Oil companies are telling investors that they will cut spending in what the UK newspaper The Guardian calls “the most brutal oil market rout in decades”.

West Texas Intermediate had dived below US$20/bbl for a time during the day and had rallied to US$20.38/bbl at the time of writing while Brent Crude had slumped more than 4% on the day to US$25.18/bbl.

According to The Guardian the collapse in the oil price means that BP is expecting a US$1billion “blow” to its first quarter results and will cut its outlay by over 20% to US$12billion in 2020, including a US$1billion cut to shale gas projects in the US.

Royal Dutch Shell has also warned that the plunge in oil prices could see a up to US$800million wiped of its first quarter finances as a consequence of what The Guardian called “a post-tax impairment charge.”

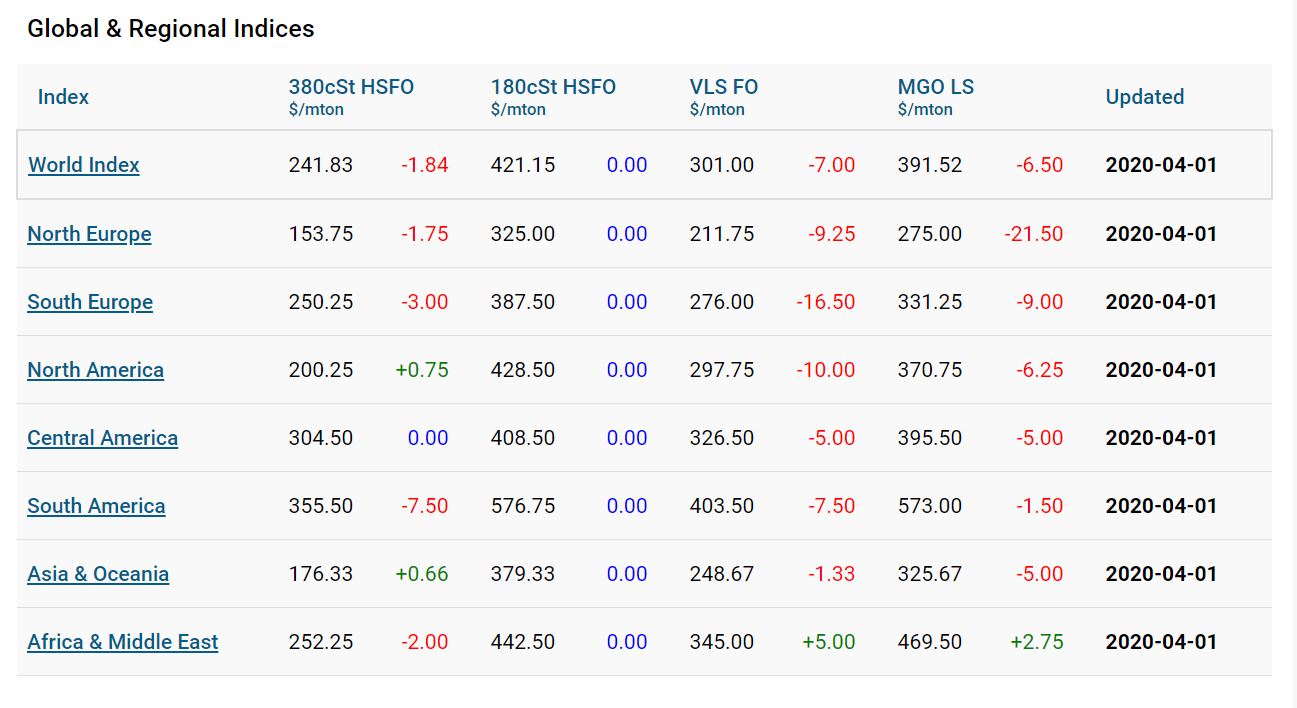

The fall in oil prices has seen a similar decline in bunker fuel prices with VLSFO narrowing the gap to its cheaper cousin, 380HFO, to less than US$26/tonne in some cases, and to less than US$60/tonne on the global average, according to the MABUX index.

![]()