Crude oil prices appear to have stabilised today while there are reports that Russia has already taken a US$40 billion hit on crude sales while Saudi Arabia continues to ramp up production in a market where demand is falling rapidly.

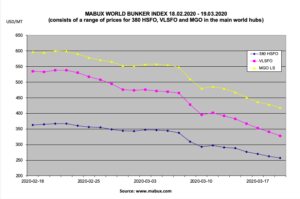

Collapsing crude prices have been met with substantial falls in the price of bunker fuel in all regions and for virtually all fuel types, with ships’ bunkers still playing catch-up with the price of crude.

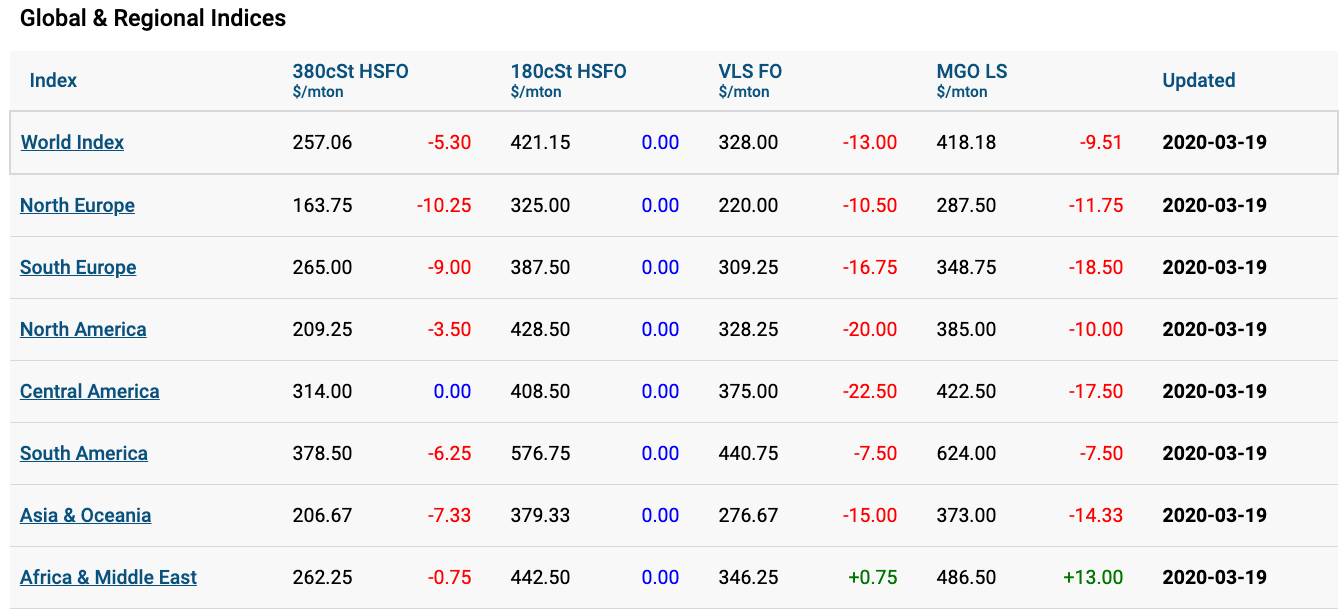

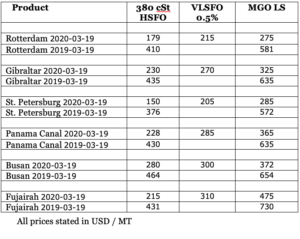

Only the North American region has the price spread between 380 HFO and VLSFO at higher than US$100/tonne. In Europe, both North and South the spread is in the mid-US$50s and US$40s respectively, while in Asia the spread has fallen to US$70/tonne. This will extend the payback period for vessels fitted with scrubber technology substantially, with no end in sight for the price war, or the Coronavirus induced demand decline.

In key individual ports the spread is considerably less with Rotterdam showing US$36/tonne spread, Gibraltar US$40 and in Busan the spread was just US$20/tonne on the 19 March.

On the supply side Adrian Tolson, marine fuel consultant with Blue Insight and the latest International Bunker Industry Association board member, told Container News that “HFO is now only available at a reasonable price in about 20 ports around the world.” If you are thinking of istalling an exhaust gas cleaning system you had better be calling at one of these ports, said Tolson.

On the supply side Adrian Tolson, marine fuel consultant with Blue Insight and the latest International Bunker Industry Association board member, told Container News that “HFO is now only available at a reasonable price in about 20 ports around the world.” If you are thinking of istalling an exhaust gas cleaning system you had better be calling at one of these ports, said Tolson.

He went on to say that as the price of crude has fallen and the spread has narrowed considerably faster than most commentators expected the economics for scrubbers has also changed, now the return on investment is much more like two to three years, with the price of oil remaining low for at least six months, possibly longer.