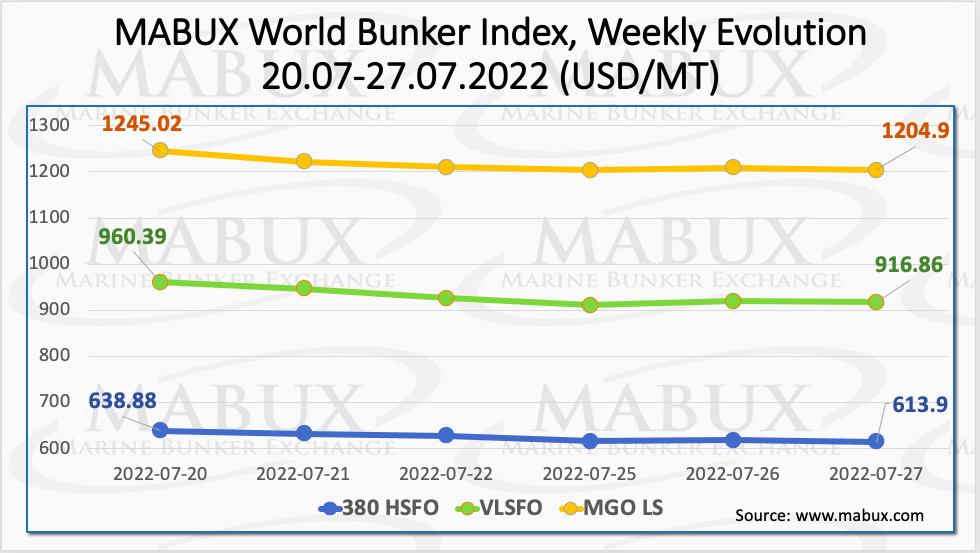

“Over the Week 30 MABUX global bunker indices continued firm downward trend,” said Sergey Ivanov, director of Marine Bunker Exchange (MABUX). The 380 HSFO index went down by another US$24.98 from US$638.88 /mt. The VLSFO index, in turn, fell by US$43.53 from US$960.39/mt. The MGO index also lost US$40.12 from US$1245.02/mt.

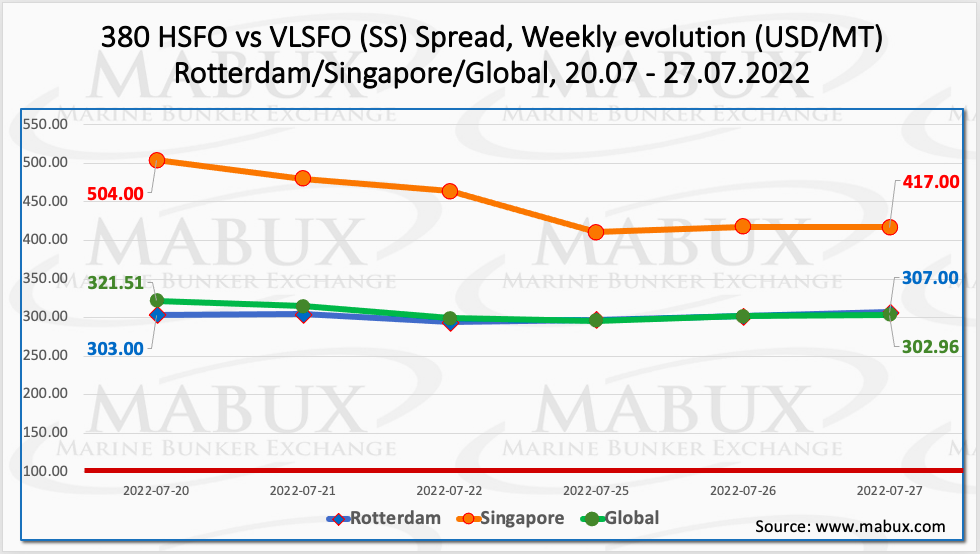

The Global Scrubber Spread (SS) weekly average – the difference in price between 380 HSFO and VLSFO – dropped sharply for the third week in a row – minus US$30.75 (vs. US$336.82 last week). In Rotterdam, the average SS Spread also declined US$20.50 (vs. US$321.67). However, the most significant decline in the average weekly price difference 380 HSFO/VLSFO was recorded in Singapore: minus US$83.83 (vs. US$532.83).

