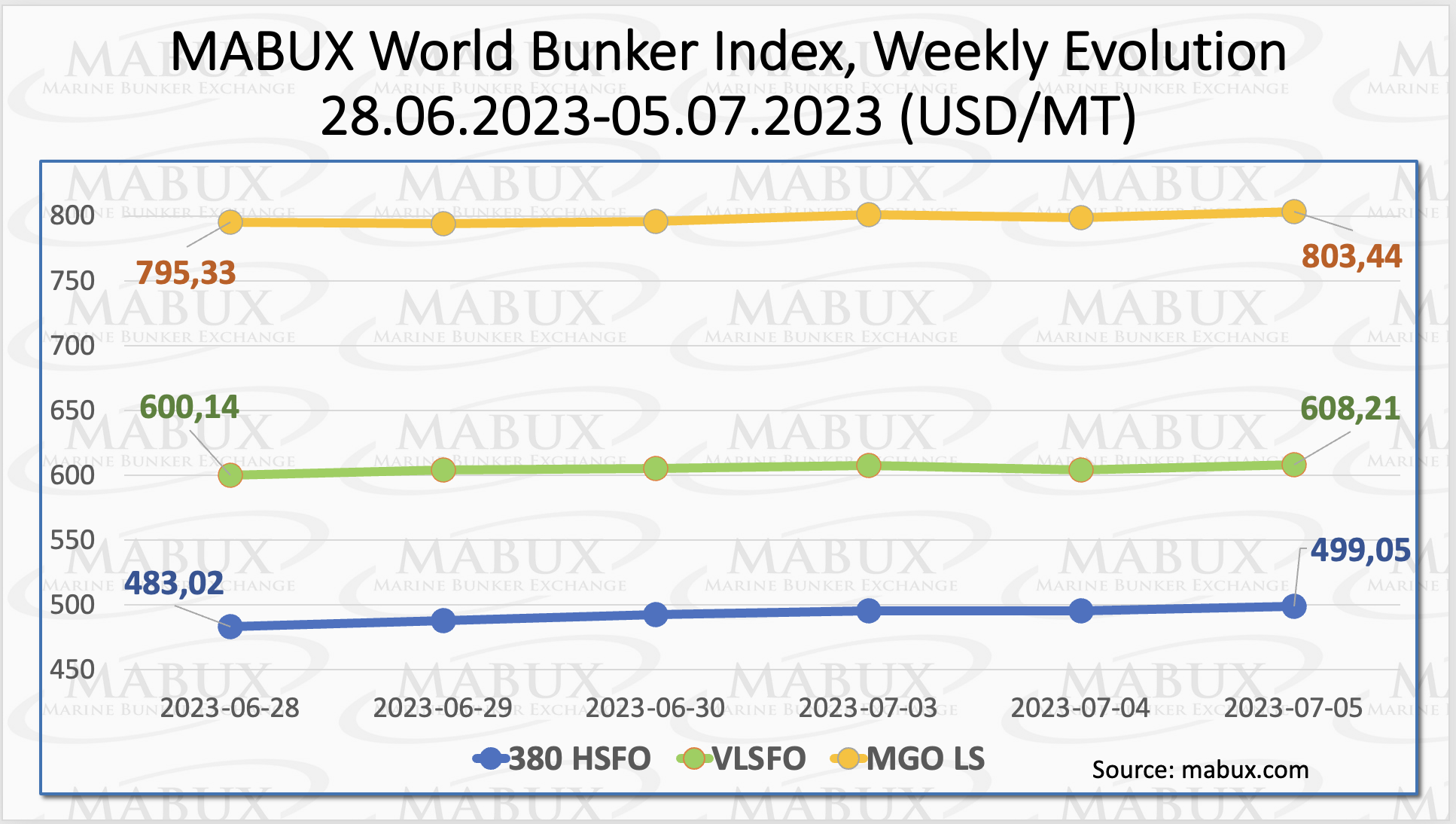

The worldwide Marine Bunker Exchange (MABUX) indexes have shown a moderate increase as of the 27th week of the year.

The 380 HSFO index increased to US$499/MT, the VLSFO index rose to US$608/MT and the MGO index climbed to US$803/MT.

“At the time of writing, the uptrend continued to prevail in the market,” pointed out a MABUX representative in the latest report.

