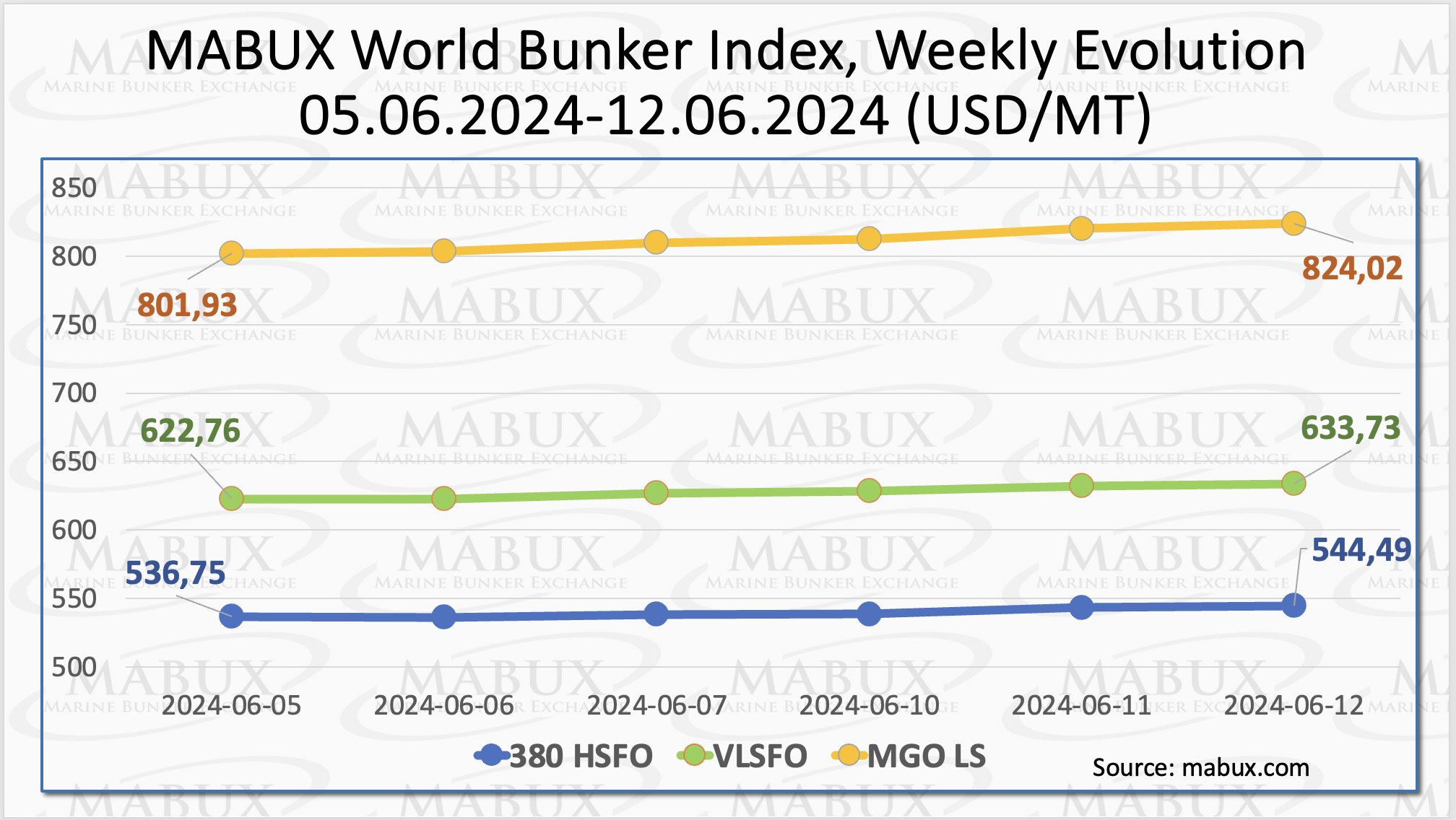

In Week 24, the MABUX global bunker indices experienced substantial growth across all segments.

The 380 HSFO index increased by US$7.74 to US$544.49/MT. The VLSFO index climbed by US$10.97, reaching US$633.73/MT. The MGO index saw the most significant increase, adding US$22.09 to US$824.02/MT.

“At the time of writing, the upward trend moderately continued in the global bunker market,” stated a Mabux official.

