Stocks of oil in north-western Europe increased by 15.8% in a week, according to reports from Platts’ Bunkerworld in the seven days to 15 April the Amsterdam-Rotterdam-Antwerp range of ports saw fuel reserves rise to 1.473 million tonnes.

A steep decline in demand is credited with the cause of the increase in stocks as the Covid-19 virus spreads causing the major consuming states lockdown populations, and stifling growth.

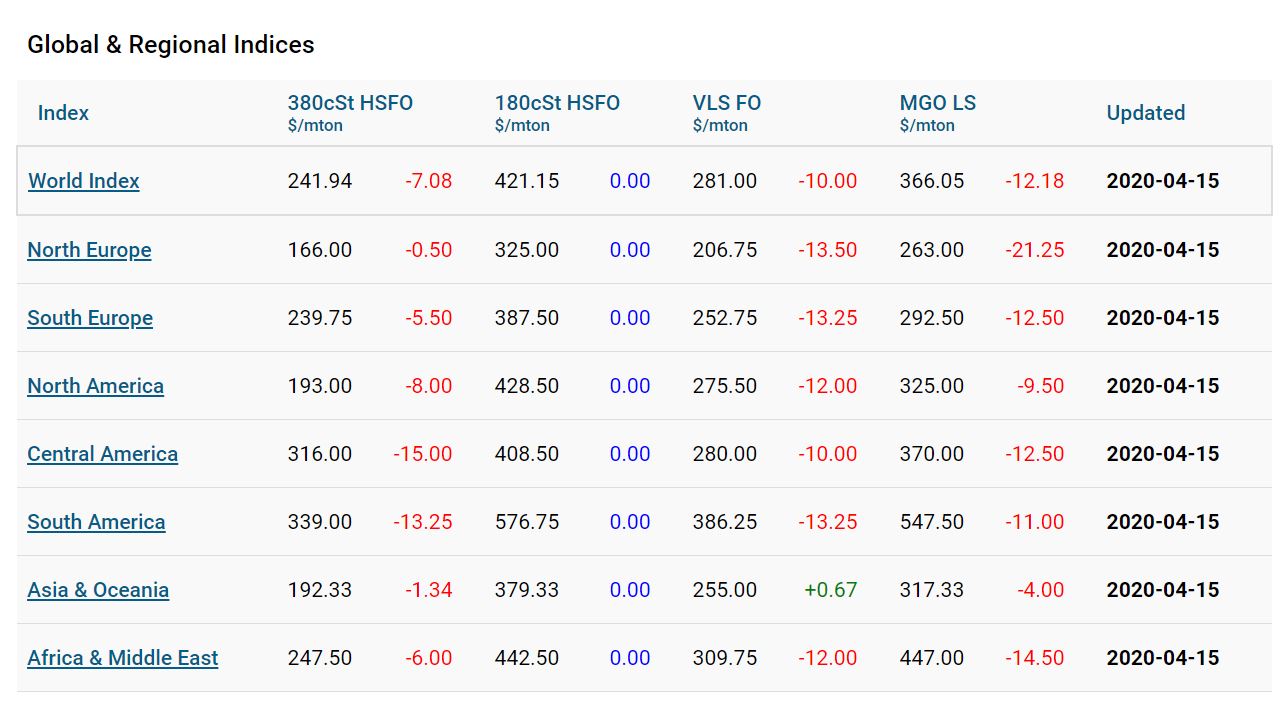

Oil prices have crashed, partly due to the dispute between OPEC and non-OPEC oil producers over the cuts to oil production which saw Saudi Arabia ramp up production as western Europe and the US went into lockdown. As Container News published WTI had again fallen below US$20/bbl, while Brent crude had drifted down to US$27/bbl, even after the announced agreement, reached on 13 April, between oil producers to cut 20% production in May and June.

Meanwhile, Bloomberg has reported that the Singapore-based oil dealer Hin Leong Trading is in talks with up to 10 creditor banks who are owed US$3 billion. The company was the parent of Singapore’s third largest marine bunker fuel supplier Ocean Bunkering Services.

Bloomberg reported that, “Before crude’s spectacular crash, it would have been almost unfathomable that a company of Hin Leong’s status could be in such a position.”