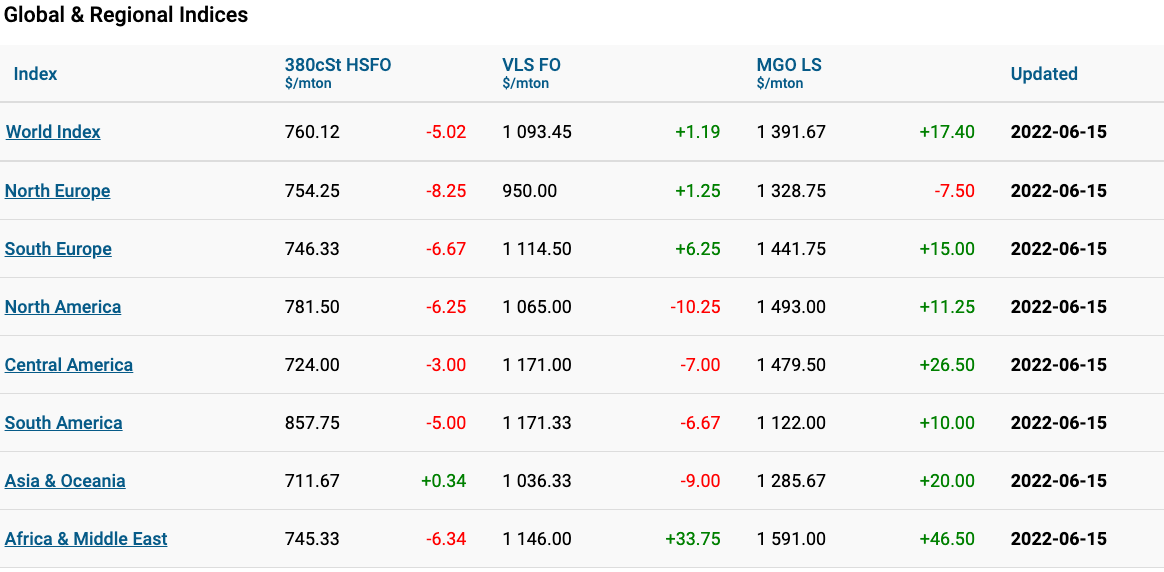

Over Week 24 of the year, the world bunker indices showed moderate irregular changes, according to Sergey Ivanov, director of Marine Bunker Exchange (MABUX).

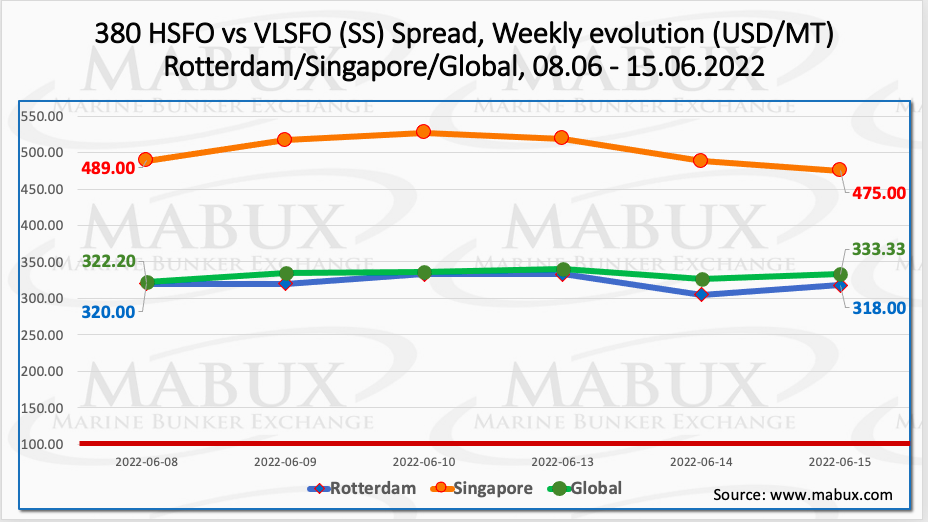

The 380 HSFO index fell to US$760.12 /mt, the VLSFO index, in turn, rose to US$1093.45 /mt and the MGO index climbed to US$1391.67 /mt.

“The VLSFO and MGO indices are at their all-time highs” pointed out Ivanov.

