Asia’s third largest bunker fuel supplier, Ocean bunkering, and its parent company oil trader Hin Leong Trading have reportedly run into financial difficulties with at least two major financial institutions refusing to lend to the company.

Malaysian web publication The Edge Markets reported that company officials had not responded to emails and phone calls, when asked about at least two lenders refusing to issue letters of credit to the company following concerns over the whether the company could repay the short-term loans.

Ocean Bunkering has been a major bunker trader in Singapore with company raising its monthly sales to 1million tonnes a month in January 2018, a quarter of Singapore’s bunker sales at that time.

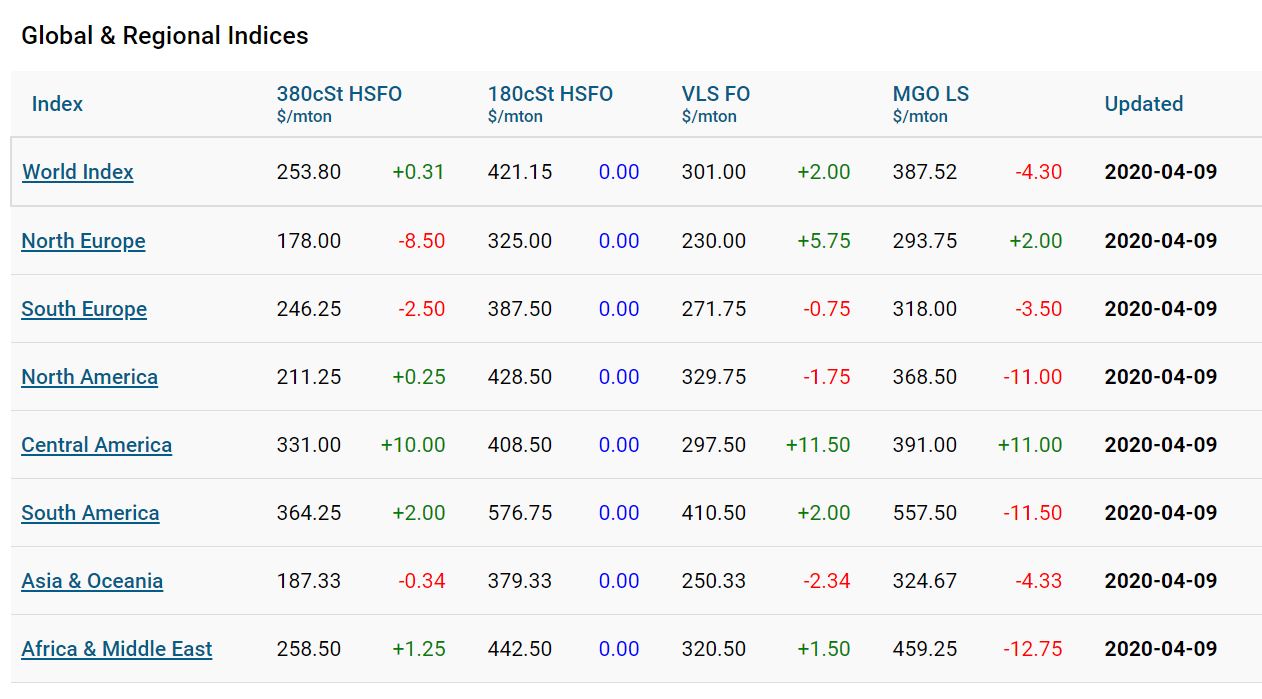

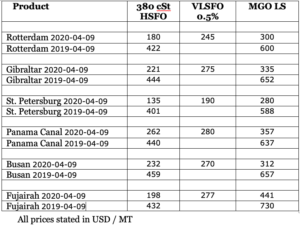

Hin Leong Trading and Ocean Bunkering could be one of the first victims in the bunkering business as the price of oil slumped in March following the failure of oil exporters within the OPEC cartel to agree deal with oi producers that operated outside of the group, mainly Russia.

At one stage oil had crashed from around US$65/bbl to under US$20/bbl and while it has rallied in the last few days, with West Texas Intermediate reaching US$25/bbl and Brent Crude US$33/bbl the commodity remains well below its early year levels.