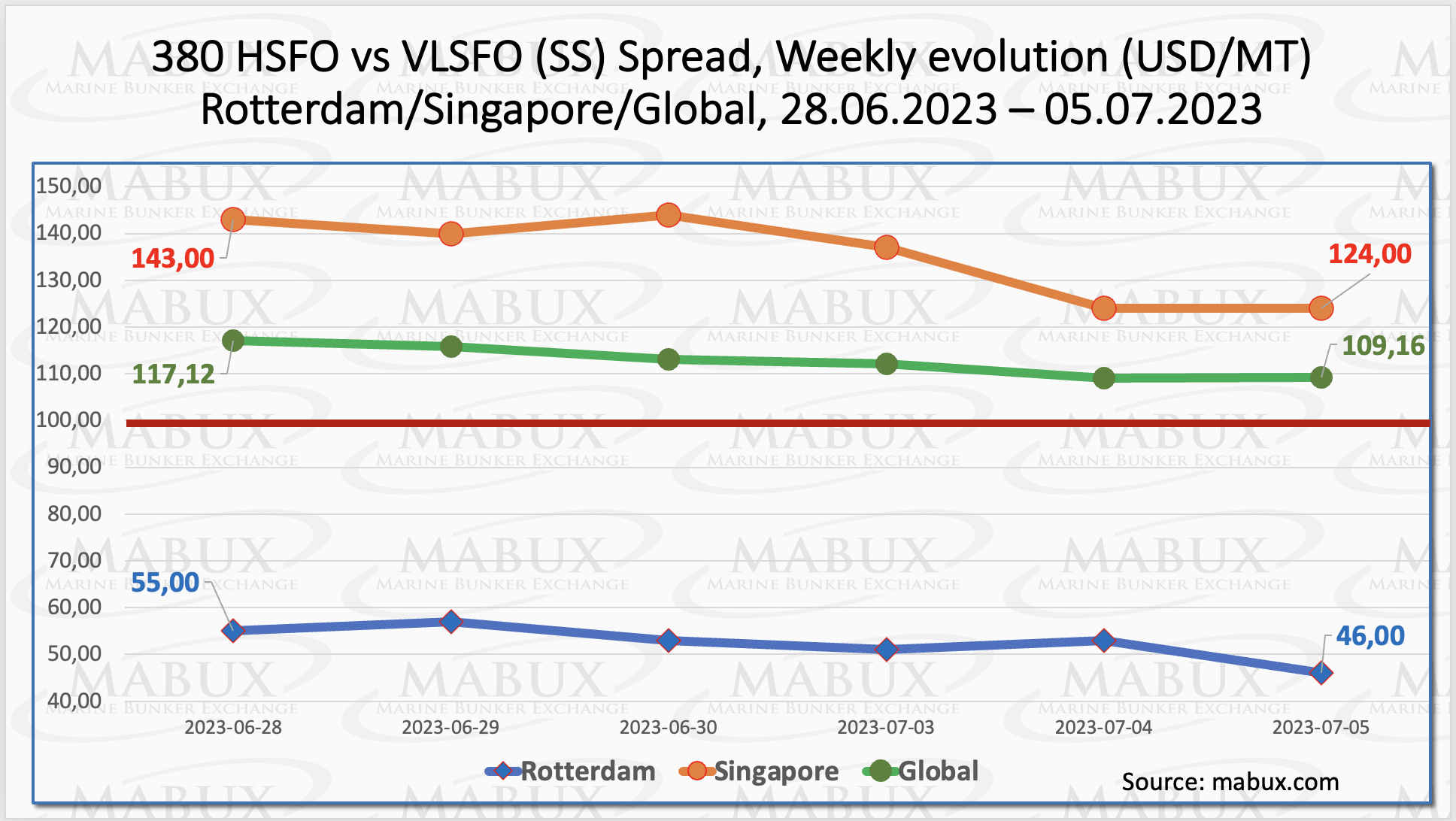

The Global Scrubber Spread (SS), which is the price difference between 380 HSFO and VLSFO, has been constantly dropping and has reached US$109. Meanwhile, the weekly average dropped by US$9.

In Rotterdam, the SS Spread dropped a further US$9 to US$46, its lowest level since 9 November 2020. The weekly average of SS Spread in Rotterdam fell by US$3.6 as well.

