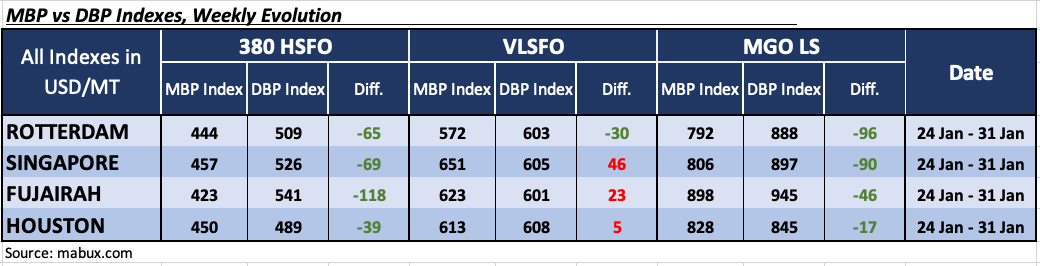

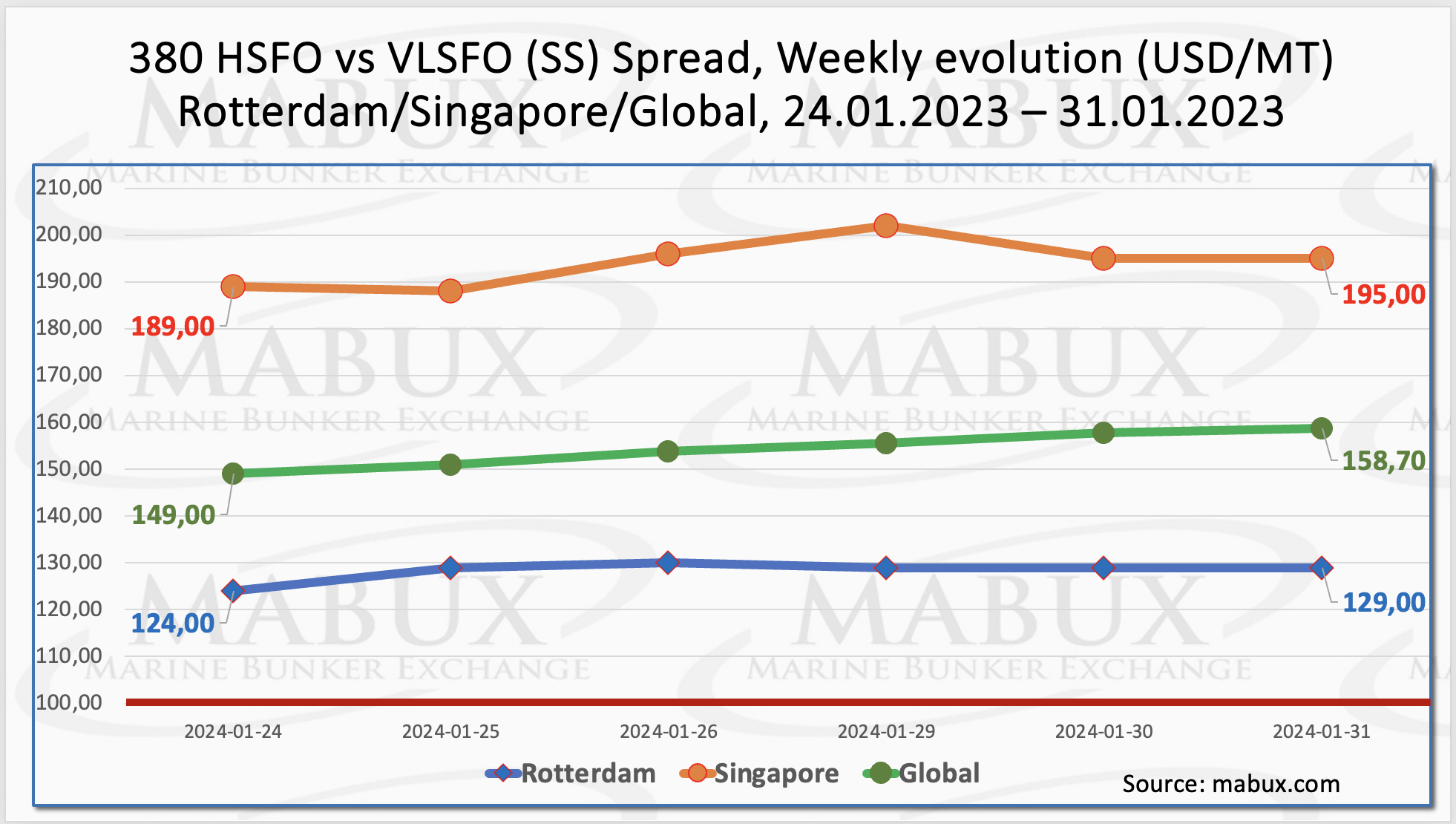

After the 05th week’s outcomes, there was a noticeable uptick in the MABUX global bunker indices. The 380 HSFO index experienced a gain of US$13.81, climbing from US$502.49/MT the previous week to a solid US$516.30/MT, surpassing the US$500 threshold.

Simultaneously, the VLSFO index saw an increase of US$23.51, reaching US$675.00/MT compared to last week’s US$651.49/MT. The MGO index also demonstrated growth, rising by US$24.50 to US$918.69/MT, breaking through the US$900 mark.

“At the time of writing, the market was undergoing a moderate downward correction,” stated a MABUX spokesperson.

