A war of words is fuelling the collapse of crude oil prices which is pushing bunker prices to ever lower levels.

The Financial Times reports today that Saudi Arabia will maximise its output, to around 12.3 million barrels per day in April, higher than “Saudi Arabia’s maximum sustained production capacity, suggesting that the kingdom will take barrels from storage to flood the market rapidly.”

Saudi Arabia’s decision to ramp up production as demand collapses due to the Coronavirus and other global issues has already seen crude oil prices plummet to US$36.15/barrel for Brent crude and US$32.91 for West Texas Intermediate, just short of US$265/tonne. If in April the Saudi’s flood the market further there is a chance that the price of bunkers will see drop further. More importantly for those operators that paid to fit exhaust gas cleaning technology is what will happen to the spread, the difference between HFO and VLSFO.

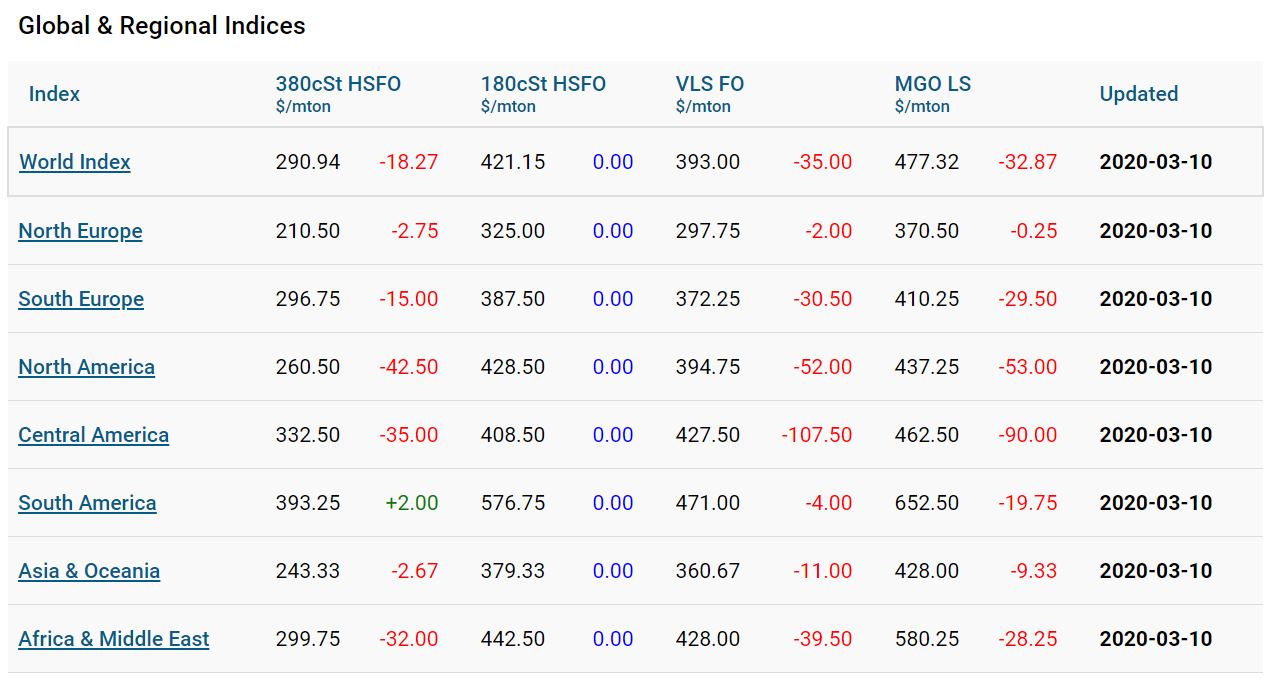

Owners with scrubbers are counting on the spread to get a relatively rapid return on their considerable investment. Already the spread has declined by over US$200/tonne and MABUX’s World Index now puts the spread at US$102/tonne, while in Asia and North America it is around US$117 and US$130/tonne; but in North Europe VLSFO has dipped below US$300/tonne for the first time and the spread is down to just US$87/tonne. And still narrowing.

Danish consultancy, Sea-Intelligence wrote in its weekly report, The Sunday Spotlight, “Two months ago, IMO2020 was set to be the carriers’ major problematic issue. Today, low-Sulphur fuel prices are dipping below the levels for normal fuel last year. Furthermore, the sudden price war on oil has the potential to send fuel prices back to levels seen in 2015/16 and hence make the cost of low-sulphur fuel the least of the carriers’ problems.”