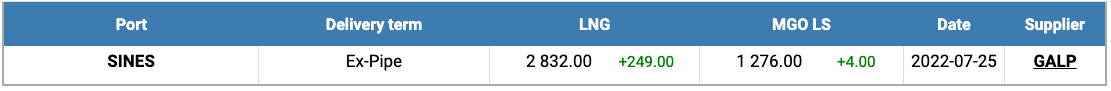

“The natural gas market in Europe remains highly volatile amid the risks of gas supplies outages from Russia,” said Ivanov.

LNG as bunker fuel in the port of Sines (Portugal) rose again on July 25 by US$249 /mt (vs US$2583 /mt a week earlier). LNG prices are more than double the price of the most expensive conventional bunker fuel: MGO LS at the port of Sines was quoted on July 27 at US$1276 /mt.

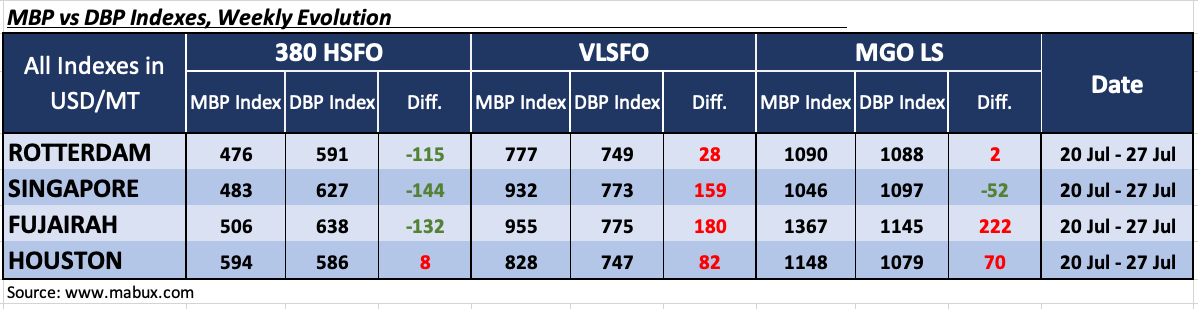

Over the Week 30, the MDI index (comparison of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark)) showed an undercharge of 380 HSFO fuel grade in three out of four ports selected: Houston moved into the overprice zone: plus US$8. In other ports, the underestimation premium rose slightly and amounted to: Rotterdam – minus US$115, Singapore – minus US$144 and Fujairah – minus US$132.

VLSFO fuel, according to MDI, remained, on the contrary, overpriced in all four selected ports: plus US$28 in Rotterdam, plus US$159 in Singapore, plus US$180 in Fujairah and plus US$82 in Houston. Here, the MDI index did not have firm dynamics: the overcharge decreased significantly in Rotterdam, Singapore and Fujairah, but increased in Houston.

“The most significant change was the overprice reduction in Singapore by 100 points at once. Nevertheless, VLSFO remains the most overvalued segment in the global bunker market,” highlighted Ivanov.

As for MGO LS grade, MDI index registered a fuel overcharge in three ports out of four selected: Rotterdam – plus US$2, Fujairah – plus US$222 and Houston – plus US$70. Singapore remained the only port where the MDI index registered underestimation – minus US$52. The underpricing premium was growing while the overcharge one was moderately decreasing.

The US became the world’s largest LNG exporter during the first half of the current year, according to data from CEDIGAZ. Characteristic is the fact, that compared to the second half of 2021, US LNG exports increased by 12% in the first half of 2022, averaging 11.2 billion cubic feet per day (Bcf/d).

According to the US Energy Information Administration (EIA), there are three reasons for the continued growth in LNG exports: increased LNG export capacity, increased international natural gas and LNG prices and increased global demand, particularly in Europe.

Like 2021, the United States sent the most LNG to the EU and UK during the first half of the year, providing 47% of the 14.8 Bcf/d of Europe’s total LNG imports, followed by Qatar at 15%, and Russia at 14%, and four African countries combined at 17%. The EIA also noted that international natural gas and LNG prices hit record highs in the last quarter of 2021 and first half of 2022.

“We expect downward trend to continue in Global bunker market next week,” Ivanov concluded.