end in India, VesselsValue trade data shows that the scale of restrictions is fairly limited. Looking specifically at 2022 Tanker journeys that completed in India, performed by vessels aged greater than 25 years, one can see that only 130 journeys were made, of which 105 were domestic, and by 11 unique vessels. 2022 saw a total of 6,259 journeys ending in India made by vessels younger than 25 years of age; this represents 98% of all Tanker journeys.

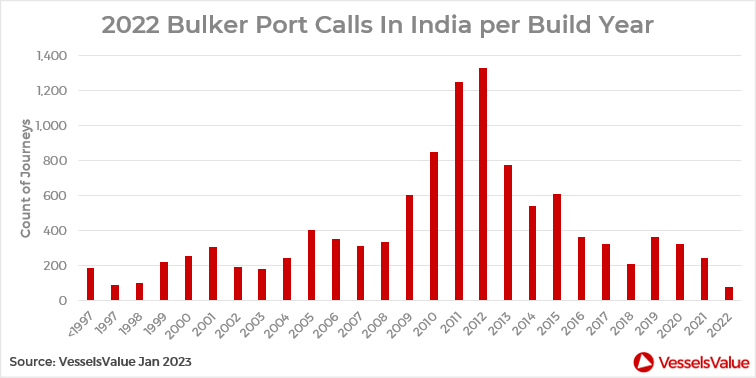

The distribution in age of bulkers whose journeys finish in Indian ports in 2022 further shows that the proposed changes will not significantly limit the supply of vessels to the Indian market. A majority of vessels that visit India are built post 2009, and whilst the tail is long, it does not pose an immediate shock to the market.

Whilst the proposed rules by India do not have a significant impact in terms of vessels restricted, they do signal an intention to reduce the environmental impact of global trade. The global fleet continues to be updated with more efficient vessels that use cleaner fuels with innovative green features onboard. With that being said, those vessels that have either reached the end of their economic life, or those that operate inefficiently, may become limited in the markets that they can serve.

Author of the article: Peter Williams, Trade Product Manager at VesselsValue

Peter Williams is a Trade Product Manager at VesselsValue, having previously worked in banking and aviation.

Peter studied for an MSc in Shipping, Trade and Finance from Cass Business School and a BA in Economics from Exeter University.