After more than a week of consecutive daily declines in bunker fuels, Europe’s benchmark natural gas prices began to rise again amid lower orders for Russian gas supply transiting Ukraine.

Europe is also looking to boost its imports of liquefied natural gas (LNG), and various countries, including major economies dependent on Russian gas such as Italy and Germany, have been in talks with exporters, including the United States and Qatar, for more LNG supply, if possible. LNG as a bunker fuel is still not listed.

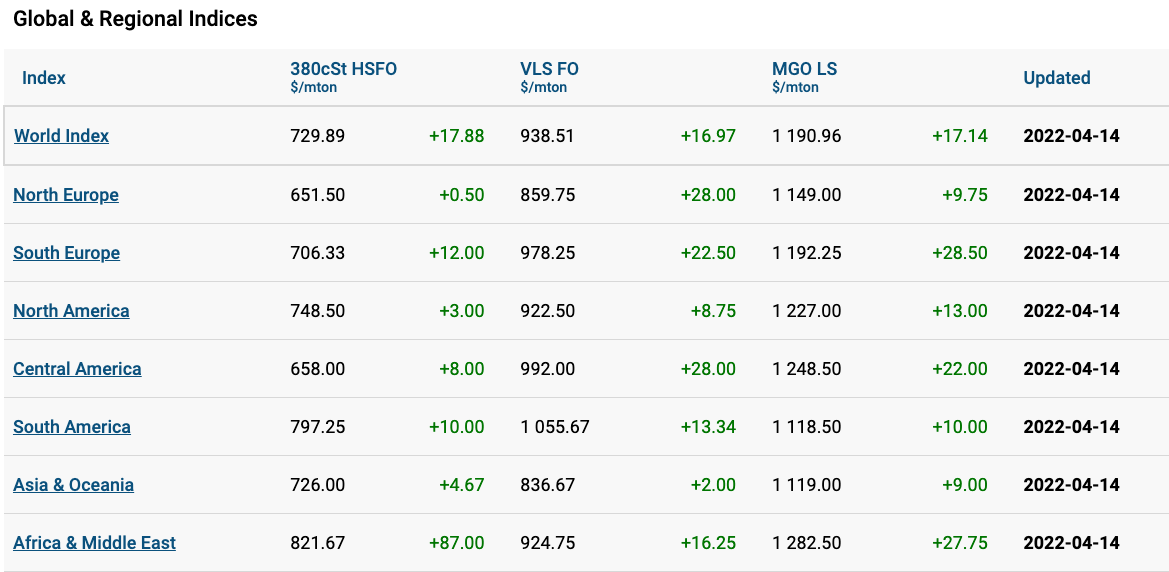

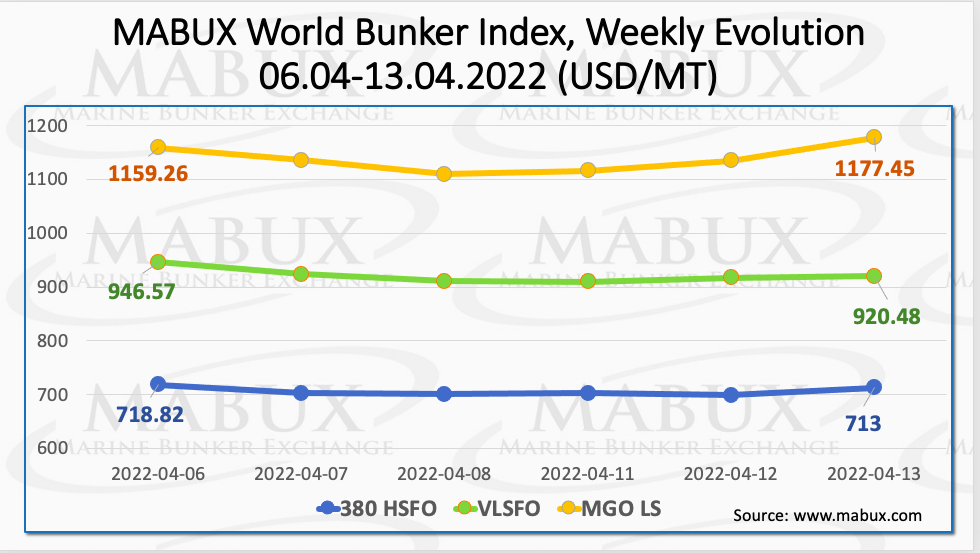

During the 15th week of the year, the Marine Bunker Exchange (MABUX) Bunker Index showed moderate irregular changes, but the high volatility in the bunker market, caused by the ongoing military conflict in Ukraine, prevents the formation of a sustainable trend in fuel indices.

In particular, the 380 high-sulphur fuel oil (HSFO) index fell to US$713/MT, the very low sulphur fuel oil (VLSFO) index dropped more to US$920.48/MT, while the marine gas oil (MGO) index, in turn, rose to US$1,177.45/MT.