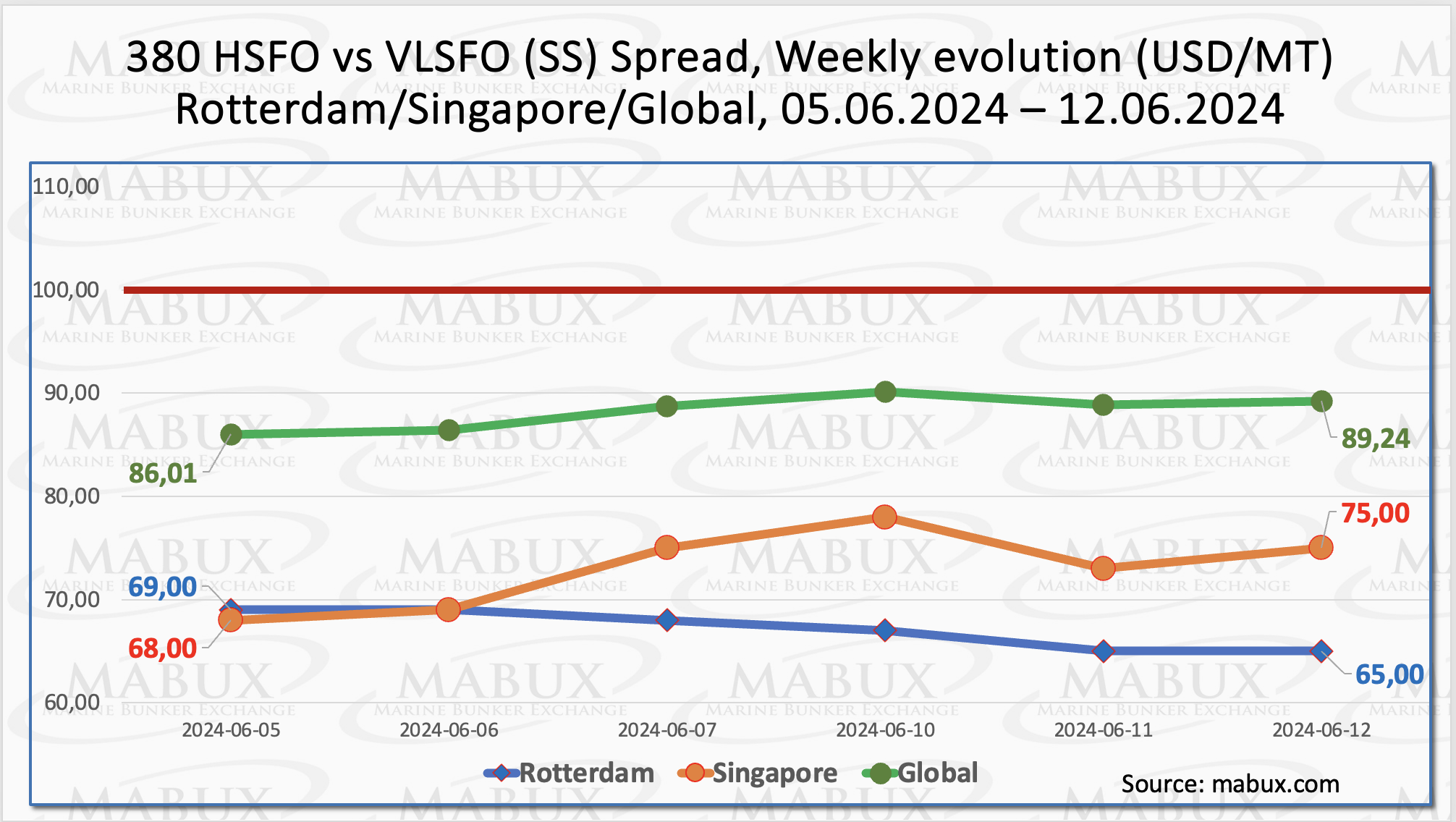

In Week 24, the MABUX Global Scrubber Spread (SS) – the price difference between 380 HSFO and VLSFO – saw a moderate increase of US$3.23, rising from US$86.01 to US$89.24.

Despite this uptick, the spread remains consistently below the critical US$100 breakeven point. Conversely, the weekly average of the SS decreased by US$5.40.

In Rotterdam, the SS Spread continued its decline, dropping by US$4.00 from US$69.00 to US$65.00, with the port’s weekly average also falling by US$6.50. In Singapore, the 380 HSFO/VLSFO price difference slightly increased by US$7.00, moving from US$68.00 to US$75.00, and the weekly average rose by US$7.67.

“Overall, while the contraction of the SS Spread has paused, the indicators suggest an upward correction may continue into the next week,” mentioned a MABUX spokesperson.

