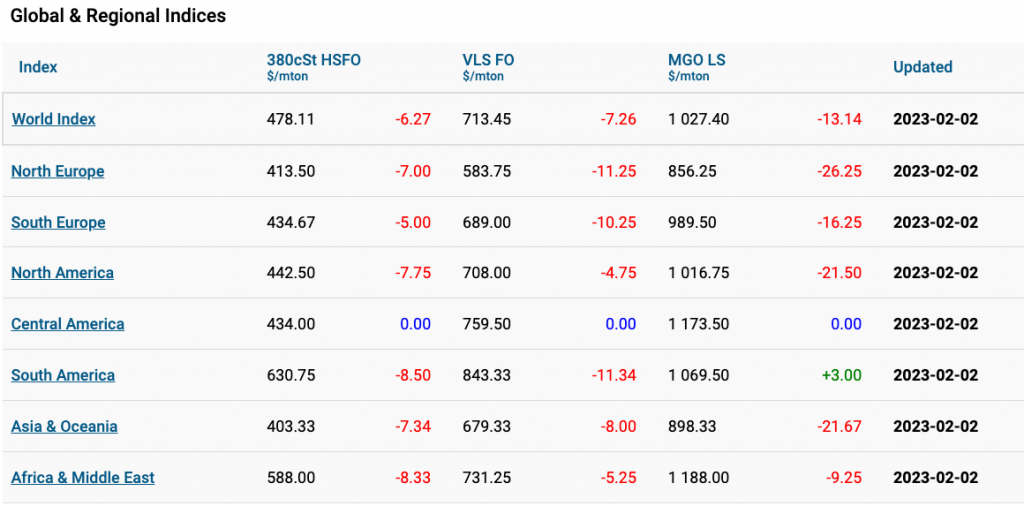

Over the fifth week of the year, Marine Bunker Exchange (MABUX) global bunker indices showed a moderate downward correction.