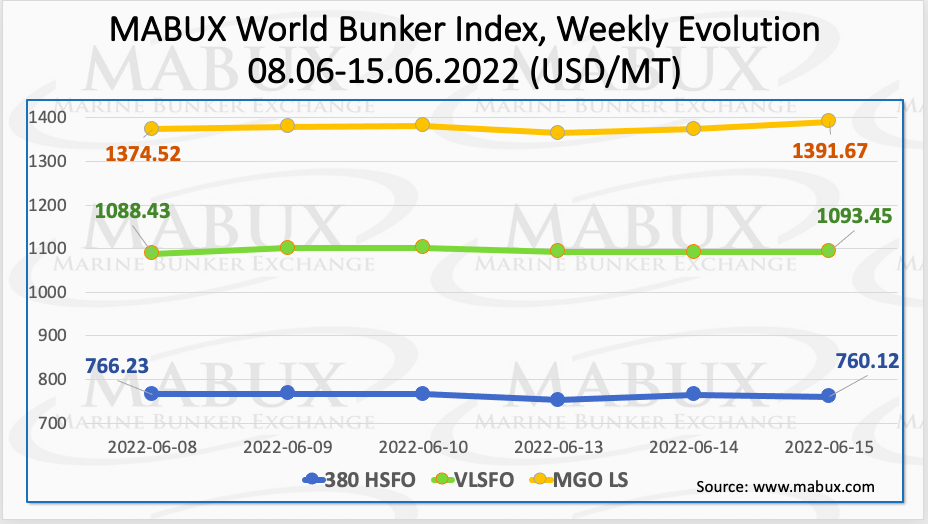

The Global Scrubber Spread (SS) weekly average – the price difference between 380 HSFO and VLSFO – continued its firm upward trend over the week – plus US$32.06 – reaching US$332.26. In Rotterdam, the average SS Spread rose significantly by US$71.33, reaching US$321.50. In Singapore, the average weekly price difference of 380 HSFO/VLSFO also rose by US$20 to US$502.50 from $482.50 last week, but dropped back to US$475 on 15 June.

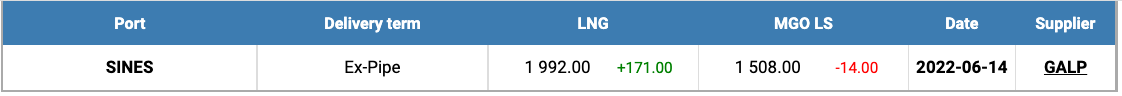

“Natural gas prices in Europe have turned again into moderate growth,” highlighted Ivanov. The price for LNG as bunker fuel in the port of Sines in Portugal rose on 14 June to US$1992 /mt. LNG prices are still significantly higher than those of traditional bunker fuels: the price index for MGO LS in the port of Sines was quoted at US$1508 /mt as of 14 June. Meanwhile, the development of 25 LNG export terminal projects in the US could result in more than 90 million tonnes of greenhouse gas (GHG) emissions a year, according to the US-based NGO Environmental Integrity Project (EIP). In March 2022, America exported 7.6 million tonnes of LNG, quadruple the amount four years earlier.

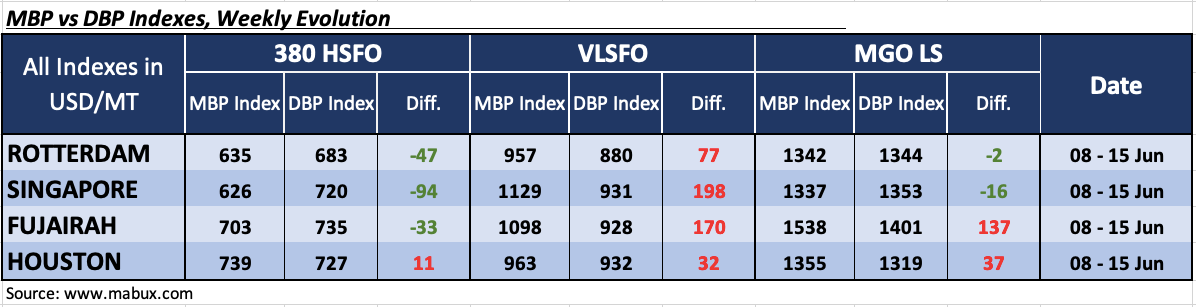

Over the week 24, the MDI index (comparison of MABUX MBP Index -market bunker prices- vs MABUX DBP Index -digital bunker benchmark-) continued to register an underestimation of 380 HSFO fuel in three ports out of four selected: Rotterdam – minus US$14, Singapore – minus US$94 and Fujairah – minus US$3. The only overpriced port was Houston – plus US$11. Underprice premium continued to rise slightly, while the overcharge ratio declined.

VLSFO fuel grade, according to MDI, remained overpriced at all four selected ports: plus US$77 in Rotterdam, plus US$198 in Singapore, plus US$170 in Fujairah and plus US$32 in Houston. Ivanov stated, “here, the MDI index had not a firm trend, increasing in Rotterdam and Fujairah, but declining in Singapore and Houston. VLSFO fuel remains the most overvalued segment in the global bunker market”.

As for MGO LS, over the week, MDI registered an undercharge in two ports out of four selected: in Rotterdam – minus US$2 and in Singapore – minus US$16. In other ports, the overcharge margins were: Fujairah – plus US$137 and Houston – plus US$27. Undercharge premium is gradually decreasing while overcharge one is going up.

Thus, high volatility remains in the global market. There is still no firm trend in the correlation of market and digital MABUX bunker prices benchmark (MDI).

The 4,115,500 metric tonnes (mt) of marine fuel sold in Singapore in May was the highest monthly total of the year. Last month’s total represented a 1.1% increase on the 4,071,800 mt of bunkers sold in May 2021 and a 10% increase on the 3,742,300 mt registered in April. During the first five months of the year a total of 19,162,900 mt of marine fuel was sold in the Port of Singapore – 9.4% down on the 21,150,700 mt of bunker sales in the corresponding period in 2021. The number of vessels calling for marine fuel at the global bunker hub rose from 3,025 in April to 3,168 in May.

“There is some stabilisation of fuel indices registered in the market recently. We expect bunker prices to continue moving in different directions next week,” said Ivanov said.