The Organization of the Petroleum Exporting Countries (OPEC) and the non-OPEC nations known as OPEC+, have agreed to reduce oil production by 9.7 million barrels per day (bpd) for two months from 1 May in the hope that oil prices will recover some of its losses, as the Covid-19 outbreak sees demand slump, reported Reuters.

A number of other states have also agreed to cut their production though falling prices due to the lack of demand will account for some of the production cuts. Reuters said, “output cuts could total 19.5 million bpd, including G20 nations and oil purchases for reserves.”

Around 20% of production could be cut in what some have described as an “unprecedented” reduction in oil production.

Oil market response to the agreement has been muted with both WTI and Brent Crude slipping in price, WTI to US$21.44/bbl and Brent to US$31.11/bbl.

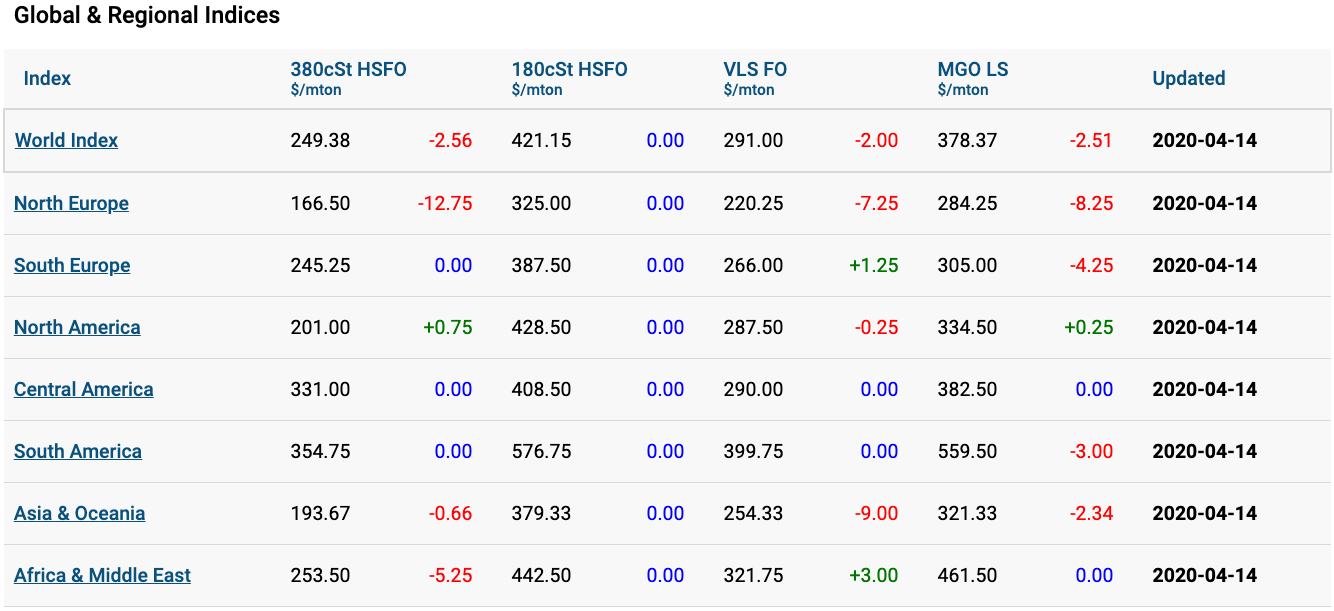

Marine bunker fuel prices also showed a muted response to the deal with the MABUX index barely registering a change in any of the regional sectors and only a minimal decline in the global averages.