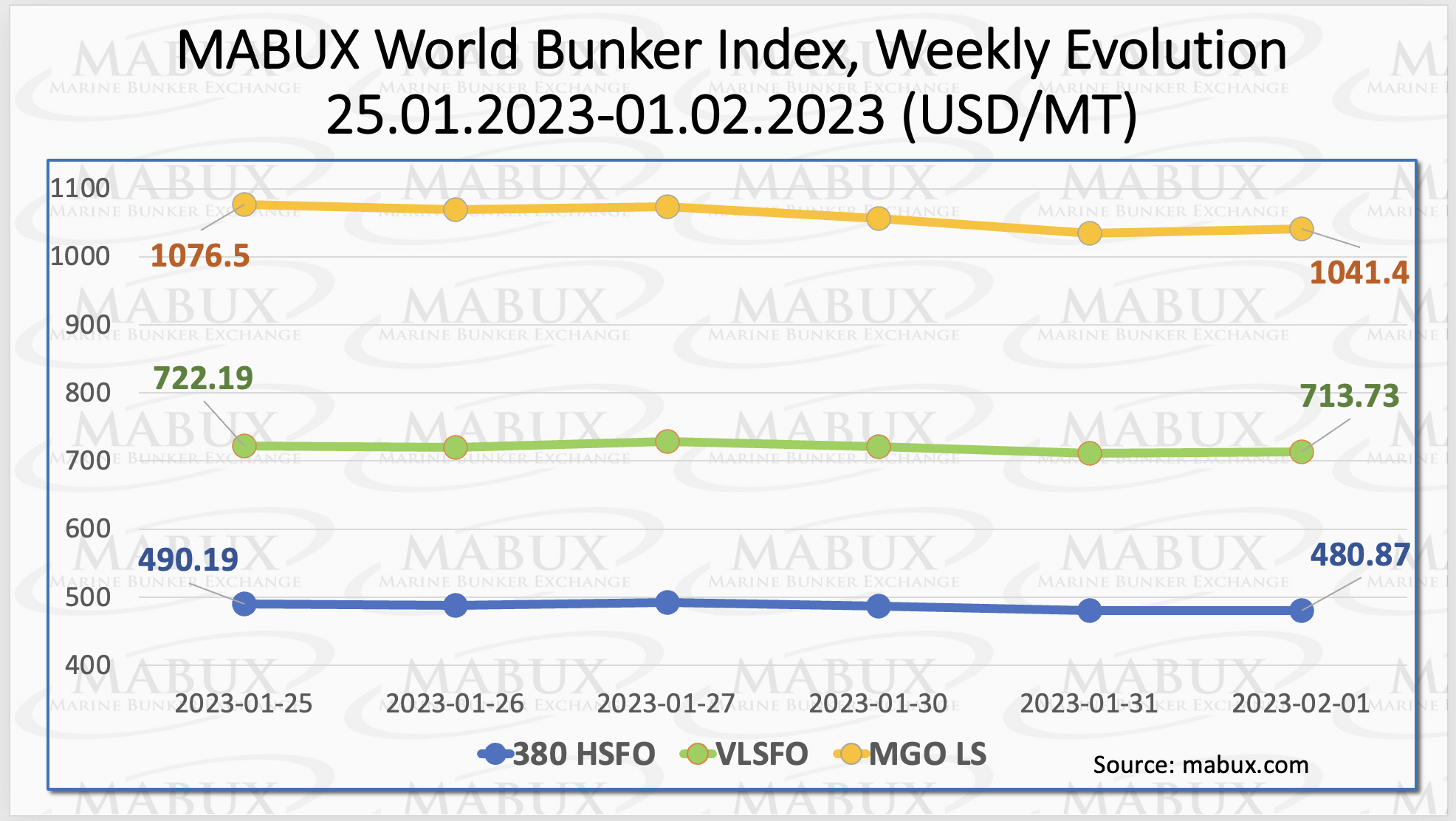

The 380 HSFO index fell by US$9.32 to US$480.87/MT, the VLSFO index dropped by US$8.46 reaching US$713.73/MT and the MGO index decreased by US$35.10 to US$1,041.40/MT.

“We expect this is a short-run downward correction and the global bunker market still retains the potential for a further uptrend,” commented a MABUX official.

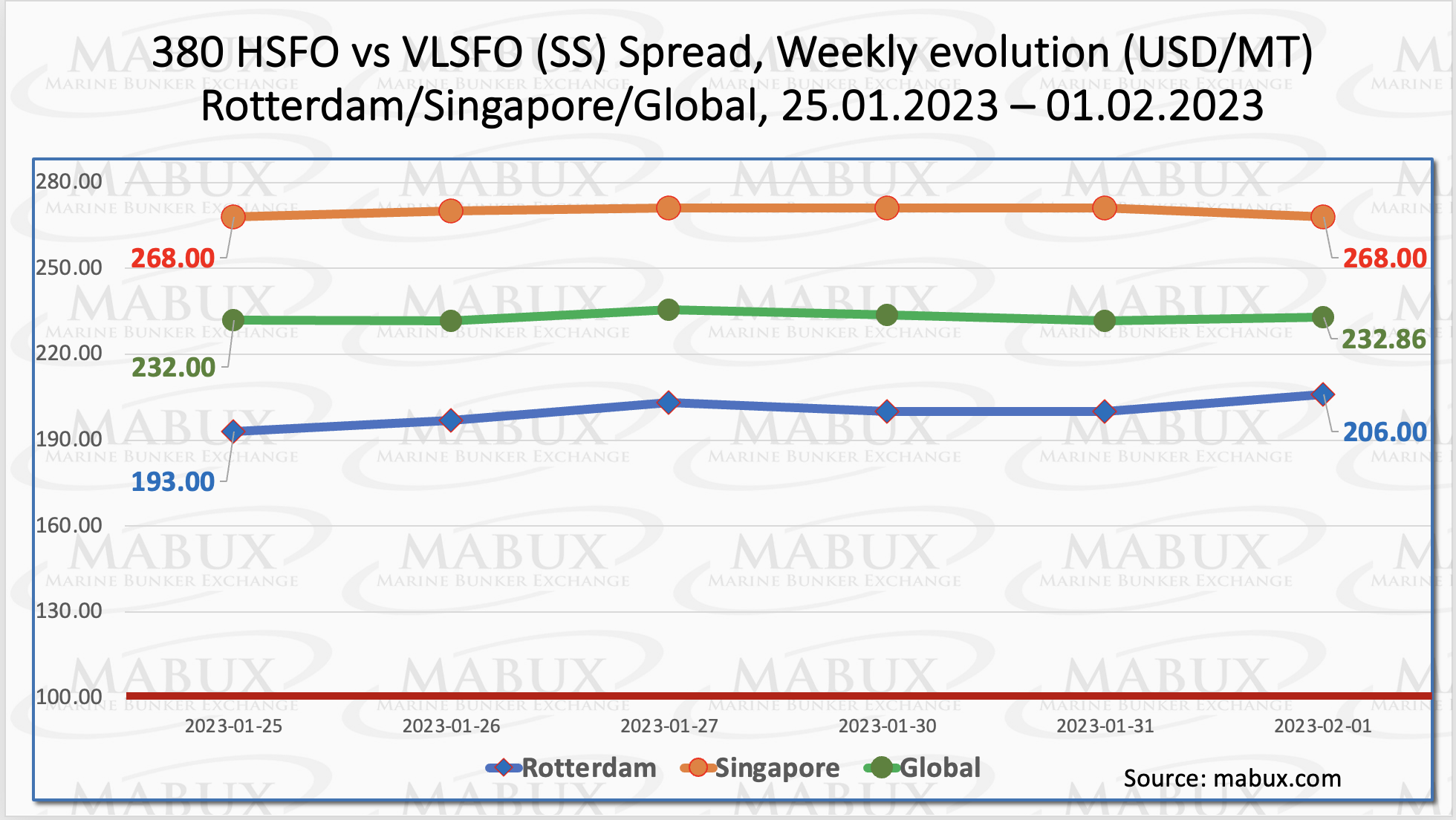

Meanwhile, Global Scrubber Spread (SS) weekly average – the price differential between 380 HSFO and VLSFO – remained unchanged over the fifth week at US$232.86.