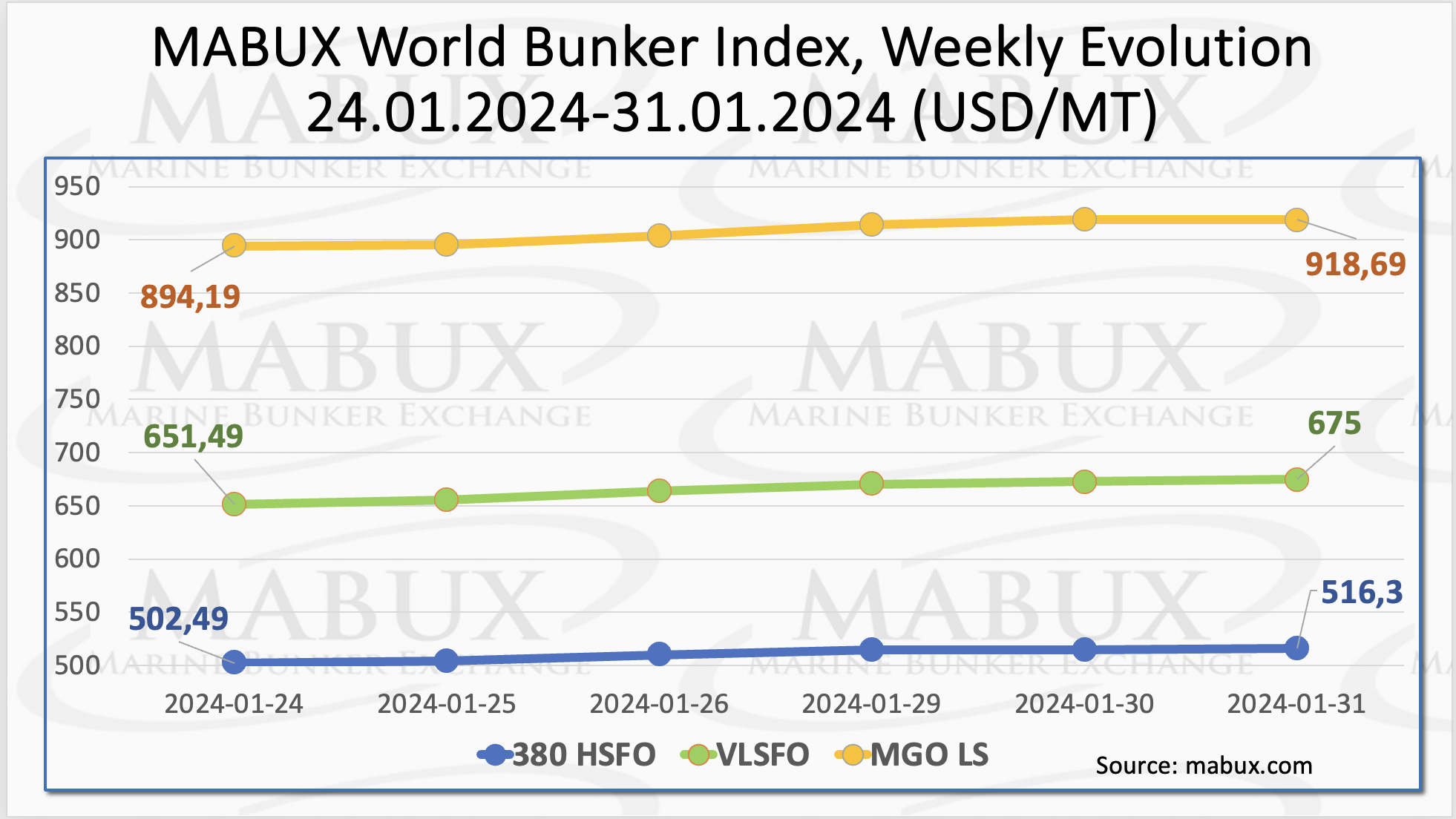

The Global Scrubber Spread (SS) – representing the price gap between 380 HSFO and VLSFO – continued its upward trajectory, reaching a positive US$$9.70. The weekly average also saw an increase of US$14.35. In Rotterdam, SS Spread grew by US$5 to US$129, firmly surpassing the US$100 mark, with the weekly average rising by US$12.16.

Meanwhile, in Singapore, the price difference for 380 HSFO/VLSFO expanded by US$6 to US$195, breaking through the US$200 mark during the week. The weekly average also witnessed a rise of US$26.67.

“The consistent upward trend of SS Spread enhances the profitability of utilizing the currently more economical high-sulfur fuel HSFO in combination with a scrubber,” added a MABUX official.

The oil and gas industry is anticipated to invest over US$1 trillion in natural gas supply, allocating a substantial US$223 billion for the development and operation of new gas extraction sites to meet demand in Europe. Despite a potential structural decline in Europe’s gas demand, there is a necessity to secure alternative supplies to replace Russian pipeline gas, which served as the primary source until 2022.

