The number of LNG newbuilding orders have more than doubled from the same period last year where 34 orders were placed, compared to 78 in the first five months of 2024, an increase of c.129%.

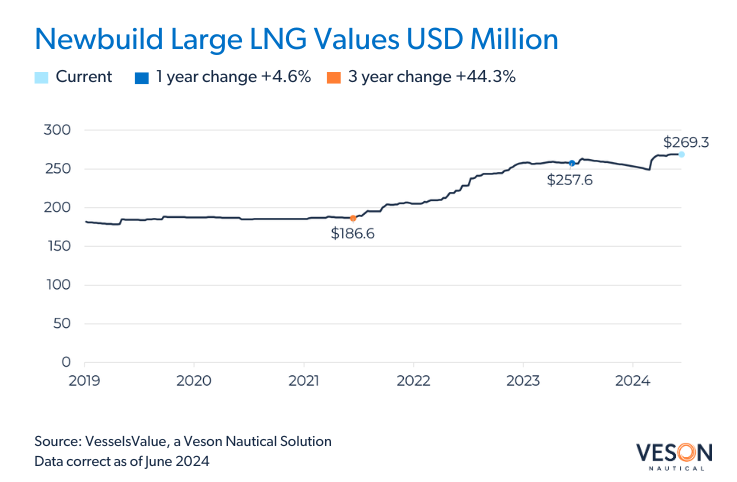

Newbuilding prices for the Large LNG sector of 174,000 CBM are currently at an all-time high of US$269 million, up by c. 6.1%.

Values for LNG vessels have increased across all sub-sectors and age categories since the start of the year, with 20YO Large LNG vessels of 140,000 CBM up by around US$10 million from US$62.85 million to US$72.40 million, equating to a c.15% increase since the first of January 2024.

At the moment, the orderbook for the Large LNG sector specifically, stands at c.64% in comparison to the live fleet. The majority of orders placed so far this year are in the Large LNG sector, representing c.74%, followed by QMAX with c.23%.

Historically, the only other orders taken for the QMAX sector were in the 2000s, indicating that the recent orders could be part of a fleet renewal program. Qatar has lead orders in 2024 with a share of c.44%, the UAE represents c.13% and in third place, China with c.9%.

Earnings are currently stable but at low levels, which is usual for the time of year. Although LNG spot rates are up by c.12% month-on-month. Year-on-year earnings are down slightly by c.1%.

However, positive sentiment for this sector stemming from geopolitical uncertainties and an increased amount of LNG being delivered to EU ports to replace the Russian Gas formerly shipped by pipeline, in combination with a push towards newer, greener vessels, have ensured that new building demand for the LNG sector has remained firm.

Notable new orders include 10 x Large LNG vessels of 174,000 CBM by ADNOC scheduled to be built at Samsung and Hanwha Ocean and set to be delivered in 2028, VV value 2.7 bn.

This article was written by Rebecca Galanopoulos Jones, Senior Content Analyst, Veson Nautical