In Rotterdam, SS Spread rose by US$13 to US$206 and in Singapore, the average weekly price differential of 380 HSFO/VLSFO was flat at US$268.

Meantime, the SS Spread weekly averages in Rotterdam and Singapore also added US$13.16 and US$8.16, respectively.

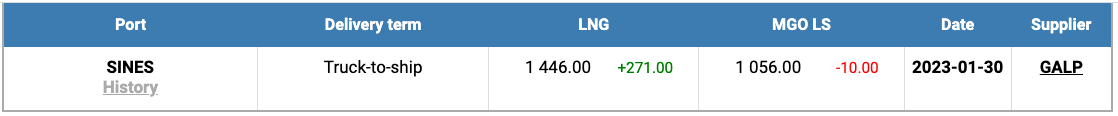

“European Union (EU) gas inventories are still unusually high for this time of the year – at full across the EU and well above the five-year average for the winter heating season. The high volumes of gas in storage and the constant influx of LNG cargoes are easing supply concerns in the absence of most of the Russian pipeline gas,” said MABUX in its analysis.

The price of LNG as bunker fuel at the port of Sines in Portugal unexpectedly rose on 30 January to US$1,446/MT. The price difference between LNG and conventional fuel was US$390 on that day and MGO LS at the port of Sines was quoted at US$1,056/MT that day.

“We expect LNG bunker prices may fall again next week,” pointed out a MABUX official.

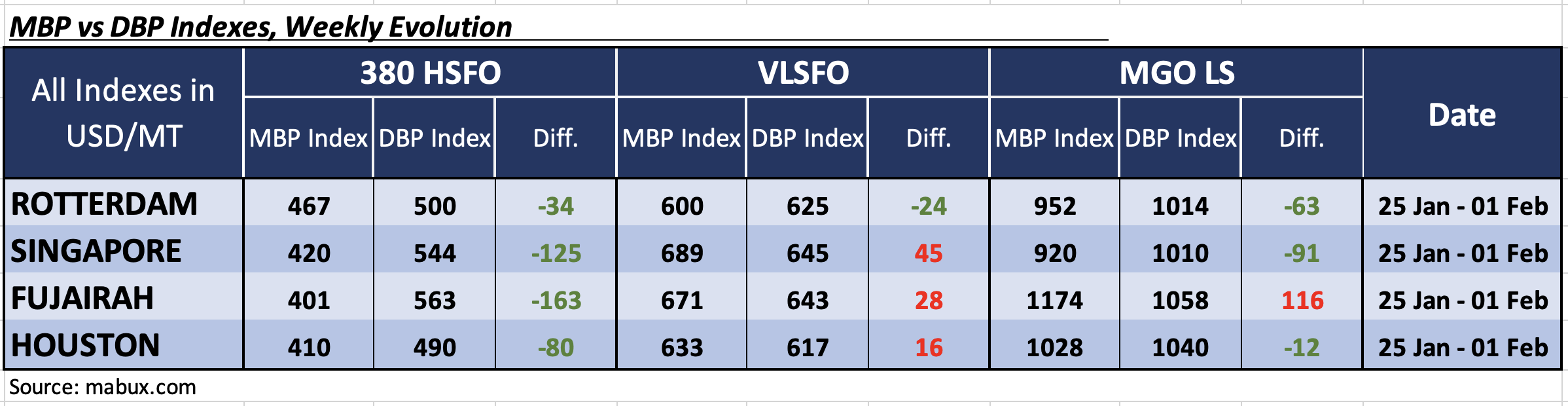

During the fifth week of 2023, the MDI index (comparison of MABUX market bunker prices (MBP Index) vs MABUX digital bunker benchmark (DBP Index)) showed an underpricing of 380 HSFO fuel grade in all four selected ports. The underestimation sharply declined during the week in all ports except Houston and amounted to Rotterdam – minus US$34, Singapore – minus US$125, Fujairah – minus US$163 and Houston – minus US$80.

VLSFO fuel grade, according to MDI, remained, overpriced in all selected ports: in Singapore plus US$45, in Fujairah plus US$28 and in Houston plus US$16. Only Rotterdam remains a VLSFO underestimated port – minus US$24. Overprice margins have risen while underpricing has declined, according to MABUX.

In the MGO LS segment, MDI registered underpricing in three ports out of four selected ones over the week: Rotterdam – minus US$63, Singapore – minus US$91 and Houston – minus US$12. MGO LS fuel remained overvalued in Fujairah – plus US$116.

“There are a lot of uncertainties regarding Russian fuel supply in the coming months, the key being whether Russia can place the fuel displaced from Europe elsewhere and whether a planned price cap on Russia’s fuels would work as intended. Despite the current downward correction in the global bunker market, we are of the option that there is still the potential for further growth. World bunker indices may show a moderate uptrend next week,” commented Sergey Ivanov, director of MABUX.