Just as we roll over from the year of the rat to the year of the ox, the shift in the pattern of cargo flows is also taking place. The ox is honest and hard-working, according to Chinese lore, so the omens are better than for the tricky rat the fooled the oxen into giving him a ride.

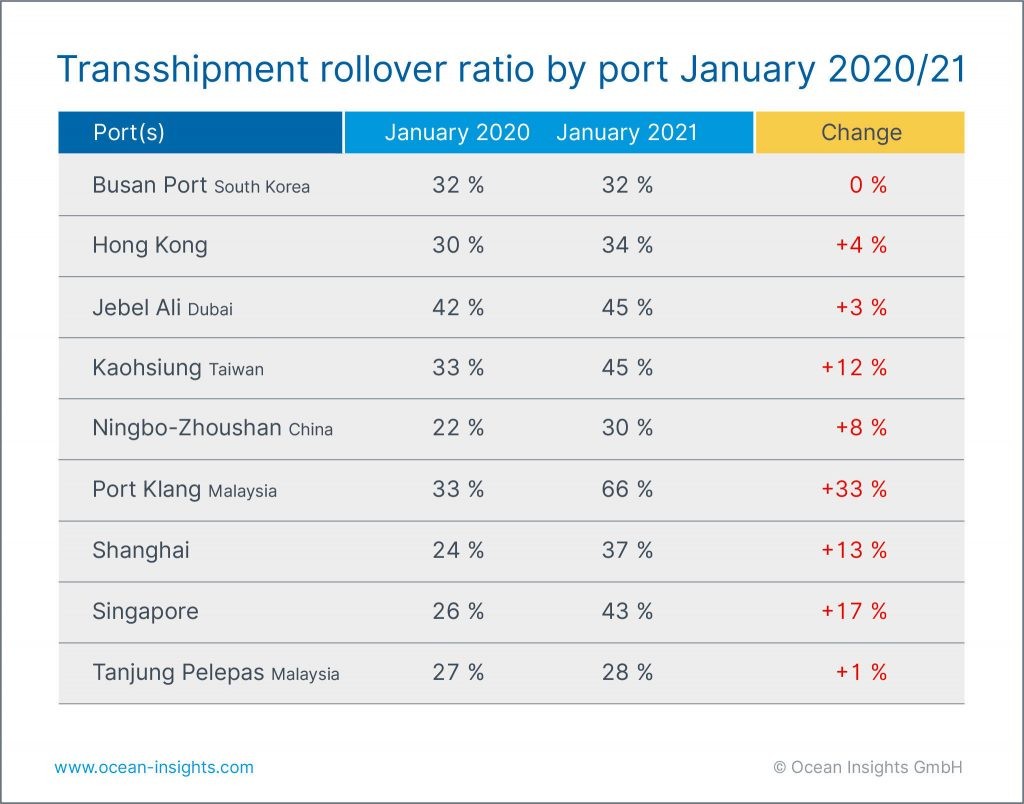

[s2If is_user_logged_in()]Seasonal rollover cargo rates have increased year-on-year with the major export regions in Asia, including Singapore, Shanghai and Kaohsiung, all recording double digit increases in delays to cargo, according to data analyst firm Ocean Insights.

Intriguingly, the overall delays apparently slowed in January, compared to December, particularly in the major export ports such as Singapore and Shanghai, and that trend would likely continue as we head into Chinese New Year. The question is, was this trend a consequence of Beijing’s policy of quarantining travellers for 14 days each time they travel between regions, so extending the Luna New Year down time from late January and into late February?

The answer to that question will be known in time, however, the freight rate situation, according to the Freightos Baltic Index (FBX) has also seen a minor plateau. Asia to North Europe rates were US$7,961/FEU, up US$19 on a week ago, while Pacific rates to the US West Coast dipped US$200 from US$4,470/FEU on 2 February before recovering to US$4,440/FEU by 10 February.

Ocean Insights believes that the quarantine regulations could well shift the congestion upstream from the ports to the factories as the supply chain is now stymied by the lack of truck transport in China for a five-week period, which may be the cause of the pause in rollovers and that this has been reflected in a similar pause in the rates.

If that is the case, then the response time, in terms of rollovers and freight rates, to the trucker service decline, will have been very rapid. If the slowing in the pace of growth in rollovers and rates is caused by something else, perhaps an increase in available equipment then a decrease in the rollover rate, currently 30% higher than a year ago, could be on the cards.

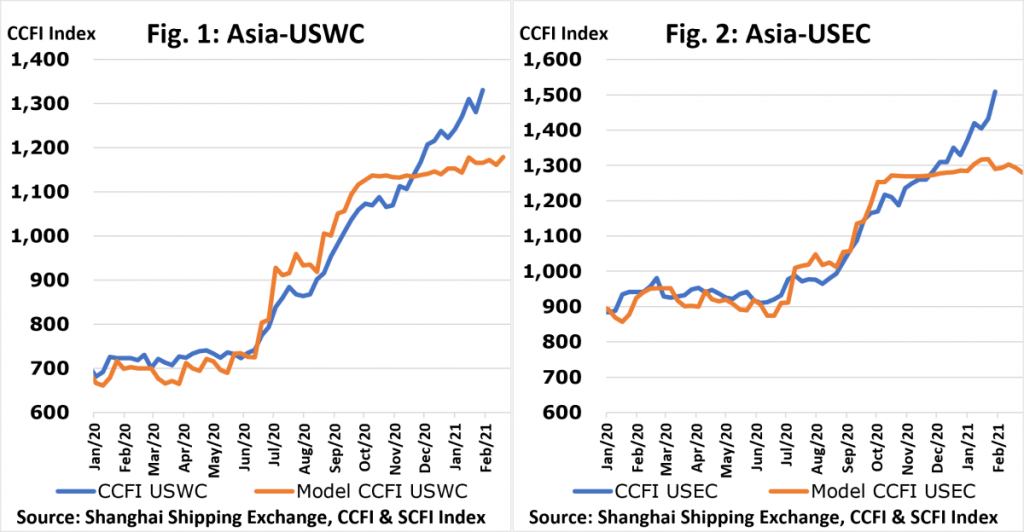

If the improvement in the supply chain is longer term then it seems that has not been reflected in the contract discussions, with Sea-Intelligence reporting that the contract index, the CCFI, is “15% too high”.

Sea-Intelligence uses the historical correlation between the Shanghai Container Freight Index (SCFI) and the CCFI to show that in the Asia to Europe trades contract rates largely reflect the spot rates, with a three-week time lag. That is the SCFI can predict where the CCFI will be in three weeks-time with a 95% certainty.

On the Transpacific, the correlation over the past two years for both the East and West Coast spot rates compared to the CCFI is in excess of 95%. That means that as the SCFI has levelled off the CCFI should have followed suit, but it has not.

“What we have seen instead is a continued increase in contract rate levels. For both Transpacific trade lanes, we are now at a point where the contract levels are 15% higher than what would be expected based on the spot market developments,” said Sea-Intelligence CEO Alan Murphy.

According to Murphy, this supports the notion of a more permanent shift to higher Pacific rates. “Prepare for permanently higher contract rates on the Transpacific, but also that the current levels right now might have overshot the mark,” said Murphy.

James Hookham, of the Global Shippers Forum (GSF), said that shippers would be “disturbed” to hear that contract rates were too high, but Hookham added he “Was not surprised to hear it.”

Nick Savvides

Managing Editor

[/s2If]

[s2If !is_user_logged_in()]Please login or register to read the rest of the story[/s2If]