In Singapore, the price differential between 380 HSFO and VLSFO fell by US$19, but the average weekly value shrank by US$18.84.

“The significant reduction in the SS Spread in Northern Europe continues to drive the increased adoption of LNG as an alternative bunker fuel,” commented a MABUX official.

Natural gas costs in the European Union (EU) have recently been declining. The decrease in European natural gas consumption is one of the key causes of this price drop. Europe has purchased much less natural gas than the previous year.

This is because Europe’s storage caverns have limited capacity, and there is still a significant amount of gas left over from the previous year. However, worries have been voiced about the forthcoming year and heating season, which will put the gas supply to the test. Europe received full amounts of Russian gas during the first half of the previous year, which were utilised to fill the storage caverns.

“This year, the amount of Russian gas entering Europe is considerably smaller, limited to the gas transited via Ukraine and Turkey, which only represents a fraction of the previous total. Considering the combination of reduced gas production in the United States and increased demand anticipated for the winter heating season, there is a possibility that gas prices might rise. However, this outcome depends on whether the upcoming winter experiences mild temperatures like the previous one. If the temperatures remain mild, likely, the gas prices will not increase significantly, following a similar pattern as last winter,” stated a MABUX official.

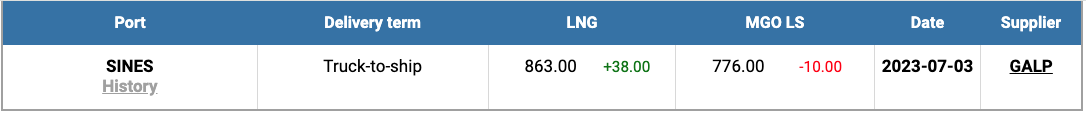

On 3 July, the price of LNG as a bunker fuel in the port of Sines (Portugal) jumped once again, hitting US$863/MT. This is a US$38 gain over the previous week.

Furthermore, on 3 July, the price differential between LNG and conventional fuel widened further, with MGO quoted at US$776/MT in the port of Sines. This corresponds to an US$87 differential in favour of MGO versus LNG.

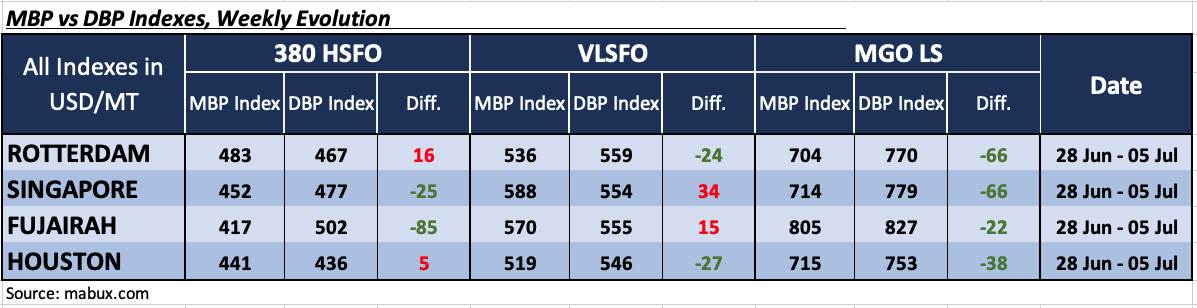

The MDI index and the MABUX digital bunker benchmark revealed an underestimate of 380 HSFO fuel in two of the four chosen ports during Week 27: Singapore and Fujairah. The weekly underpricing average in Singapore fell by 8 points, while it rose by 3 points in Fujairah.

Rotterdam and Houston, on the other hand, remained overpriced. The average overcharge in Houston grew by 4 points, but there was no change in Rotterdam.

According to MDI statistics, Singapore and Fujairah remain overpriced ports in the VLSFO sector. The weekly overcharge average fell by ten points. Rotterdam and Houston, on the other hand, were underestimated, with the average ratio climbing by 3-6 points.

MDI recorded an underestimate in all four chosen ports in the MGO LS section. The average undervaluation level increased by US$2 and US$4 in Rotterdam and Fujairah, respectively, while it decreased by US$7 in Houston. The MDI in Singapore remained unchanged.

“We expect the moderate uptrend in the Global bunker market to continue next week,” stated Sergey Ivanov, director of MABUX.