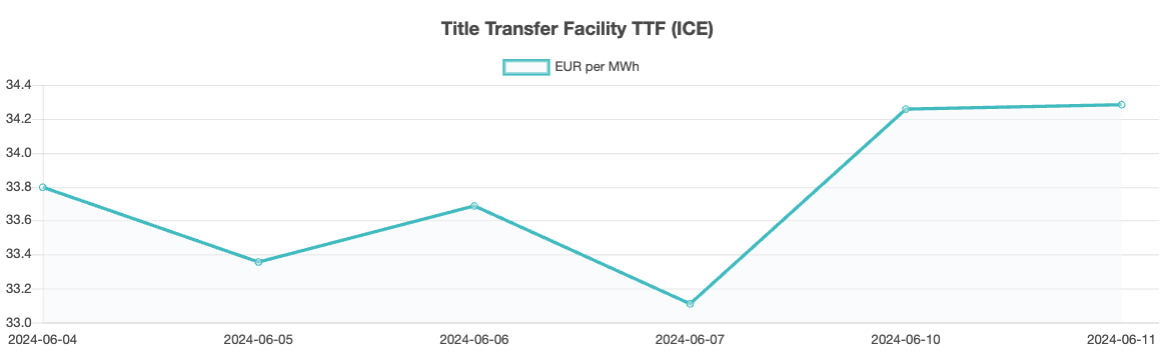

StanChart has reported that the European gas market continues with unchanged dominant dynamics, characterized by slower-than-usual inventory builds and heightened sensitivity to supply issues.

As of 2 June, EU gas inventories totaled 81.75 billion cubic meters (bcm), marking a year-on-year increase of 1.1 bcm and a surplus of 14.9 bcm above the five-year average. However, experts highlight that this surplus has diminished over 45 of the past 48 days.

StanChart anticipates that prices will likely remain elevated due to the sluggish pace of inventory accumulation. In Week 24, the European gas benchmark TTF saw a moderate increase of 0.488 EUR/MWh, rising from 33.797 EUR/MWh to 34.285 EUR/MWh.

Meanwhile, in the port of Sines (Portugal), the price of LNG as bunker fuel saw a slight decrease, reaching US$793/MT on 11 June, down by US$25 compared to the previous week.

Concurrently, the price gap between LNG and conventional fuel narrowed significantly. On 11 June, LNG was priced only US$4 below MGO LS, a notable shift from the previous week when MGO LS was US$14 cheaper. On the same date, MGO LS was quoted at US$797/MT in the port of Sines.

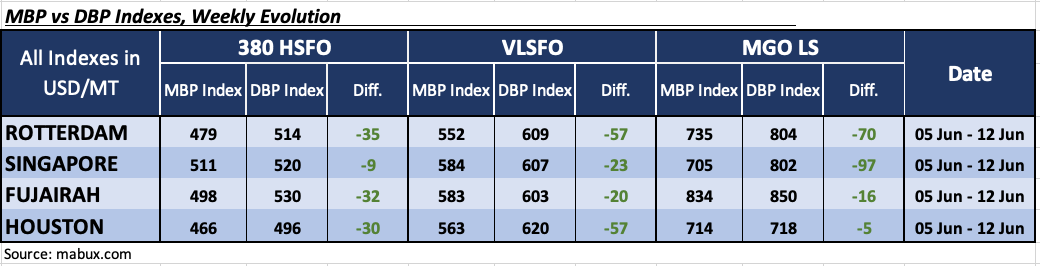

During Week 24, the MDI index (which correlates market bunker prices via the MABUX MBP Index with the MABUX digital bunker benchmark, MABUX DBP Index) indicated notable trends across major global hubs including Rotterdam, Singapore, Fujairah, and Houston:

In the 380 HSFO segment, Singapore reverted to an undervalued position, thereby categorizing all selected ports as underpriced. Weekly averages expanded by 5 points in Rotterdam, 11 points in Singapore, 1 point in Fujairah, and 4 points in Houston.

For the VLSFO segment, MDI identified all ports as undervalued, with average weekly underpricing levels increasing by 10 points in Rotterdam, 2 points in Singapore, 3 points in Fujairah, and 18 points in Houston.

Regarding the MGO LS segment, Houston joined other ports in the undervalued category. Average weekly levels rose by 7 points in Rotterdam, 1 point in Fujairah, and 14 points in Houston. However, in Singapore, the MDI index decreased by 2 points, dropping below US$100.

“We anticipate a sustained upward trend in the global bunker market into the next week,” mentioned Sergey Ivanov, director of MABUX.