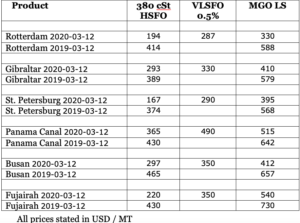

The price differential between VLSFO and 380 HFO in Northern European harbours is just US$80/tonne now with the major bunkering port in Rotterdam a little higher at US$93/tonne difference.

In southern Europe the average spread is at US$81/tonne with Gibraltar offering VLSFO at US$330/tonne, a mere US$37 above the 380 HFO price. Other ports, such as Busan are offering 380 HFO at US$297 and VLSFO at US$350/tonne. In Fujairah thespread has been maintained at US$130/tonne largely due to the decline in the price of 380 HFO, which has fallen to US$220/tonne.

In southern Europe the average spread is at US$81/tonne with Gibraltar offering VLSFO at US$330/tonne, a mere US$37 above the 380 HFO price. Other ports, such as Busan are offering 380 HFO at US$297 and VLSFO at US$350/tonne. In Fujairah thespread has been maintained at US$130/tonne largely due to the decline in the price of 380 HFO, which has fallen to US$220/tonne.

With the price of West Texas Intermediate falling over 6% to US$30/bbl and Brent declining by 8% to rest at a little over US$2/bbl more than its WTI relation the expectation is that bunker prices for fuel types will decline further over the coming days and weeks.

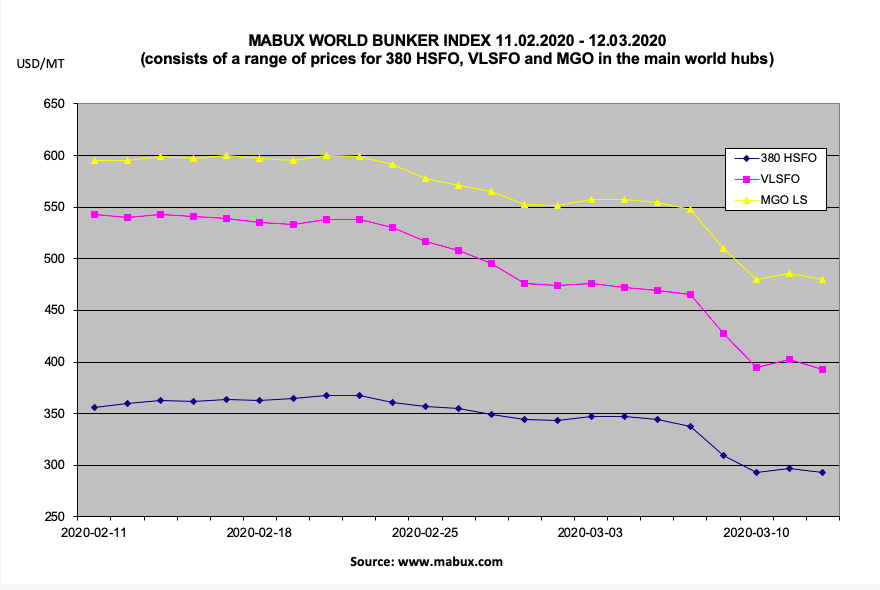

Until early March the cost of 380 HFO remained flat with VLSFO declining slowly, in early March both fuels saw a sharp fall with VLSFO falling furthest. The failure of the talks between the Organization of Petroleum Exporting Countries (OPEC) and non-OPEC countries in meetings, dubbed OPEC+, to reach an agreement on production levels has seen oil prices, and therefore bunker prices slashed over the last week.

The failure of the OPEC+ talks has led to a price war with Saudi Arabia expected to raise its production levels to 13 million barrels per day, by April and Russia expected to increase its output as a result in what is an already depressed market with falling demand and trade levels.

As a result of the Coronavirus pandemic, the oil price war between Saudi Arabia and Russia along with an already stuttering global economy the Organization of Economic Co-operation and Development has slashed its growth projections for the global economy from, what the OECD calls an already weak, 2.9% to 2.4%.

That points to tough year all round for all those in the maritime industry.