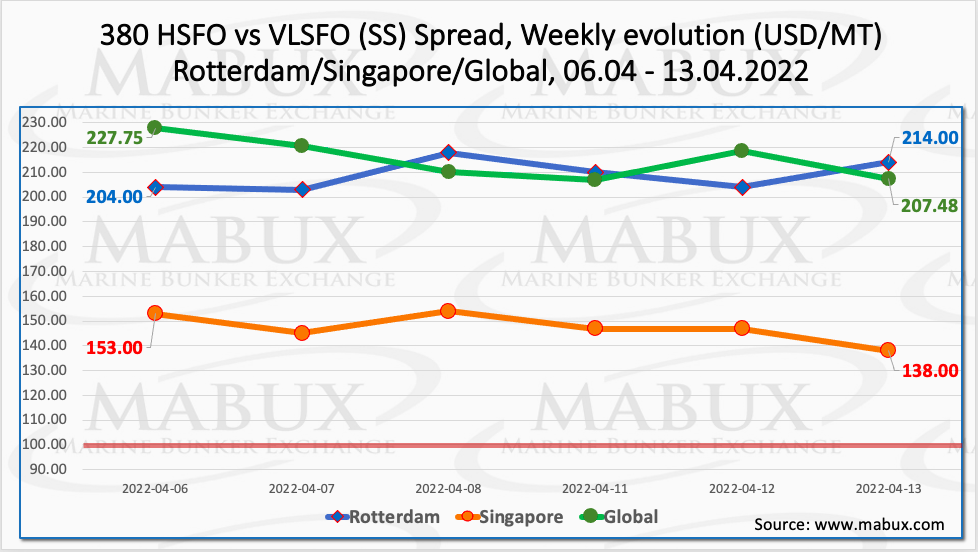

The Global Scrubber Spread (SS) weekly average, the price difference between 380 HSFO and VLSFO, showed a moderate decline over the week at US$215.32.

Furthermore, in Rotterdam, the average SS Spread, on the contrary, slightly increased to US$208.83. In the meantime, the sharp decline in 380 HSFO/VLSFO price difference at the port of Singapore continued, while the average ratio decreased to US$147.33, and in absolute value, the SS Spread fell to US$138 as of 13 April.

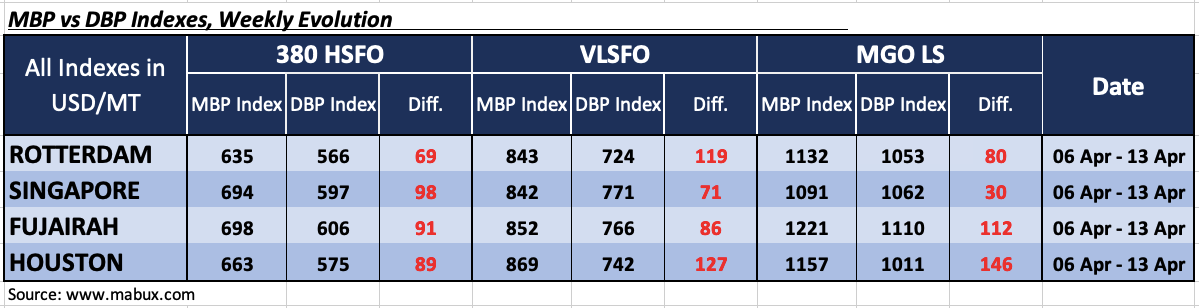

Over week 15, the average correlation of the MABUX market bunker prices (MBP) index vs the MABUX digital bunker benchmark (DBP) index showed that all major bunker fuels are in the zone of significant overpricing in all selected ports amid continued high volatility.

Thus, 380 HSFO fuel’s overcharge margins at the end of the week were registered as: in Rotterdam plus US$69, in Singapore – plus US$98, in Fujairah – plus US$91 and in Houston, plus US$89.

VLSFO fuel grade, according to MABUX MBP/DBP Index, was also overpriced in all selected ports: plus US$119 in Rotterdam, plus US$71 in Singapore, plus US$86 in Fujairah and plus US$127 in Houston.

The MABUX analysts pointed out that the pace of growth of overcharge margins in the VLSFO segment is significantly behind that of 380 HSFO.

As for MGO LS, MABUX MBP/DBP Index also recorded an overpricing over the week in all four selected ports: Rotterdam – plus US$80, Singapore – plus US$30, Fujairah – plus US$112 and Houston – plus US$146.

Meanwhile, a study carried out by the research and consulting company Blue Insight indicated that in 2021 the practice of short VLSFO deliveries cost owners and charterers around US$100 million in Fujairah and US$150 million in Rotterdam.

The data collected by the company suggest that a significant number of deliveries in these bunker hubs are being made below financial breakeven, which indicates the continuing practice of delivery shortfalls.

Evidence for the report’s conclusions is said to have been provided by input from suppliers, buyers and surveyors in Rotterdam and Fujairah. While the “costs” of short delivery were based on the delivery economics of VLSFO, the research is said to support similar patterns of losses for HSFO and even greater losses for MGO.

The report’s findings should provide an impetus for more widespread use of mass flow meters in bunker deliveries, according to Blue Insight.