In response to reduced Russian gas deliveries, Europe has shifted its focus to liquefied natural gas (LNG) and increased pipeline supplies from Norway and Africa to fulfil its energy needs. Key players in this significant investment, including ExxonMobil, Shell, TotalEnergies, Equinor, and Eni, are collectively expected to invest approximately US$144 billion over the next decade to ensure a stable gas supply for Europe.

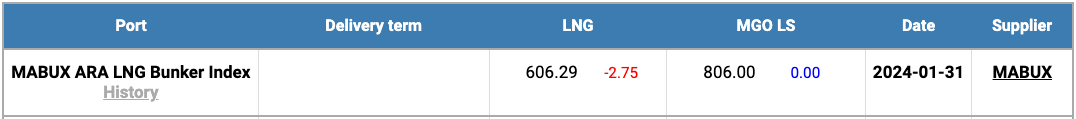

Simultaneously, the price of LNG as bunker fuel in the port of Rotterdam, Netherlands, continued its descent, reaching US$606/MT on 31 January (a decrease of US$2.75 compared to the previous week). Additionally, the price gap between LNG and conventional fuel expanded to US$200 in favour of LNG, compared to US$169 a week earlier. On 31 January, MGO LS was quoted at US$806/MT in the port of Rotterdam.

indices in the upcoming week,” stated Sergey Ivanov, Director of MABUX.