The diversity of services and/or products that a company can provide can help in its financial results, according to Bronson Hsieh, former chairman of Evergreen and Yang Ming, two of the major global container carriers.

Focussing on the transportation sector, Hsieh said that any shipping company which has a freight forwarding department or owns a freight forwarding subsidiary can gain profit from value-added services, such as the “one-stop service”.

In addition, he mentioned that being active in more than one mode of transportation simultaneously could give an advantage. “If you have some kind of a diversified business, it can probably help you,” Hsieh told Mike King in the podcast “The Freight Buyers’ Club”.

When the shipping sector cannot bring the desired results, then the air services could support the financial performance of a company, noted the former chairman of the major Taiwanese ocean carriers, pointing out that back in 1989, Evergreen had inaugurated an airline sector and gained advantages from its presence in both sea and air transportation industries.

Hsieh believes that Maersk and CMA CGM are currently moving into the integrator’s direction, while MSC seems to try to dominate the market with massive vessel orders, increasing its TEU capacity.

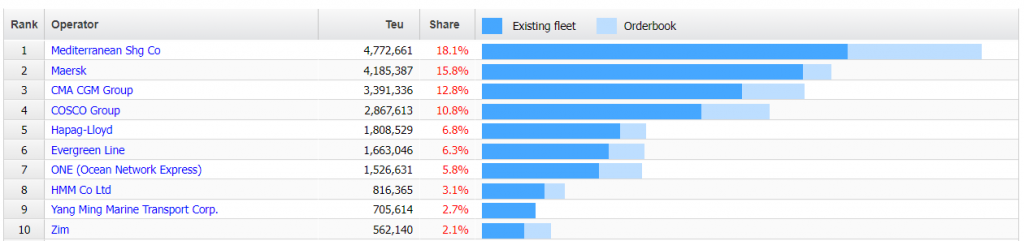

The Swiss/Italian box carrier has become the largest container shipping company in the world, having dethroned Maersk, and continues to heavily invest in new container vessels. Currently, MSC owns more than 18% of the total container ship fleet with over 4.77 million TEUs.

As shown in the Alphaliner figure, the gap between MSC and the other container lines is expected to widen in the coming months and years, as the Geneva-based carrier’s orderbook is much larger than the orderbooks of the other companies.

Therefore, we see different strategies from the container shipping giants in the post-Covid era, having entered a year when we anticipate a significant fall in freight rates, compared with record levels in 2022. It will be interesting to see which strategy will yield better results in the long run.